2025 AURA Fiyat Tahmini: Bu DeFi Token Boğa Piyasasında Yeni Zirvelere Çıkabilir mi?

Giriş: AURA'nın Piyasa Konumu ve Yatırım Potansiyeli

Aura Network (AURA), ölçeklenebilir ve çevik bir Layer 1 blokzincir olarak, kurulduğundan beri NFT’lerin küresel çapta benimsenmesini hızlandırıyor. 2025 yılı itibarıyla AURA'nın piyasa değeri 2.939.846 dolar seviyesine ulaştı; dolaşımdaki token miktarı yaklaşık 407.463.190 ve fiyatı 0,007215 dolar civarında seyrediyor. Kapsamlı ekosistemiyle bilinen bu varlık, küresel NFT piyasasında gittikçe daha kritik bir rol üstleniyor.

Bu makale, 2025-2030 yılları arasında AURA'nın fiyat eğilimlerini; tarihsel örüntüler, piyasa arz-talep dinamikleri, ekosistem gelişimi ve makroekonomik faktörleri bir araya getirerek, profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler sunacaktır.

I. AURA Fiyat Geçmişi ve Güncel Piyasa Görünümü

AURA Tarihsel Fiyat Gelişimi

- 2024: Tüm zamanların en yüksek fiyatı 0,06798 dolar ile 6 Ocak 2024’te görüldü

- 2025: Tüm zamanların en düşük fiyatı 0,003149 dolar ile 14 Mayıs 2025’te kaydedildi

- 2025: Piyasa toparlandı, fiyat 14 Ekim 2025 itibarıyla 0,007215 dolara yükseldi

AURA Güncel Piyasa Durumu

14 Ekim 2025 tarihi itibarıyla AURA, 0,007215 dolardan işlem görüyor ve son 24 saatte %6,4 oranında değer kaybetti. Token, farklı zaman dilimlerinde karma bir performans sergiledi: son 30 günde %61,41 yükselirken, yıl bazında %44,04 değer kaybetti. Güncel piyasa değeri 2.939.846,92 dolar ve AURA, kripto para piyasasında 2.110’uncu sırada bulunuyor. 24 saatlik işlem hacmi 55.856,83 dolar ile orta düzeyde piyasa aktivitesine işaret ediyor. Dolaşımdaki 407.463.190,74 AURA tokenı, toplam arzın %40,75’ini oluşturuyor ve proje kontrollü bir token dağıtımı sürdürüyor. Tam seyreltilmiş değerleme 7.215.000 dolar olup, tüm tokenların dolaşıma girmesi halinde büyüme potansiyeli barındırıyor.

Güncel AURA piyasa fiyatını görmek için tıklayın

AURA Piyasa Duyarlılık Göstergesi

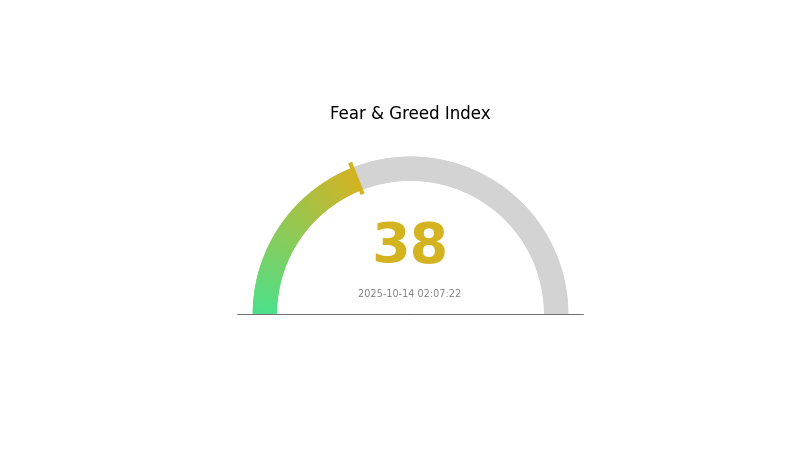

2025-10-14 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık "Korku" bölgesinde seyrediyor ve Korku ve Açgözlülük Endeksi 38 seviyesinde bulunuyor. Bu, yatırımcılar arasında temkinli bir ortam olduğu anlamına geliyor ve zıt pozisyon alanlar için potansiyel alım fırsatları doğurabilir. Ancak piyasa duyarlılığı hızla değişebilir. Her zaman detaylı araştırma yapmalı, risk profilinizi göz önünde bulundurmalı ve yatırım kararlarınızı dikkatle vermelisiniz. Gate.com, bu koşullarda piyasa takibini kolaylaştıracak araçlar ve kaynaklar sunuyor.

