2025 BLOCKST Fiyat Tahmini: Yükselen Blockchain Tokenı için Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

Giriş: BLOCKST'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Block (BLOCKST), USD1'in benimsenmesinde kilit bir rol üstlenerek kurulduğu günden bu yana kayda değer ilerlemeler göstermiştir. 2025 yılı itibarıyla BLOCKST'nin piyasa değeri 10.669.000 $'a ulaşmıştır; dolaşımdaki yaklaşık 470.000.000 token bulunmakta ve fiyatı yaklaşık 0,0227 $ seviyesindedir. “USD1 benimseme katalizörü” olarak adlandırılan bu varlık, DeFi, ödeme sistemleri, oyun ve gerçek varlık entegrasyonu gibi alanlarda giderek daha stratejik bir rol üstlenmektedir.

Bu makale, BLOCKST'nin 2025-2030 dönemi fiyat eğilimlerine ilişkin kapsamlı bir analiz sunacak; geçmiş veriler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörleri birleştirerek yatırımcılar için profesyonel fiyat öngörüleri ve pratik yatırım stratejileri ortaya koyacaktır.

I. BLOCKST Fiyat Geçmişi ve Güncel Piyasa Durumu

BLOCKST Fiyatının Tarihsel Gelişimi

- 2025 Ağustos: BLOCKST, 0,2032 $ ile tüm zamanların en yüksek seviyesine ulaşıp fiyat tarihinde önemli bir dönüm noktası yaşadı.

- 2025 Ekim: Token, sert bir düşüşle 6 Ekim'de en düşük seviyesi olan 0,0203 $'a indi.

- 2025 8 Ekim: BLOCKST şu anda 0,0227 $ seviyesinden işlem görüyor ve yakın zamandaki dipten toparlanma işaretleri veriyor.

BLOCKST Güncel Piyasa Görünümü

8 Ekim 2025 tarihinde BLOCKST 0,0227 $ seviyesinden işlem görmektedir; 24 saatlik işlem hacmi 68.196,82 $'dır. Token son 24 saatte %13,68 oranında değer kaybetmiştir. Piyasa değeri 10.669.000 $ olup, küresel kripto para sıralamasında 1.383. sıradadır. Dolaşımdaki arz 470.000.000 BLOCKST olup toplam 1.000.000.000 token arzının %47'sini oluşturur. Son dönemdeki fiyat düşüşüne rağmen BLOCKST, geçtiğimiz bir saatte %1,11 oranında kısmi toparlanma göstermiştir. Ancak, token son bir haftada %53,39 ve son 30 günde %70,6 oranında değer kaybederek kısa ve orta vadede negatif bir trend sergilemektedir.

Güncel BLOCKST piyasa fiyatını görüntüleyin

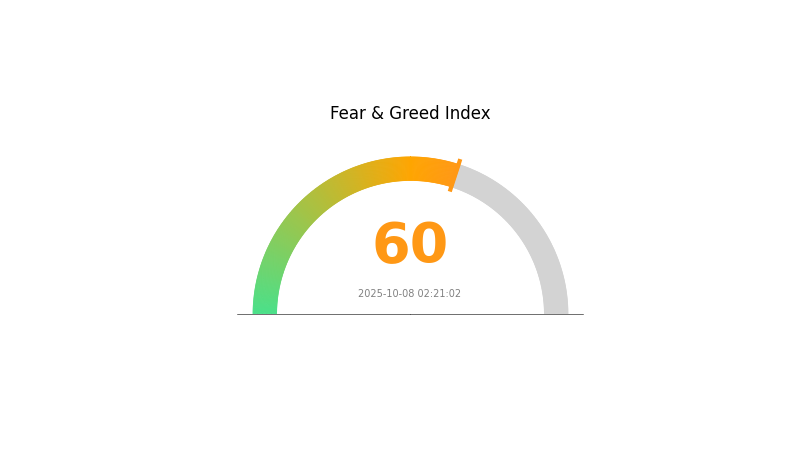

BLOCKST Piyasa Duyarlılığı Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi'ni görüntüleyin

