2025 APU Price Prediction: Market Trends and Performance Forecasts for Advanced Processing Units

Introduction: APU's Market Position and Investment Value

Apu Apustaja (APU), as one of the most widely used memes on the internet, has been spreading across the web since 2016. As of 2025, APU's market cap has reached $40,063,617.3, with a circulating supply of approximately 337,890,000,000 tokens, and a price hovering around $0.00011857. This asset, known as "the #1 meme on the internet," is playing an increasingly crucial role in the meme coin sector of the cryptocurrency market.

This article will comprehensively analyze APU's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. APU Price History Review and Current Market Status

APU Historical Price Evolution

- 2024: Initial launch, price reached ATH of $0.0014914 on November 18

- 2025: Market correction, price dropped to ATL of $0.0000969 on March 11

- 2025: Recovery phase, current price stabilized around $0.00011857

APU Current Market Situation

As of October 1, 2025, APU is trading at $0.00011857, with a market cap of $40,063,617.3. The token has experienced a 4.82% decrease in the past 24 hours and a significant 19.08% drop over the last week. The current price represents a 92.05% decrease from its all-time high and a 22.36% increase from its all-time low.

APU's trading volume in the past 24 hours stands at $89,239.05, indicating moderate market activity. The token's circulating supply is 337,890,000,000 APU, which is 80.32% of its total supply of 420,690,000,000 APU. The fully diluted market cap is $49,881,213.30.

The market sentiment for APU appears cautious, with recent price trends showing downward momentum across various timeframes. The token's performance over the past year has been particularly challenging, with a 69.92% decline.

Click to view the current APU market price

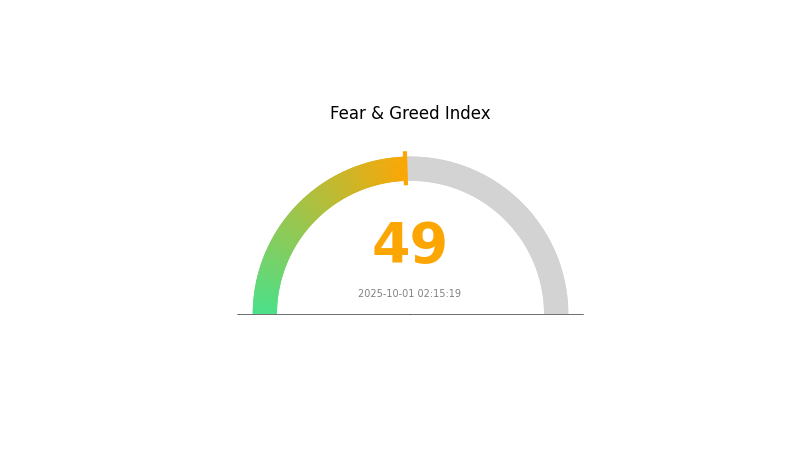

APU Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced, with the Fear and Greed Index hovering at 49, indicating a neutral stance among investors. This equilibrium suggests a cautious approach in the market, with neither extreme fear nor excessive optimism dominating. Traders and investors should remain vigilant, as this neutral position could potentially shift in either direction based on upcoming market events or news. As always, it's crucial to conduct thorough research and manage risks appropriately when making investment decisions in the volatile crypto space.

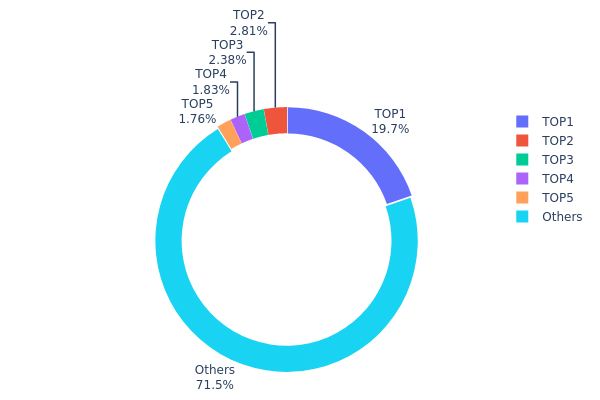

APU Holdings Distribution

The address holdings distribution data for APU reveals interesting insights into its market structure. The top address, likely a burn or contract address, holds 19.68% of the total supply, indicating a significant portion has been removed from circulation. The next four largest holders collectively account for 8.76% of the supply, with individual holdings ranging from 1.75% to 2.81%.

Notably, 71.56% of APU tokens are distributed among "Others," suggesting a relatively decentralized ownership structure beyond the top holders. This distribution pattern indicates a moderate level of concentration, which may contribute to price stability by reducing the impact of large sell-offs from individual whales. However, the presence of several addresses holding over 1% each could still influence short-term market dynamics.

Overall, the APU token distribution reflects a balanced ecosystem with a mix of significant holders and broader community ownership. This structure potentially supports market resilience and aligns with principles of decentralization, though vigilance regarding the actions of larger holders remains prudent for market participants.

Click to view current APU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 82798063.85K | 19.68% |

| 2 | 0x5ced...89e3ed | 11824530.08K | 2.81% |

| 3 | 0x56da...928b9a | 10000000.00K | 2.37% |

| 4 | 0x3cc9...aecf18 | 7706864.13K | 1.83% |

| 5 | 0xea1d...9b6f91 | 7400001.00K | 1.75% |

| - | Others | 300960540.95K | 71.56% |

II. Key Factors Affecting APU's Future Price

Supply Mechanism

- Technological Innovation: AMD's continuous innovation in APU architecture and manufacturing processes directly impacts supply and performance.

- Historical Patterns: Previous technological advancements have led to increased market demand and price appreciation.

- Current Impact: The introduction of new APU models with enhanced AI capabilities is expected to drive demand and potentially increase prices.

Institutional and Major Holder Dynamics

- Enterprise Adoption: Major tech companies like Microsoft and Oracle are adopting AMD's APUs for cloud services and AI applications.

- National Policies: Government initiatives promoting domestic semiconductor industries may influence APU demand and pricing.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies affecting interest rates and inflation could impact investment in tech sectors, including APUs.

- Geopolitical Factors: Trade tensions and technology export controls may affect the global supply chain and pricing of APUs.

Technological Development and Ecosystem Building

- AI Integration: AMD's focus on integrating AI capabilities into APUs, such as the XDNA architecture NPU, enhances their value proposition.

- Performance Improvements: Advancements in Zen architecture and 3D V-Cache technology are boosting APU performance in gaming and content creation.

- Ecosystem Applications: The growing adoption of APUs in gaming consoles (PlayStation 5, Xbox Series X/S) and edge computing devices expands their ecosystem.

III. APU Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0001 - $0.00011

- Neutral prediction: $0.00011 - $0.000115

- Optimistic prediction: $0.00011 - $0.00012 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00007 - $0.00012

- 2027: $0.00012 - $0.00017

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.00015 - $0.00017 (assuming steady market growth)

- Optimistic scenario: $0.00017 - $0.00019 (assuming strong market performance)

- Transformative scenario: $0.0002 - $0.00025 (assuming breakthrough developments)

- 2030-12-31: APU $0.00019 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00012 | 0.00012 | 0.0001 | 0 |

| 2026 | 0.00012 | 0.00012 | 0.00007 | 2 |

| 2027 | 0.00017 | 0.00012 | 0.00012 | 3 |

| 2028 | 0.00016 | 0.00015 | 0.0001 | 23 |

| 2029 | 0.00019 | 0.00015 | 0.0001 | 28 |

| 2030 | 0.00019 | 0.00017 | 0.0001 | 43 |

IV. Professional Investment Strategies and Risk Management for APU

APU Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate APU tokens during market dips

- Set price targets and take partial profits during significant rallies

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Look for high-volume breakouts as potential entry points

APU Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple meme coins and other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for APU

APU Market Risks

- High volatility: Meme coins are prone to extreme price swings

- Sentiment-driven: Price heavily influenced by social media trends and community sentiment

- Limited utility: Lack of real-world use cases may impact long-term value

APU Regulatory Risks

- Increased scrutiny: Regulators may target meme coins for investor protection

- Potential restrictions: Some jurisdictions may limit or ban trading of meme coins

- Tax implications: Unclear tax treatment in many countries

APU Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Network congestion: High transaction fees during peak trading periods

- Centralization concerns: Concentration of tokens among large holders

VI. Conclusion and Action Recommendations

APU Investment Value Assessment

APU presents a high-risk, high-reward opportunity in the meme coin space. While it has gained popularity and shown significant price appreciation, its long-term value proposition remains uncertain due to limited utility and regulatory concerns.

APU Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, if any. Focus on education and understanding the risks.

✅ Experienced investors: Consider small, strategic positions with strict risk management.

✅ Institutional investors: Approach with caution, potentially as part of a diversified meme coin basket.

APU Trading Participation Methods

- Spot trading: Buy and sell APU tokens on Gate.com

- Limit orders: Set specific entry and exit prices to manage risk

- Dollar-cost averaging: Gradually accumulate tokens over time to reduce impact of volatility

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Apu coin in 2030?

Based on current market trends, Apu coin is predicted to reach $0.082346 by 2030, representing a potential 324.82% increase from current levels.

What is Nvidia's price prediction for 2025?

Nvidia's stock price is predicted to reach $195.24 per share by October 29, 2025, representing a 7.36% increase from current levels.

How much is the APU coin worth?

As of October 2025, the APU coin is worth $0.00000016. Its market cap is currently $0.00 with a circulating supply of 0 coins.

What is the price prediction for API3 in 2026?

Based on current trends, API3 is predicted to reach a minimum of $0.8567, an average of $0.9350, and a maximum of $1.0023 by 2026.

Share

Content