2025 ARCH Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: ARCH's Market Position and Investment Value

Archway (ARCH), as an incentivized smart contract platform rewarding developers, has been fostering next-generation dApps since its inception. As of 2025, Archway's market cap has reached $3,128,459, with a circulating supply of approximately 640,028,533 tokens, and a price hovering around $0.004888. This asset, known as the "developer-centric blockchain," is playing an increasingly crucial role in building scalable cross-chain dApps.

This article will comprehensively analyze Archway's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ARCH Price History Review and Current Market Status

ARCH Historical Price Evolution Trajectory

- 2023: ARCH reached its all-time high of $0.28899 on December 24, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with ARCH hitting its all-time low of $0.004712 on July 18.

ARCH Current Market Situation

As of October 14, 2025, ARCH is trading at $0.004888, representing a 98.31% decline from its all-time high. The token has a market capitalization of $3,128,459, ranking it at 2067 in the cryptocurrency market. Over the past 24 hours, ARCH has seen a slight decrease of 1.55%, with a trading volume of $20,869. The circulating supply stands at 640,028,533 ARCH, which is 64% of the maximum supply of 1,000,000,000 ARCH. The fully diluted market cap is currently at $4,888,000.

Looking at recent price trends, ARCH has shown mixed performance across different timeframes. While it has seen a marginal increase of 0.02% in the last hour, the token has experienced more significant declines over longer periods. The 7-day and 30-day price changes show decreases of 13.75% and 8.27% respectively, indicating a bearish short-term trend. The most substantial decline is observed in the 1-year timeframe, with ARCH losing 86.5% of its value.

Click to view the current ARCH market price

ARCH Market Sentiment Indicator

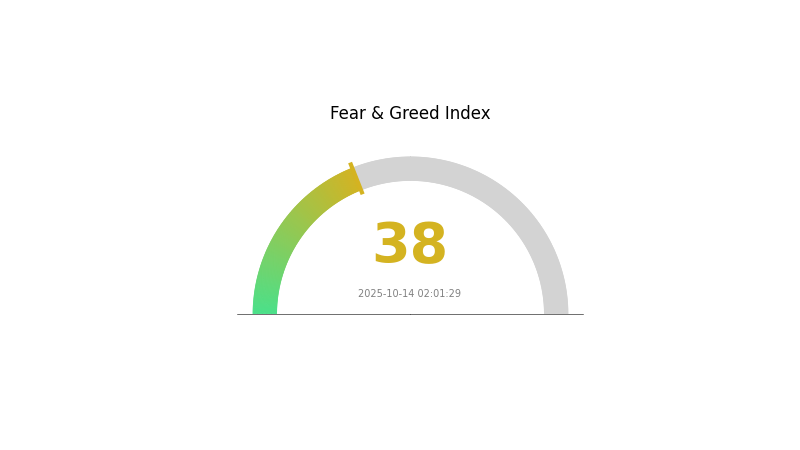

2025-10-14 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the sentiment index at 38. This indicates a cautious atmosphere among investors. During such times, it's crucial to stay informed and make rational decisions. Some traders view fear as a potential buying opportunity, following the adage "be greedy when others are fearful." However, it's essential to conduct thorough research and consider your risk tolerance before making any investment decisions in this volatile market.

ARCH Holdings Distribution

The address holdings distribution data for ARCH is currently unavailable, which limits our ability to conduct a comprehensive analysis of its token concentration and market structure. This lack of information makes it challenging to assess the degree of decentralization, potential market manipulation risks, or the overall stability of ARCH's on-chain structure.

In the absence of specific data, it's important to note that a healthy token distribution typically shows a balanced spread across various address tiers, avoiding excessive concentration in a small number of wallets. A well-distributed token supply can contribute to better market liquidity and reduced volatility, as it minimizes the impact of large holders' actions on the token price.

Without concrete holdings data, investors and analysts should exercise caution and seek additional information from reliable sources before making any investment decisions regarding ARCH.

Click to view the current ARCH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ARCH's Future Price

Supply Mechanism

- Inflationary Model: ARCH follows an inflationary supply model, with new tokens minted over time.

- Historical Pattern: Past supply increases have generally led to downward pressure on ARCH's price.

- Current Impact: The ongoing inflation is expected to continue exerting bearish pressure on ARCH's value.

Technical Development and Ecosystem Building

- Ecosystem Growth: ARCH is actively expanding its ecosystem with new DApps and projects being developed on its platform.

III. ARCH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00396 - $0.00450

- Neutral prediction: $0.00450 - $0.00489

- Optimistic prediction: $0.00489 - $0.00503 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00581 - $0.00878

- 2028: $0.00712 - $0.00912

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.00833 - $0.00992 (assuming steady market growth)

- Optimistic scenario: $0.00992 - $0.01191 (assuming strong market performance)

- Transformative scenario: $0.01191+ (extreme favorable conditions)

- 2030-12-31: ARCH $0.01191 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00503 | 0.00489 | 0.00396 | 0 |

| 2026 | 0.00714 | 0.00496 | 0.00337 | 1 |

| 2027 | 0.00878 | 0.00605 | 0.00581 | 23 |

| 2028 | 0.00912 | 0.00741 | 0.00712 | 51 |

| 2029 | 0.01157 | 0.00827 | 0.00455 | 69 |

| 2030 | 0.01191 | 0.00992 | 0.00833 | 102 |

IV. ARCH Professional Investment Strategy and Risk Management

ARCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate ARCH during market dips

- Set price alerts for significant movements

- Store in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI: Monitor for overbought/oversold conditions

- Key Points for Swing Trading:

- Look for price action at support and resistance levels

- Monitor trading volume for confirmation of trends

ARCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across different cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. ARCH Potential Risks and Challenges

ARCH Market Risks

- High volatility: ARCH price can experience significant fluctuations

- Limited liquidity: May affect ability to enter or exit positions quickly

- Market sentiment: Susceptible to broader cryptocurrency market trends

ARCH Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting ARCH

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws for cryptocurrency transactions

ARCH Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible delays during high-traffic periods

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

ARCH Investment Value Assessment

ARCH offers potential long-term value as an incentivized smart contract platform, but faces short-term risks due to market volatility and regulatory uncertainties.

ARCH Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider ARCH as part of a diversified crypto portfolio

ARCH Trading Participation Methods

- Spot trading: Buy and sell ARCH on Gate.com

- Staking: Participate in ARCH staking programs for potential rewards

- DeFi integration: Explore decentralized finance opportunities using ARCH

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Is Arch a good stock to buy?

Arch is not a stock, but a cryptocurrency. It shows potential for growth in the Web3 space, making it an interesting investment option for crypto enthusiasts.

What is the price target for ACHR 2026?

Based on current market trends and expert analysis, the price target for ACHR in 2026 is estimated to be around $3.50 to $4.00.

Is Archway crypto a good investment?

Yes, Archway crypto shows promise as an investment in 2025. Its innovative blockchain solutions and growing ecosystem make it an attractive option for long-term growth in the Web3 space.

What is the price target for Arch Capital?

Based on market trends and expert analysis, the price target for Arch Capital by 2026 is estimated to be around $2.50 to $3.00 per token.

Share

Content