Bugün kripto piyasasında duyarlılık açgözlülüğe kaymış durumda ve Korku ve Açgözlülük Endeksi 60 seviyesinde. Bu durum, yatırımcıların iyimserliğini artırarak fiyatların yükselmesine neden olabilir. Ancak, aşırı açgözlülük piyasa düzeltmelerine yol açabileceğinden yatırımcıların temkinli olması gerekir. Yatırımcılar, kazançlarını korumak için kâr alma veya zarar durdur kullanmalı. Bu volatil piyasada karar almadan önce detaylı araştırma yapmalı ve risklerini etkin şekilde yönetmelidir.

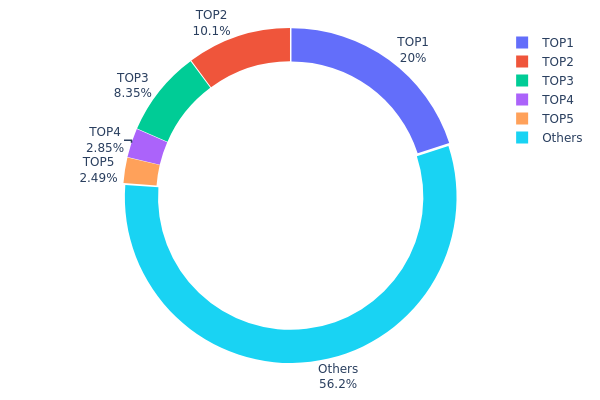

BLOCKST Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, BLOCKST tokenlarının cüzdanlar arasındaki yoğunlaşması hakkında önemli bilgiler sunar. Analizler, en büyük sahiplerde görece yüksek bir konsantrasyon olduğunu gösteriyor. En büyük adres toplam arzın %20'sini elde tutarken, ilk 5 adres birlikte BLOCKST tokenlarının %43,8'ine sahip.

Bu konsantrasyon düzeyi, piyasa istikrarı ve ani fiyat hareketlerine karşı hassasiyet açısından risk teşkil edebilir. En büyük sahip, elindeki %20'lik arzı satarsa fiyat üzerinde ciddi bir etki yaratabilir. Öte yandan, tokenların %56,2'si diğer adreslere dağılmış durumda ve bu, üst sahipler dışında daha geniş bir dağılım olduğunu gösterir.

Mevcut dağılım yapısı, piyasa dinamikleri ve volatiliteyi etkileyebilecek orta seviyede bir merkezileşme olduğunu gösterir. Aşırı yoğunlaşmış olmasa da, üst adreslerin önemli varlıkları piyasa üzerinde etkili olabileceğinden yakından izlenmesi gerekir.

Güncel BLOCKST Varlık Dağılımı'nı görüntüleyin

| En Üst | Adres | Token Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xd9ec...7718ef | 200.000,00K | 20,00% |

| 2 | 0x28fb...e320f9 | 101.407,94K | 10,14% |

| 3 | 0x9642...2f5d4e | 83.455,38K | 8,34% |

| 4 | 0xd193...2ebd51 | 28.476,41K | 2,84% |

| 5 | 0xdabc...48938e | 24.894,75K | 2,48% |

| - | Diğerleri | 561.765,52K | 56,2% |

II. BLOCKST'nin Gelecek Fiyatını Etkileyecek Temel Unsurlar

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Son aylarda BLOCKST’ye kurumsal ilgi artmış ve bazı büyük çaplı alımlar gözlenmiştir.

- Kurumsal Benimseme: MicroStrategy gibi şirketler BLOCKST varlıklarını önemli ölçüde artırmış olup, bu durum 2025’te diğer kurumların benzer adımlar atmasına vesile olabilir.

- Ulusal Politikalar: Çeşitli ülkeler kripto para düzenlemeleri oluşturmakta ve bu da BLOCKST'nin benimsenmesi ve fiyatı üzerinde etkili olabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz ve parasal genişleme politikaları BLOCKST'nin fiyat hareketlerini belirlemeye devam ediyor.

- Enflasyon Koruma Özellikleri: BLOCKST, ekonomik belirsizlikte yatırımcılar için enflasyona karşı koruma potansiyeliyle öne çıkıyor.

- Jeopolitik Faktörler: Uluslararası gerilimler ve yaptırımlar nedeniyle bazı ülkeler BLOCKST’yi geleneksel finans sistemine alternatif olarak değerlendiriyor.

Teknolojik Gelişmeler ve Ekosistem İnşası

- İkinci Katman Çözümleri: Ölçeklenebilirlikteki ilerlemeler BLOCKST'nin işlem hızını artırıp maliyetleri düşürüyor.

- Akıllı Sözleşme Yükseltmeleri: Gelişmiş akıllı sözleşmeler BLOCKST'nin DeFi ve diğer alanlardaki kullanımını genişletiyor.

- Ekosistem Uygulamaları: BLOCKST blokzinciri üzerinde merkeziyetsiz uygulama (DApp) ve projelerin büyümesi, değerini ve benimsenmesini artırıyor.

III. BLOCKST 2025-2030 Fiyat Öngörüsü

2025 Öngörüsü

- Ihtiyatlı: 0,01778 $ - 0,02280 $

- Tarafsız: 0,02280 $ - 0,02610 $

- İyimser: 0,02610 $ - 0,02941 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Öngörüsü

- Piyasa dönemi: Büyüme fazı olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,02350 $ - 0,03789 $

- 2028: 0,03262 $ - 0,04809 $

- Ana itici güçler: Artan benimseme ve piyasa olgunluğu

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,04086 $ - 0,04658 $ (istikrarlı piyasa büyümesi)

- İyimser senaryo: 0,04658 $ - 0,05230 $ (güçlü performans)

- Olağanüstü senaryo: 0,05230 $ - 0,05869 $ (olağanüstü piyasa koşulları)

- 31 Aralık 2030: BLOCKST 0,05869 $ (olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02941 | 0,0228 | 0,01778 | 0 |

| 2026 | 0,03263 | 0,02611 | 0,01514 | 15 |

| 2027 | 0,03789 | 0,02937 | 0,0235 | 29 |

| 2028 | 0,04809 | 0,03363 | 0,03262 | 48 |

| 2029 | 0,0523 | 0,04086 | 0,0237 | 79 |

| 2030 | 0,05869 | 0,04658 | 0,03913 | 105 |

IV. BLOCKST Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BLOCKST Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde BLOCKST biriktirin

- Fiyat hedefleri belirleyip projenin temellerini düzenli olarak tekrar değerlendirin

- Tokenları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktası saptamak için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumunu ölçmek için kullanılır

- Volatil alım-satımda dikkat edilmesi gerekenler:

- USD1 benimseme oranlarını ve Blockstreet Başlangıç Platformu (Launchpad) aktivitelerini izleyin

- World Liberty Financial duyurularını takip edin

BLOCKST Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'e kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: BLOCKST'yi diğer kripto varlıklar ve klasik yatırımlarla dengeleyin

- Zarar durdur: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk cüzdan: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü parola ve düzenli yazılım güncellemesi

V. BLOCKST Potansiyel Riskler ve Zorluklar

BLOCKST Piyasa Riskleri

- Oynaklık: Yeni kripto projelerinde yüksek fiyat dalgalanmaları

- Likidite: Sınırlı hacim giriş/çıkış kolaylığını azaltabilir

- Rekabet: Diğer USD’ye endeksli stablecoin ekosistemleri BLOCKST’nin pazar payını tehdit edebilir

BLOCKST Düzenleyici Riskler

- Stablecoin düzenlemeleri: USD1 ve BLOCKST için yeni düzenlemeler gündeme gelebilir

- Sınıraşan kısıtlamalar: Uluslararası düzenleyici farklılıklar küresel yayılımı sınırlayabilir

- KYC/AML gereksinimleri: Daha sıkı regülasyonlar kullanıcı edinimi ve işlem süreçlerini etkileyebilir

BLOCKST Teknik Riskler

- Akıllı sözleşme açıkları: Token ve ilgili protokollerde güvenlik zaafları olabilir

- Ölçeklenebilirlik sorunları: Hızlı büyüme Blockstreet ekosistemini zorlayabilir

- Birlikte çalışabilirlik: LayerZero veya çoklu zincir entegrasyonunda beklenmeyen sorunlar yaşanabilir

VI. Sonuç ve Eylem Önerileri

BLOCKST Yatırım Potansiyeli Değerlendirmesi

BLOCKST, USD1 ekosisteminde yüksek risk ve yüksek getiri potansiyeli sunar. Uzun vadeli değeri, USD1’in benimsenmesi ve Blockstreet’in yeni projelerindeki başarısı ile yakından bağlantılıdır. Kısa vadede ise piyasa oynaklığı ve regülasyon belirsizliği en önemli riskler arasında yer alır.

BLOCKST Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve USD1 ekosistemi hakkında bilgi edinin

✅ Deneyimli yatırımcılar: Dengeli yaklaşım uygulayın, Blockstreet gelişmelerini aktif izleyin

✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapın ve gerekirse Blockstreet ekibiyle doğrudan iletişime geçin

BLOCKST Alım-Satım Katılım Yöntemleri

- Anlık alım-satım (spot): Gate.com ve diğer borsalarda işlem yapabilir

- DeFi platformları: Likidite sağlama veya getiri çiftçiliği fırsatlarını değerlendirin

- Blockstreet Başlangıç Platformu (Launchpad) katılımı: USD1 ekosistemindeki yeni projelere katılım

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatli şekilde vermeli ve profesyonel finans danışmanlarının görüşünü almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025'te hangi kripto paralar yükselişe geçecek? Forbes tahmini

Forbes, 2025 yılında Bitcoin DeFi ve İkinci Katman (Layer 2) çözümlerinin öne çıkacağını ve kilitlenen toplam değerin ciddi şekilde artmasını öngörüyor.

BLOK iyi bir yatırım mı?

BLOK, blokzincir teknolojilerine yönelik çeşitlendirilmiş bir yatırım sunar. Performansı piyasa koşulları ve sektör trendlerine bağlıdır. Yatırım kararı öncesinde risk toleransınızı göz önünde bulundurun.

En yüksek fiyat tahminine sahip kripto para hangisi?

Bitcoin (BTC), 2025 yılında en yüksek fiyat tahminine sahip olup, tutarlı yükseliş eğilimiyle yatırımcıların ana tercihi olmaya devam ediyor.

Blockdag için 2025 fiyat tahmini nedir?

Uzun vadeli öngörülere göre, BlockDAG'ın 2025'te fiyatı 3.421,87 $ seviyesine ulaşabilir.

Stable Chain Açıklaması

ORDER nedir: Veritabanı yönetimi ve sorgu optimizasyonunda verimliliğin anahtarı

XPL Token’un Gelecek Potansiyeli ve Yatırım Fırsatları

Plasma Ağı: Dijital İşlemlerde Güvenliği Artırmak İçin Teknolojiden Yararlanmak

Polygon Topluluk Fonu, 2025 yılında POL ekosisteminin büyümesini nasıl etkiler?

Zincirler Arası Transferlerin Geleceği: Kripto Varlıklar İçin Yeni Protokollerin Keşfi

Kopya Ticaret Mekanizması Rehberi

Reserve Protocol İncelemesi: Gerçek Dünya Stablecoin Entegrasyonuna Kapsamlı Bir Rehber

Yeni başlayanlar için Spot Bitcoin ETF'ye yatırım yapmanın avantajlarını anlamak