2025 BDG Fiyat Tahmini: BitDegree Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: BDG'nin Pazar Konumu ve Yatırım Potansiyeli

Beyond Gaming (BDG), GameFi sektöründe öncü bir proje olarak çıktığı günden beri sektörde ses getirmektedir. 2025 itibarıyla BDG'nin piyasa değeri 3.922.650 $ düzeyindedir; yaklaşık 4.500.000.000 token dolaşımda olup fiyatı 0,0008717 $ civarındadır. Sıklıkla "AI-Meme GameFi Yenilikçisi" olarak tanımlanan bu varlık, blokzincir tabanlı oyunlar alanını yeniden şekillendirmede giderek daha stratejik bir rol üstleniyor.

Bu makalede, BDG'nin 2025-2030 arasındaki fiyat hareketleri; geçmiş eğilimler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında detaylı biçimde incelenecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. BDG Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

BDG Fiyatının Tarihsel Evrimi

- 2025 Mart: BDG, 0,003702 $ ile tüm zamanların en yüksek seviyesine ulaştı ve proje açısından belirleyici bir dönüm noktası oldu

- 2025 Temmuz: Token, 0,0005 $ ile tüm zamanların en düşük değerini gördü; bu, piyasada ciddi bir düzeltme anlamına geliyor

BDG Güncel Piyasa Görünümü

12 Ekim 2025 itibarıyla BDG, 0,0008717 $ seviyesinden işlem görüyor ve piyasa değeri 3.922.650 $. Token, son 24 saatte %1,21 artarken, son bir haftada %15,95 ve son bir ayda %32,16 oranında düşüş yaşadı. Güncel fiyat, tüm zamanların en yüksek değerinden %76,45 geride; en düşük seviyesinden ise %74,34 yukarıda.

BDG'nin son 24 saatlik işlem hacmi 17.421,01 $; bu miktar piyasa değerine göre görece düşük. Dolaşımdaki arz 4.500.000.000 BDG olup, toplam arzın 20.000.000.000 BDG'nin %22,5'ine denk geliyor.

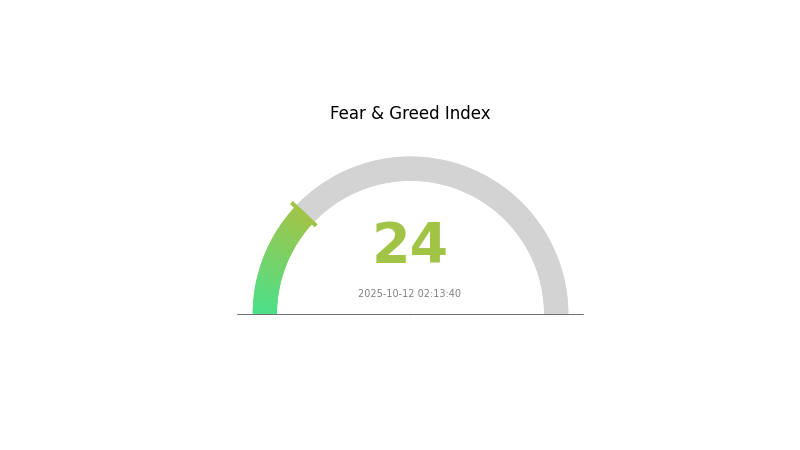

Piyasa duyarlılığı BDG için temkinli; genel kripto piyasasının "Aşırı Korku" endeksi 24 seviyesinde. Son 24 saatlik yükselişe rağmen, uzun vadeli fiyat eğilimi negatif seyrini koruyor ve BDG'nin piyasada zorluklarla karşı karşıya olduğunu gösteriyor.

Güncel BDG piyasa fiyatını görüntülemek için tıklayın

BDG Piyasa Duyarlılığı Göstergesi

2025-10-12 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında aşırı korku hakim; duyarlılık endeksi 24 seviyesine geriledi. Bu düzeydeki kötümserlik, deneyimli yatırımcılar için özel fırsatlar yaratabilir. Birçok kişi panik satış yaparken, tersine stratejiler bu dönemde birikime gitmeyi öne çıkarabilir. Yine de, kapsamlı araştırma yapmadan ve risk yönetimini sağlamadan işlem yapmayın. Piyasa döngülerinin doğal olduğunu ve aşırı korkunun kalıcı olmadığını unutmayın; bilgili olun, portföyünüzü çeşitlendirin ve Gate.com’un gelişmiş araçlarıyla dalgalı piyasa koşullarında navigasyon sağlayın.

