2025 AURA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: AURA's Market Position and Investment Value

Aura Network (AURA), as a scalable and agile layer 1 blockchain ecosystem, has been accelerating the global adoption of NFTs since its inception. As of 2025, AURA's market capitalization has reached $3,141,409, with a circulating supply of approximately 407,393,284 tokens, and a price hovering around $0.007711. This asset, known as the "NFT adoption accelerator," is playing an increasingly crucial role in the blockchain and NFT sectors.

This article will comprehensively analyze AURA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AURA Price History Review and Current Market Status

AURA Historical Price Evolution

- 2024: AURA reached its all-time high of $0.06798 on January 6, marking a significant milestone in its price history.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.003149 on May 14, demonstrating high volatility in the market.

AURA Current Market Situation

As of October 13, 2025, AURA is trading at $0.007711, with a market capitalization of $3,141,409.62. The token has shown mixed performance across different timeframes. In the past 24 hours, AURA has experienced a slight decline of 0.45%, while its 30-day performance shows a remarkable increase of 72.35%. However, the year-to-date performance indicates a significant drop of 42.33%.

The current circulating supply of AURA is 407,393,284.655983 tokens, representing 40.74% of its total supply of 1,000,000,000. The fully diluted valuation stands at $7,711,000, indicating potential for growth if the entire supply were to enter circulation.

AURA's trading volume in the last 24 hours amounts to $47,607.42, suggesting moderate market activity. The token's market dominance is currently at 0.00018%, reflecting its position as a relatively small player in the overall cryptocurrency market.

Click to view the current AURA market price

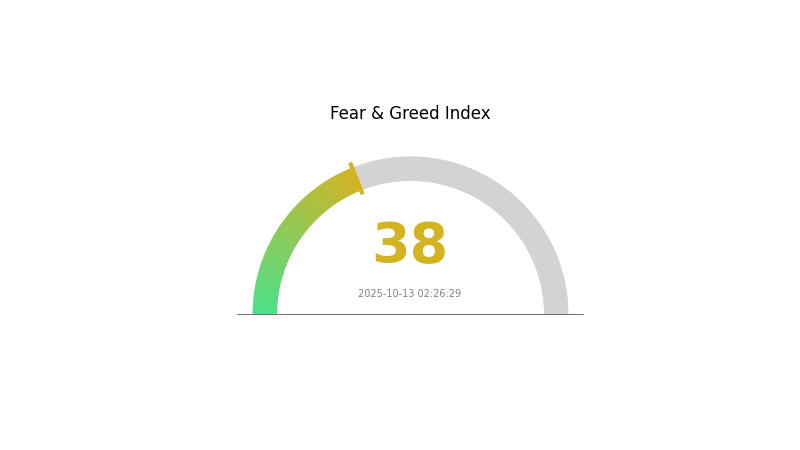

AURA Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 38, indicating a fearful mood among investors. This suggests a potential buying opportunity for those looking to enter the market at lower prices. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Remember, market sentiment can shift rapidly, and it's essential to stay informed about the latest developments in the crypto space.

AURA Holdings Distribution

The address holdings distribution chart for AURA reveals an unusual situation where no significant wallet concentrations are observed. This absence of data could indicate several possibilities: the token may be in an early stage of distribution, there might be technical issues with data collection, or the token's circulation mechanism could be unique.

Without clear concentration patterns, it's challenging to assess AURA's decentralization level or potential market manipulation risks. This lack of visible large holders could suggest a more evenly distributed token ownership, potentially leading to a more stable market structure. However, it's crucial to investigate further to understand the true state of AURA's distribution and its implications for market dynamics.

The current data, or lack thereof, highlights the importance of transparency in token distribution. It underscores the need for more comprehensive on-chain analysis to accurately gauge AURA's market characteristics and structural stability.

Click to view the current AURA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing AURA's Future Price

Supply Mechanism

- Token Supply: Investors are closely monitoring token supply and its impact on Aura's future listings and market value.

- Current Impact: Analysis of Aura token's supply and demand dynamics is crucial for predicting future price trends and staking profitability.