AURA Varlık Dağılımı

AURA'nın adres bazlı varlık dağılımı grafiği sıra dışı bir tablo ortaya koyuyor; büyük adreslerde anlamlı büyüklükte token bulunmuyor. Büyük yatırımcılar hakkında belirgin veri eksikliği ise kripto piyasasında özgün bir duruma işaret ediyor.

En büyük adreslerde yoğunlaşmanın olmaması, AURA tokenlarının son derece merkeziyetsiz bir biçimde dağılmış olduğunu gösteriyor. Tokenın çok sayıda küçük yatırımcıya yayılması, geniş çaplı benimsenme ve topluluk katılımını yansıtabilir. Ancak, mevcut piyasa yapısı ve likidite dinamikleri açısından da soru işaretleri oluşturuyor.

Büyük yatırımcıların yokluğu, AURA piyasasında genellikle "balina" hareketlerinden kaynaklanan oynaklığı azaltabilir. Böyle bir dağılım fiyat hareketlerinde daha istikrarlı bir seyir sağlayabilir; çünkü piyasayı etkileyebilecek güçlü oyuncular bulunmuyor. Öte yandan, belirgin büyük paydaşların olmaması piyasa derinliği ve likidite üzerinde olumsuz etki yaratabilir; bu da fiyat keşfi ve işlem verimliliğinde zorluklara yol açabilir.

Güncel AURA varlık dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. AURA'nın Gelecekteki Fiyatına Etki Eden Temel Unsurlar

Arz Mekanizması

- Enflasyonist Model: AURA, maksimum arz sınırı olmayan ve sürekli yeni token üretimiyle enflasyonist bir yapıya sahip.

- Tarihsel Gözlem: Geçmişte arz artışları genellikle fiyat üzerinde aşağı yönlü baskı oluşturdu.

- Güncel Etki: Sürekli enflasyonun AURA fiyatı üzerinde satış baskısı yaratmaya devam etmesi bekleniyor.

Makroekonomik Çevre

- Enflasyona Karşı Koruma Özellikleri: Kripto para olarak AURA, enflasyona karşı potansiyel bir koruma aracı olarak değerlendirilebilir; fakat bu rolü henüz pratikte kanıtlanmış değildir.

Teknik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: AURA, Balancer ekosisteminde getiri ve teşvikleri artırmaya odaklanan Aura Finance protokolünün yönetim tokenı olarak görev yapıyor.

III. 2025-2030 Dönemi AURA Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00583 - 0,00737 dolar

- Tarafsız tahmin: 0,00737 - 0,00851 dolar

- İyimser tahmin: 0,00851 - 0,00966 dolar (olumlu piyasa koşulları ve artan benimsenme ile)

2026-2027 Görünümü

- Piyasa aşaması: Büyüme dönemi ve yüksek oynaklık beklentisi

- Fiyat tahmini aralıkları:

- 2026: 0,00681 - 0,00988 dolar

- 2027: 0,00717 - 0,01085 dolar

- Önemli tetikleyiciler: Teknolojik gelişmeler, ekosistemin büyümesi ve genel piyasa trendleri

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00832 - 0,01364 dolar (istikrarlı piyasa büyümesi ve kesintisiz proje gelişimiyle)

- İyimser senaryo: 0,01364 - 0,01883 dolar (güçlü piyasa performansı ve ekosistemin yaygın benimsenmesiyle)

- Dönüştürücü senaryo: 0,01883 - 0,02000 dolar (çığır açan yenilikler ve ana akım entegrasyon ile)

- 2030-12-31: AURA 0,01883 dolar (iyimser tahmine göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,00966 | 0,00737 | 0,00583 | 2 |

| 2026 | 0,00988 | 0,00852 | 0,00681 | 18 |

| 2027 | 0,01085 | 0,0092 | 0,00717 | 27 |

| 2028 | 0,01434 | 0,01003 | 0,00842 | 38 |

| 2029 | 0,01511 | 0,01218 | 0,00743 | 68 |

| 2030 | 0,01883 | 0,01364 | 0,00832 | 89 |

IV. AURA Profesyonel Yatırım Stratejisi ve Risk Yönetimi

AURA Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli değer odaklı yatırımcılar

- Strateji önerileri:

- Piyasa düşüşlerinde AURA biriktirin

- Kısmi kâr alımı için fiyat hedefleri oluşturun

- Varlıklarınızı güvenli, saklama dışı cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım seviyelerini analiz eder

- Dalgalı işlem için temel noktalar:

- Destek ve direnç seviyelerini takip edin

- Risk yönetimi için zararı durdur emirleri kullanın

AURA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %10-15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlıkta dağıtın

- Zararı durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Büyük varlıklar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, güçlü şifreler oluşturun

V. AURA Potansiyel Riskler ve Zorluklar

AURA Piyasa Riskleri

- Oynaklık: Kripto piyasalarında yaygın olan yoğun fiyat dalgalanmaları

- Likidite: Sınırlı işlem hacmi fiyat stabilitesini olumsuz etkileyebilir

- Rekabet: Diğer NFT odaklı blokzincirlerin pazar payı elde etme riski

AURA Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen küresel kripto mevzuatı benimsenmeyi etkileyebilir

- Uyum zorlukları: Gelecekteki düzenleyici gerekliliklerin karşılanmasında güçlükler yaşanabilir

- Sınır ötesi kısıtlamalar: Uluslararası mevzuat farklılıkları küresel kullanımı sınırlayabilir

AURA Teknik Riskler

- Akıllı kontrat açıkları: Blokzincir kodunda olası güvenlik zaafları

- Ölçeklenebilirlik sorunları: Yoğun talep dönemlerinde ağ tıkanıklığı yaşanabilir

- Birlikte çalışabilirlik sorunları: Diğer blokzincirlerle entegrasyon güçlükleri

VI. Sonuç ve Eylem Önerileri

AURA Yatırım Değeri Değerlendirmesi

AURA, NFT odaklı blokzincir sektöründe yüksek riskli ancak yüksek potansiyelli bir yatırım sunuyor. Uzun vadeli değer önerisi ölçeklenebilir altyapısı ve büyüyen ekosistemine dayanırken, kısa vadeli riskler arasında piyasa oynaklığı ve düzenleyici belirsizlikler yer alıyor.

AURA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Detaylı araştırmadan sonra küçük ve uzun vadeli pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: AURA’yı çeşitlendirilmiş kripto portföyünde, NFT ekosistemi potansiyeline odaklanarak değerlendirin

AURA Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da AURA token alın ve tutun

- Staking: Ağ doğrulamasına katılarak pasif gelir elde edin (varsa)

- NFT ekosistemine katılım: AURA tabanlı NFT projelerinde yer alarak pozisyon alın

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını risk toleranslarına göre dikkatle vermeli, profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Aura coin için 2030 yılı fiyat tahmini nedir?

Piyasa eğilimleri ve potansiyel büyüme dikkate alındığında, Aura coin’in 2030’da artan benimsenme ve ekosistem genişlemesiyle 50-75 dolar aralığına ulaşması bekleniyor.

Aura için fiyat hedefi nedir?

Piyasa trendleri ve potansiyel büyüme esas alındığında, Aura'nın 2025 yılı fiyat hedefi artan benimsenme ve ekosistem genişlemesiyle 10 ila 15 dolar aralığına ulaşabilir.

Augur’un geleceği var mı?

Evet, Augur’un geleceği parlak görünüyor. Merkeziyetsiz tahmin piyasası platformu gelişimini sürdürüyor ve hem kullanıcı hem de geliştirici kitlesi büyüyor. Sürekli geliştirmeler ve artan benimsenmeyle Augur, blokzincir tabanlı öngörü alanında önemli bir aktör olmaya devam edecek.

Aura alınacak iyi bir hisse mi?

Aura, bir hisse senedi değil, bir kripto para birimidir. Web3 alanında büyüme potansiyeline sahip olan Aura, portföyünü çeşitlendirmek isteyen kripto yatırımcıları için cazip bir alternatif olabilir.

2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Tokeni İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Token’ı Yeni Zirvelere Yükselecek mi?

ARTEM ve KAVA: DeFi ile zincirler arası çözümler sunan iki yenilikçi blockchain platformunun karşılaştırılması

ZORA ve LINK: Dijital İçeriğin Geleceğinde Blockchain Protokollerinin Rekabeti

FLOW ve ZIL: dApp Geliştirme Amaçlı İki Lider Blockchain Platformunun Karşılaştırmalı Analizi

2025 SUPER Fiyat Tahmini: Kripto Para Birimi İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Fantom Blockchain Teknolojisini Anlamak: Temel Özellikler Açıklandı

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi