2025 BLUE Price Prediction: Market Analysis and Future Outlook for Blockchain Loyalty Utility Ecosystem Tokens

Introduction: BLUE's Market Position and Investment Value

Bluefin (BLUE), as a decentralized spot and derivatives trading platform on the Sui blockchain, has achieved significant success since its launch in September 2023. As of 2025, BLUE's market capitalization has reached $50,073,449.79, with a circulating supply of approximately 330,125,592 tokens, and a price hovering around $0.15168. This asset, known as the "largest protocol on Sui by total volume," is playing an increasingly crucial role in decentralized finance and cryptocurrency trading.

This article will comprehensively analyze BLUE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. BLUE Price History Review and Current Market Status

BLUE Historical Price Evolution

- 2023: Bluefin launched in September, trading volume exceeded $39B

- 2024: Reached all-time high of $0.8694 on December 15

- 2025: Experienced significant decline, hitting all-time low of $0.0574 on April 7

BLUE Current Market Situation

BLUE is currently trading at $0.15168, showing a 9.73% increase in the last 24 hours. The token has demonstrated strong momentum over the past week and month, with 48.38% and 118.45% gains respectively. However, BLUE is still down 50.95% compared to a year ago. The current price represents a 82.55% decline from its all-time high and a 164.25% increase from its all-time low. With a circulating supply of 330,125,592 BLUE tokens, the current market cap stands at $50,073,449.79. The fully diluted valuation is $151,680,000, indicating potential for growth if the total supply of 1 billion tokens enters circulation.

Click to view the current BLUE market price

BLUE Market Sentiment Indicator

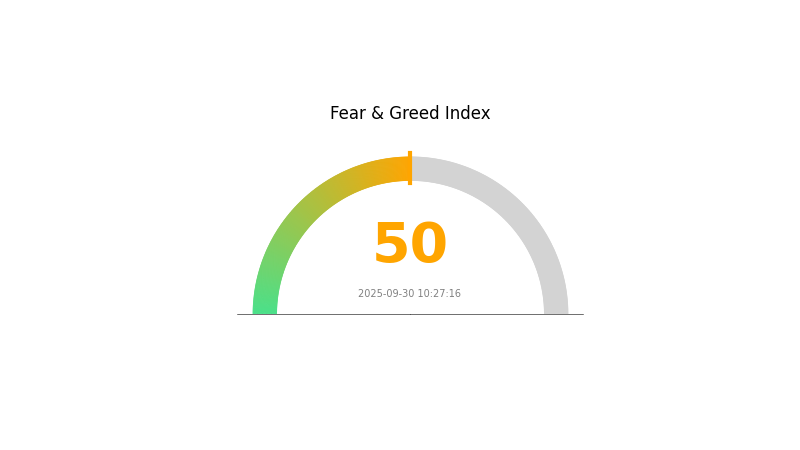

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment has stabilized at a neutral level, with the Fear and Greed Index reading 50. This balanced state suggests that investors are neither overly fearful nor excessively greedy. It's an ideal time for traders to reassess their strategies and portfolios. While the market doesn't show extreme emotions, it's crucial to remain vigilant and make informed decisions. Gate.com offers comprehensive tools and analysis to help navigate these market conditions effectively.

BLUE Holdings Distribution

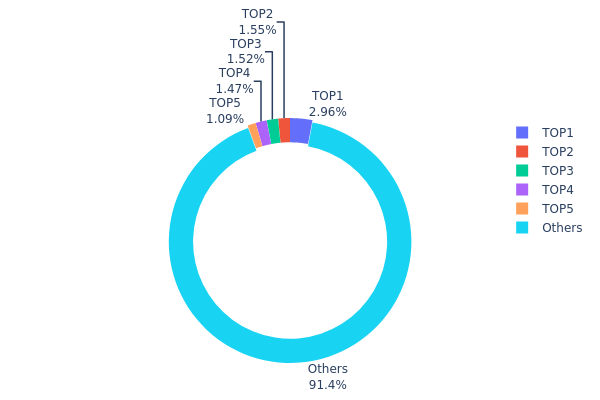

The address holdings distribution data provides crucial insights into the concentration of BLUE tokens across different wallet addresses. According to the data, the top 5 addresses collectively hold 8.56% of the total BLUE supply, with the largest single address controlling 2.95%. This distribution pattern suggests a relatively decentralized ownership structure, as no single entity holds a dominant position.

The absence of extreme concentration is a positive indicator for BLUE's market stability. With 91.44% of tokens distributed among numerous smaller holders, the risk of market manipulation by large individual players is significantly reduced. This dispersed ownership structure contributes to a more robust and resilient market, potentially leading to smoother price movements and reduced volatility.