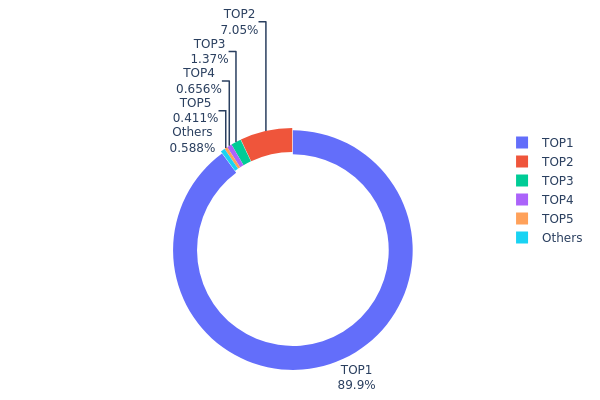

BDG Varlık Dağılımı

BDG adres varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. En büyük adres, toplam arzın %89,92'sini yani 17,63 milyar token'ı elinde bulunduruyor. Bu aşırı yoğunlaşma, token'ın merkeziyetsizliği ve piyasa istikrarı açısından ciddi endişeler doğuruyor.

İkinci en büyük adres, arzın %7,05’ini elinde tutarken; en büyük ilk 5 adresin toplam payı %2,5’ten az. Bu dağılım, dolaşımdaki token ve likidite üzerinde merkezi kontrolün yüksek olduğu bir tabloya işaret ediyor. Böyle bir sahiplik yapısı, fiyat oynaklığının ve manipülasyon riskinin artmasına neden olabilir; çünkü büyük adreslerin hareketleri piyasa üzerinde ciddi etki yaratabilir.

Bu konsantrasyon, BDG'nin zincir üstü yapısının şu anda istikrarsız ve merkeziyetsiz olmaktan uzak olduğunu gösteriyor. Token’ın fiyatı ve piyasa dinamikleri, tek bir büyük sahibin kararlarından etkilenebilir; bu da uzun vadeli sürdürülebilirlik ve benimsenme ihtimalini zayıflatabilir.

Güncel BDG Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xa8b9...06c308 | 17.630.392,22K | 89,92% |

| 2 | 0xf389...d88847 | 1.382.300,49K | 7,05% |

| 3 | 0x0d07...b492fe | 268.733,25K | 1,37% |

| 4 | 0xc299...f80d6f | 128.536,39K | 0,65% |

| 5 | 0x20db...f815b3 | 80.535,93K | 0,41% |

| - | Diğerleri | 115.193,17K | 0,60% |

II. BDG'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Piyasa Arzı ve Talebi: Piyasadaki arz-talep dengesi BDG'nin fiyatında belirleyici rol oynar; aşırı arz fiyatı aşağı çekebilir.

- Mevcut Etki: Şirket, piyasa fazlasına bağlı fiyat düşüşlerini azaltmak için Ar-Ge bağlantılarını aşağı yönlü müşterilerle güçlendiriyor.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Benimseme: Şirketlerin blokzincir ve kripto para teknolojilerini giderek daha fazla benimsemesi, BDG için bir fırsat sunabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Faiz oranları ve genel para politikaları, BDG'nin fiyatını ve yatırım ortamını dolaylı olarak etkiler.

- Jeopolitik Gelişmeler: Ulusal ve uluslararası siyasi-ekonomik gelişmeler, BDG'nin değerini ve yatırım cazibesini etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Teknik Risk: BDG uydu uygulama sektöründeyse, bu alandaki teknolojik ilerleme ve riskler projenin geleceği ve fiyatı üzerinde belirleyici olabilir.

- Ar-Ge Faaliyetleri: Şirketin, özellikle aşağı yönlü müşterilerle ilişkilerini güçlendirmeye yönelik Ar-Ge çalışmaları, BDG'nin değerine olumlu katkı yapabilir.

III. BDG 2025-2030 Fiyat Tahmini

2025 Beklentisi

- Temkinli senaryo: 0,00074 $ - 0,00080 $

- Tarafsız senaryo: 0,00080 $ - 0,00090 $

- İyimser senaryo: 0,00090 $ - 0,00098 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Beklentisi

- Piyasa aşaması: Artan oynaklıkla potansiyel büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,00063 $ - 0,00117 $

- 2028: 0,00061 $ - 0,00161 $

- Kilit katalizörler: Proje kilometre taşları ve genel kripto piyasası trendleri

2029-2030 Uzun Vadeli Tahmin

- Temel senaryo: 0,00136 $ - 0,00151 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00151 $ - 0,00166 $ (proje benimsemesi yüksek olursa)

- Dönüştürücü senaryo: 0,00166 $ - 0,00169 $ (çığır açıcı inovasyon ve kitlesel benimseme ile)

- 2030-12-31: BDG 0,00169 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00098 | 0,00087 | 0,00074 | 0 |

| 2026 | 0,0012 | 0,00093 | 0,00068 | 6 |

| 2027 | 0,00117 | 0,00106 | 0,00063 | 21 |

| 2028 | 0,00161 | 0,00112 | 0,00061 | 28 |

| 2029 | 0,00166 | 0,00136 | 0,00078 | 56 |

| 2030 | 0,00169 | 0,00151 | 0,00079 | 73 |

IV. Profesyonel BDG Yatırım Stratejileri ve Risk Yönetimi

BDG Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına ve risk toleransına sahip olanlar