Institutional and Whale Dynamics

- Corporate Adoption: LVMH has launched the Aura alliance chain, aiming to implement blockchain technology in their products.

Macro Economic Environment

- Inflation Hedging Properties: As a cryptocurrency, AURA may be viewed as a potential hedge against inflation in certain economic environments.

Technological Development and Ecosystem Building

- Community Participation: Aura's active community plays a crucial role in its growth and price movement.

- Ecosystem Applications: Aura is deployed on the Solana blockchain, positioning itself as a meme coin with a focus on social influence and personal aura.

III. AURA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00686 - $0.00771

- Neutral forecast: $0.00771 - $0.00867

- Optimistic forecast: $0.00867 - $0.00964 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00581 - $0.01549

- 2028: $0.00814 - $0.01562

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.01437 - $0.01538 (assuming steady market growth)

- Optimistic scenario: $0.01538 - $0.01661 (assuming strong market performance)

- Transformative scenario: Above $0.01661 (extreme favorable conditions)

- 2030-12-31: AURA $0.01538 (potential peak based on average predictions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00964 | 0.00771 | 0.00686 | 0 |

| 2026 | 0.01284 | 0.00867 | 0.00573 | 12 |

| 2027 | 0.01549 | 0.01076 | 0.00581 | 39 |

| 2028 | 0.01562 | 0.01312 | 0.00814 | 70 |

| 2029 | 0.01638 | 0.01437 | 0.00805 | 86 |

| 2030 | 0.01661 | 0.01538 | 0.01169 | 99 |

IV. AURA Professional Investment Strategies and Risk Management

AURA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NFT enthusiasts

- Operation suggestions:

- Accumulate AURA tokens during market dips

- Participate in the Aura Network ecosystem and NFT projects

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- RSI (Relative Strength Index): Use for overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined resistance levels

AURA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 1 blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for AURA

AURA Market Risks

- High volatility: Cryptocurrency market fluctuations can lead to significant price swings

- Competition: Other Layer 1 blockchains and NFT platforms may impact Aura Network's market share

- Market sentiment: Changes in overall crypto market sentiment can affect AURA's price

AURA Regulatory Risks

- Uncertain regulations: Evolving global cryptocurrency regulations may impact AURA's adoption

- NFT-specific regulations: Potential new laws targeting NFTs could affect Aura Network's core business

- Cross-border compliance: Varying international regulations may limit global expansion

AURA Technical Risks

- Smart contract vulnerabilities: Potential bugs in the network's smart contracts could lead to security issues

- Scalability challenges: Rapid growth in NFT adoption may test the network's scalability

- Interoperability issues: Challenges in connecting with other blockchain networks could limit growth

VI. Conclusion and Action Recommendations

AURA Investment Value Assessment

Aura Network shows potential as a specialized Layer 1 blockchain for NFTs, but faces significant competition and market volatility. Long-term value depends on widespread NFT adoption and ecosystem growth, while short-term risks include market fluctuations and regulatory uncertainties.

AURA Investment Recommendations

✅ Beginners: Consider small, long-term positions as part of a diversified crypto portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy and actively participate in the Aura ecosystem ✅ Institutional investors: Conduct thorough due diligence and consider AURA as part of a broader blockchain investment strategy

AURA Trading Participation Methods

- Spot trading: Purchase AURA tokens on Gate.com

- Staking: Participate in staking programs to earn passive income

- NFT marketplace engagement: Utilize AURA tokens within the Aura Network NFT ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for Aura coin?

Aura coin is expected to trade between $0.055 and $0.079 in 2025, with a potential increase of 3.75%.

What is the price target for Aura?

The price target for Aura is projected to be between $19.00 and $24.00, with an average target suggesting a 271% upside potential.

What is the price prediction for Aureal One in 2030?

The price prediction for Aureal One in 2030 ranges from $0.10358 to $0.28874, with an average of $0.19616, representing a potential 7,867.69% increase.

How much is Aura coin worth?

As of 2025-10-13, Aura coin is worth $0.0817. It has seen a 5.3% decline in the past 24 hours and is down 28.2% from its previous day's value.

Share

Content