Overall, the current address distribution reflects a healthy level of decentralization in BLUE's ecosystem. This balanced distribution enhances the token's on-chain structural stability and may foster greater confidence among investors and users in the long-term viability of the project.

Click to view the current BLUE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x62f3...fa53ad | 29571.27K | 2.95% |

| 2 | 0x95e7...5ab228 | 15455.06K | 1.54% |

| 3 | 0x260e...bc8317 | 15163.47K | 1.51% |

| 4 | 0x3a15...0b36b7 | 14728.95K | 1.47% |

| 5 | 0x3114...621d01 | 10945.62K | 1.09% |

| - | Others | 914135.63K | 91.44% |

II. Key Factors Influencing BLUE's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central banks' policy expectations will significantly influence BLUE's price. As global economic conditions evolve, central bank actions on interest rates and quantitative easing measures will affect overall market sentiment and capital flows into cryptocurrencies like BLUE.

-

Inflation Hedging Properties: BLUE's performance in inflationary environments will be closely watched. As global inflation trends develop, investors may turn to BLUE as a potential store of value, similar to how some view Bitcoin.

-

Geopolitical Factors: International tensions and conflicts can impact BLUE's price. Geopolitical events may lead to increased demand for cryptocurrencies as alternative assets, potentially benefiting BLUE.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects on BLUE's network will be crucial for its adoption and value. A thriving ecosystem with diverse applications can drive user engagement and increase BLUE's utility.

III. BLUE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.08988 - $0.12

- Neutral prediction: $0.12 - $0.15

- Optimistic prediction: $0.15 - $0.16178 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.12463 - $0.19786

- 2027: $0.10433 - $0.1892

- Key catalysts: Project milestones, market adoption, and overall crypto market trends

2028-2030 Long-term Outlook

- Base scenario: $0.18301 - $0.23389 (assuming steady project growth and market stability)

- Optimistic scenario: $0.23389 - $0.25622 (assuming strong project performance and favorable market conditions)

- Transformative scenario: $0.25622 - $0.30 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: BLUE $0.23389 (54% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16178 | 0.1498 | 0.08988 | -1 |

| 2026 | 0.19786 | 0.15579 | 0.12463 | 2 |

| 2027 | 0.1892 | 0.17682 | 0.10433 | 16 |

| 2028 | 0.25622 | 0.18301 | 0.12262 | 20 |

| 2029 | 0.24817 | 0.21962 | 0.18448 | 44 |

| 2030 | 0.24558 | 0.23389 | 0.1801 | 54 |

IV. Professional Investment Strategies and Risk Management for BLUE

BLUE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate BLUE tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Monitor Sui ecosystem developments for potential price catalysts

- Set stop-loss orders to manage downside risk

BLUE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Sui wallet

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for BLUE

BLUE Market Risks

- High volatility: BLUE price may experience significant fluctuations

- Competition: Other DeFi platforms on Sui or other blockchains may impact market share

- Market sentiment: Overall crypto market trends can affect BLUE's performance

BLUE Regulatory Risks

- Regulatory uncertainty: Changing global regulations on DeFi and cryptocurrencies

- Compliance challenges: Potential difficulties in adhering to evolving financial regulations

- Geopolitical factors: International tensions may impact crypto markets and BLUE

BLUE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Bluefin protocol

- Scalability issues: Possible limitations in handling increased transaction volume

- Interoperability challenges: Integration difficulties with other blockchain networks

VI. Conclusion and Action Recommendations

BLUE Investment Value Assessment

BLUE presents a high-risk, high-reward investment opportunity within the growing Sui ecosystem. Long-term potential exists due to Bluefin's strong trading volume and backing, but short-term volatility and regulatory uncertainties pose significant risks.

BLUE Investment Recommendations

✅ Beginners: Limited exposure (1-3% of crypto portfolio) with a long-term holding strategy ✅ Experienced investors: Consider active trading with strict risk management ✅ Institutional investors: Evaluate for inclusion in diversified DeFi portfolios, monitor ecosystem growth

BLUE Participation Methods

- Spot trading: Purchase BLUE tokens on Gate.com

- Staking: Participate in Bluefin's liquidity provision programs if available

- Derivatives: Trade BLUE-related futures or options contracts on Gate.com

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is blue stock a good buy?

Yes, BLUE stock is currently considered a good buy. Analysts rate it as a 'Buy' with positive consensus, suggesting potential for growth and value.

Is bluefin a good investment?

Yes, Bluefin shows promise as an investment. Its innovative technology and growing market presence suggest potential for significant returns in the Web3 space by 2025.

How much will Bluzelle coin price be in 2030?

Based on current predictions, Bluzelle coin price could potentially reach $0.05 by 2030, assuming a 5% price change. However, this is a speculative forecast.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, followed closely by Ethereum. These predictions are based on current market trends and expert analysis.

Share

Content