- Operasyon önerileri:

- Piyasa düşüşlerinde BDG biriktirin

- Hedef fiyatlarla kısmi kar alımı uygulayın

- BDG'yi güvenli, saklama dışı cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trend takibi

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım sinyallerini belirleyin

- Dalgalı piyasada alım-satım için kritik noktalar:

- Potansiyel zararları sınırlamak için zarar durdur emirleri kullanın

- Önceden belirlenmiş direnç seviyelerinde kar alımı yapın

BDG Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto varlığa dağıtın

- Zarar durdur emirleri: Aşağı yönlü riski sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: 2FA kullanın, güçlü şifreler oluşturun ve yazılımınızı güncel tutun

V. BDG için Potansiyel Riskler ve Zorluklar

BDG Piyasa Riskleri

- Yüksek oynaklık: BDG fiyatında ciddi dalgalanmalar görülebilir

- Düşük likidite: Sınırlı borsada işlem görmesi fiyat istikrarını etkileyebilir

- Piyasa duyarlılığı: Genel kripto piyasası trendlerine karşı hassastır

BDG Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: GameFi projelerine yönelik daha sıkı düzenlemeler gündeme gelebilir

- Sınır ötesi uyumluluk: Farklı ülkelerdeki düzenlemelere uyum sağlama zorlukları

- Token sınıflandırması: Bazı ülkelerde menkul kıymet olarak değerlendirilme riski

BDG Teknik Riskleri

- Akıllı sözleşme açıkları: Kodda olası açıklardan kaynaklı istismar riski

- Ölçeklenebilirlik sorunları: Artan ağ yüküyle başa çıkmada zorluklar

- Uyumluluk problemleri: Diğer blokzincir ekosistemleriyle entegrasyon güçlükleri

VI. Sonuç ve Eylem Önerileri

BDG Yatırım Değeri Değerlendirmesi

BDG, GameFi alanında yüksek risk ve yüksek potansiyel sunar. Yapay zeka ve meme temalı yenilikçi yaklaşımı gelecek vaat etse de, piyasa oynaklığı ve regülasyon belirsizlikleri nedeniyle yatırımcıların temkinli olması gerekir.

BDG Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kapsamlı araştırma sonrası küçük ve deneysel pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetli alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve BDG’yi çeşitlendirilmiş portföyde değerlendirin

BDG'ye Katılım Yolları

- Spot alım-satım: BDG token'ı Gate.com üzerinden satın alın

- Staking: Uygun programlar varsa staking'e katılın

- GameFi katılımı: BDG tabanlı oyun ve ekosistemlere dahil olun

Kripto para yatırımları çok yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Her yatırımcı kendi risk profilini göz önünde bulundurmalı ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

Sıkça Sorulan Sorular

BDG'nin Güncel Değeri Nedir?

12 Ekim 2025 itibarıyla BDG'nin fiyatı 0,00046893 $. 1 $ ile güncel kurda yaklaşık 2.132 BDG token alınabilir.

2025'te Hangi Meme Coin Patlama Yapacak?

Büyük borsalarda listelenen bir meme coin'in 2025'te patlama yapması, Ekim ayında 860 milyon $ piyasa değerine ve %8.000 değer artışına ulaşması öngörülüyor.

2025 için Altın Fiyat Tahmini Nedir?

Altın fiyatlarının 2025 sonunda ons başına 3.675 $ seviyesine çıkması bekleniyor. Merkez bankaları ve yatırımcıların güçlü talebi bu artışta etkili olacak. Analistler yıl boyunca istikrarlı bir yükseliş öngörüyor.

Dogecoin Ne Kadar Yükselebilir?

Uzman tahminlerine göre Dogecoin, 2030 yılında potansiyel olarak 0,20 $ seviyesine ulaşabilir. Ancak uzun vadeli fiyat gidişatı belirsizliğini koruyor ve piyasa trendleri ile yaygın benimsenmeye bağlıdır.

2025 BDG Fiyat Tahmini: BitDegree'nin Gelecekteki Değerine Yönelik Piyasa Trendleri ve Uzman Görüşlerinin Analizi

kripto neden çöküyor ve toparlanacak mı?

2025 FARTCOIN Fiyat Tahmini: Yükselen Meme Token Ekosisteminde Piyasa Trendlerinin ve Potansiyel Büyüme Faktörlerinin Analizi

2025 GROK Fiyat Tahmini: Yapay Zeka Destekli Kripto Para İçin Potansiyel Yükseliş mi, Piyasa Düzeltmesi mi?

2025 GORK Fiyat Tahmini: Piyasa Analizi ve Yükselen Kripto Para Birimi İçin Gelecek Büyüme Potansiyeli

Grok (GROK) iyi bir yatırım mı?: Elon Musk'ın AI Token'ının potansiyeli ve riskleri üzerine analiz

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak