2025 APT Fiyat Tahmini: Aptos Token’ı Yeni Zirvelere Taşıyabilecek Temel Dinamikler

Giriş: APT'nin Piyasa Konumu ve Yatırım Değeri

Layer 1 blokzincir alanında yüksek performansıyla öne çıkan Aptos (APT), 2022'den bu yana kayda değer başarılara imza attı. 2025 itibarıyla Aptos'un piyasa değeri 3.014.151.906 ABD doları seviyesinde, dolaşımdaki arzı yaklaşık 688.791.569 token, token fiyatı ise 4,376 ABD doları civarında bulunuyor. "Güvenli ve ölçeklenebilir Layer 1 çözümü" olarak adlandırılan bu varlık, blokzincir uygulamalarının geliştirilmesi ve optimizasyonunda giderek daha önemli bir rol oynuyor.

Bu makalede, Aptos’un 2025-2030 dönemindeki fiyat eğilimleri tarihsel örüntüler, arzdaki ve taleptaki değişimler, ekosistem gelişimi ve makroekonomik faktörlerle birlikte ele alınarak yatırımcılara profesyonel fiyat öngörüleri ve stratejik yatırım yaklaşımları sunulacaktır.

I. APT Fiyat Geçmişi ve Güncel Piyasa Durumu

APT Tarihsel Fiyat Seyri

- 2022: Proje lansmanı, fiyat aralığı 3,08 - 19,92 ABD doları

- 2023: Piyasa toparlanması, 26 Ocak’ta tüm zamanların en yüksek fiyatı olan 19,92 ABD doları görüldü

- 2024: Piyasa konsolidasyonu, fiyat 4-6 ABD doları aralığında sabitlendi

APT Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla APT 4,376 ABD doları düzeyinden işlem görüyor; 24 saatlik işlem hacmi 766.909,68 ABD dolarıdır. Son 24 saatte %2,7 değer kaybı yaşanmıştır. Piyasa değeri 3.014.151.906 ABD dolarıyla küresel kripto para piyasasında 52. sıradadır. Dolaşımdaki arzı 688.791.569 APT ve toplam arzı 1.174.258.942 APT'dir. En yüksek fiyatına 26 Ocak 2023’te (19,92 ABD doları) ulaşırken, en düşük fiyatı 30 Aralık 2022’de (3,08 ABD doları) görülmüştür. Geçen yıl içinde APT %30,19 değer kaybetmiştir; bu, genel piyasa trendlerini ve proje bazlı gelişmeleri yansıtmaktadır.

Güncel APT piyasa fiyatını görüntüleyin

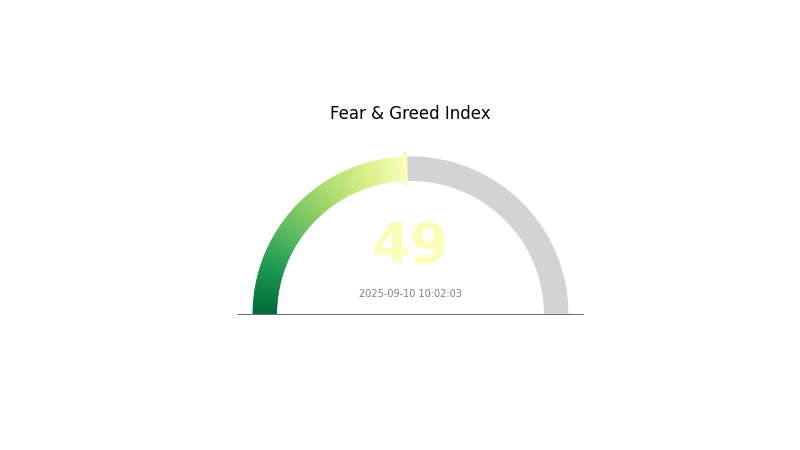

APT Piyasa Duyarlılık Göstergesi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku ve Açgözlülük Endeksi verilerine ulaşın

APT için piyasa duyarlılığı bugün nötr düzeyde; Korku ve Açgözlülük Endeksi 49’da sabit kaldı. Bu durum, yatırımcıların panik yapmadığını veya aşırı risk almadığını gösteriyor. Piyasa istikrarı sürse de, yatırımcıların portföylerini çeşitlendirmesi ve kritik destek/direnç seviyelerini takip etmesi önemlidir. Gate.com’un profesyonel işlem araçlarını kullanarak nötr piyasada bilinçli stratejiler geliştirebilirsiniz.

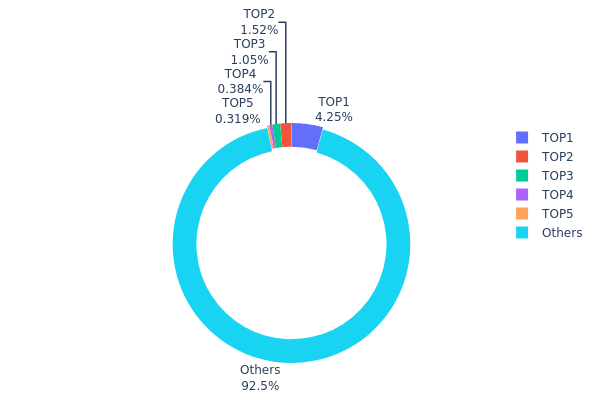

APT Varlık Dağılımı

APT adres bazında varlık dağılımı, ilk sıralardaki sahiplerin yüksek yoğunluğa sahip olması şeklinde kendini gösteriyor. En büyük adres, toplam arzın %23,84’üne sahipken; ilk 5 adresin toplamdaki payı %42,19’dur. Bu yoğunlaşma, olası piyasa manipülasyonu ve volatilite risklerini gündeme taşımaktadır.

Bununla birlikte, APT tokenlarının %57,81’i “Diğerleri” arasında dağılmış durumda; bu merkeziyetsizliğin bir göstergesidir. Ancak üst adreslerin yüksek varlığı, piyasa üzerinde önemli dalgalanmalara yol açabilecek kapasitededir.

Bu dağılım, APT zincir üstü yapısında orta seviyede merkezileşmeye işaret eder. Yoğunlaşma aşırı olmasa da, üst adreslerdeki yüksek miktarlı alım-satımlar likidite ve piyasa istikrarı açısından yakından izlenmelidir.

Güncel APT Varlık Dağılımı tablosu için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xed8c...c0a60e | 49.944,42K | 23,84% |

| 2 | 0xcc03...1b207e | 17.808,73K | 8,50% |

| 3 | 0x84b1...dba6e0 | 12.374,61K | 5,91% |

| 4 | 0xdc7a...fd8fa4 | 4.503,86K | 2,15% |

| 5 | 0xe8ca...49b9ea | 3.747,73K | 1,79% |

| - | Diğerleri | 1.085.814,35K | 57,81% |

II. APT’nin Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Dolaşımdaki Arz: 10 Eylül 2025 itibarıyla APT'nin dolaşımdaki arzı 688.791.565,0266898 token.

- Toplam Arz: Toplam APT arzı 1.174.258.942,9301016 token.

- Mevcut Etki: Arzın hızlı artışı, talep aynı oranda büyümezse fiyat üzerinde baskı oluşturabilir.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Benimseme: Aptos teknolojisini kullanan büyük şirketler APT'nin değerini yükseltebilir.

- Devlet Politikaları: Farklı ülkelerdeki düzenleyici gelişmeler, APT fiyatında dalgalanmalara yol açabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: APT’nin enflasyonist dönemlerdeki performansı fiyatı üzerinde belirleyici olabilir.

- Jeopolitik Etkenler: Küresel gelişmelerin kripto piyasasına, dolayısıyla APT'ye etkisi söz konusudur.

Teknolojik Gelişim ve Ekosistem İnşası

- Ağ İyileştirmeleri: Sürekli yapılan teknik güncellemeler ve ağ geliştirmeleri, APT fiyatını olumlu etkileyebilir.

- Ekosistem Uygulamaları: Aptos ekosisteminde DApp ve farklı projelerin çoğalması, APT'ye olan talebi artırabilir.

III. 2025-2030 Dönemi için APT Fiyat Tahminleri

2025 Görünümü

- Temkinli yaklaşım: 3,25 - 4,00 ABD doları aralığı

- Nötr yaklaşım: 4,00 - 4,50 ABD doları

- İyimser yaklaşım: 4,50 - 4,92 ABD doları (güçlü piyasa aşaması ve artan benimsemeyle)

2027-2028 Görünümü

- Piyasa döngüsü beklentisi: Benimsenmede artış ile büyüme dönemi yaşanabilir

- Fiyat aralıkları tahmini:

- 2027: 4,85 - 8,21 ABD doları

- 2028: 3,62 - 8,07 ABD doları

- Başlıca tetikleyiciler: Teknolojik ilerlemeler, ekosistemde genişleme ve piyasa trendleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 7,26 - 8,75 ABD doları (düzenli büyüme ve benimsemeyle)

- İyimser senaryo: 8,75 - 10,06 ABD doları (yaygın benimsenme ve olumlu piyasa şartlarında)

- Dönüştürücü senaryo: 10,06 ABD doları üzeri (çığır açan kullanım alanları ve ana akım entegrasyon ile)

- 31 Aralık 2030: Ortalama APT fiyatı 8,75 ABD doları olarak öngörülüyor

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 4,9168 | 4,39 | 3,2486 | 0 |

| 2026 | 6,74743 | 4,6534 | 3,02471 | 6 |

| 2027 | 8,2086 | 5,70042 | 4,84535 | 30 |

| 2028 | 8,06723 | 6,95451 | 3,61634 | 58 |

| 2029 | 9,98945 | 7,51087 | 4,58163 | 71 |

| 2030 | 10,06268 | 8,75016 | 7,26263 | 99 |

IV. Profesyonel APT Yatırım Stratejileri ve Risk Yönetimi

APT Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Aptos ekosistemine inanan ve uzun vadeli yatırım hedefleyenler

- Uygulama önerileri:

- APT birikimini kademeli olarak yapın

- APT tokenlarını staking yaparak pasif gelir elde edin

- Fonları güvenli donanım cüzdanı veya güvenilir saklama hizmetlerinde tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve dönüş noktalarını tespit etmede etkin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım bölgelerinin saptanmasında yardımcı olur

- Kısa vadeli alım-satım için kritik ipuçları:

- Temel destek ve direnç seviyelerini takip edin

- Aptos ekosistemindeki yeni iş ortaklıkları ve gelişmeleri düzenli izleyin

APT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ünü APT’ye ayırmalı

- Agresif yatırımcılar: Kripto portföyünün %5-10’u aralığına kadar APT tutabilir

- Profesyonel yatırımcılar: Portföylerinde %15’e kadar APT bulundurabilir

(2) Riskten Korunma Çözümleri

- Portföy çeşitlendirmesi: Farklı Layer 1 projelerine yatırım yaparak riski yaymak

- Stop loss emirleri: Potansiyel zararı önceden belirlenmiş seviyelerde sınırlamak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet

- Soğuk cüzdan: Donanım cüzdanlarında uzun süreli saklama

- Güvenlik önlemleri: İki aşamalı kimlik doğrulama, güçlü parola kullanımı ve düzenli yazılım güncellemeleri

V. APT İçin Potansiyel Riskler ve Zorluklar

APT Piyasa Riskleri

- Yüksek volatilite: APT fiyatında kayda değer dalgalanmalar gözlemlenebilir

- Yoğun rekabet: Layer 1 blokzincir projelerine olan ilginin artışı

- Piyasa duyarlılığı: Genel kripto piyasası hareketlerine açık olma

APT Düzenleyici Riskler

- Düzenleyici belirsizlik: Layer 1 projelerine yönelik denetim ve düzenleme riskleri

- Uyum zorlukları: Değişen küresel kripto regülasyonlarına ayak uydurma zorunluluğu

- Jeopolitik etkenler: Uluslararası politikaların blokzincir piyasasına etkisi

APT Teknik Riskler

- Akıllı sözleşme açıkları: Aptos ekosisteminde olası güvenlik zaafları

- Ölçeklenebilirlik sorunları: Ağ kullanımı arttıkça performansı sürdürme gerekliliği

- Teknolojik eskime: Daha yeni blokzincir teknolojilerinin gerisinde kalma riski

VI. Sonuç ve Eylem Tavsiyeleri

APT Yatırım Değeri Analizi

Aptos (APT), yüksek performanslı Layer 1 altyapısıyla uzun vadede cazip bir yatırım potansiyeline sahip; ancak kısa vadede volatilite ve sektördeki rekabet nedeniyle belirgin riskler içeriyor.

APT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düzenli ve düşük miktarlarda alımlar ile kademeli pozisyon oluşturun

✅ Deneyimli yatırımcılar: Tutma ve aktif alım-satım stratejilerini birleştirerek dengeli portföy oluşturun

✅ Kurumsal yatırımcılar: APT’yi çeşitlendirilmiş blokzincir portföyüne dahil etmeyi değerlendirin

APT İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında APT işlemleri

- Staking: Pasif gelir için APT staking programlarına katılım

- DeFi getirileri: Aptos ekosistemi içinde merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk içerir, bu metin yatırım tavsiyesi niteliği taşımamaktadır. Her yatırımcı kendi risk toleransına göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze aldığınızdan fazlasını yatırmayın.

Sık Sorulan Sorular

Aptos 100 ABD dolarına ulaşabilir mi?

Aptos, 25-50 milyar ABD doları piyasa değerine ulaşırsa 100 ABD doları gibi bir seviyeye erişebilir. Bu, piyasa koşulları ve dolaşımdaki arz ile doğrudan bağlantılıdır. Beklentinin yüksek olduğu boğa piyasasında imkansız değildir.

Aptos'un geleceği var mı?

Evet; öngörüler, APT’nin bir yıl içinde 9,44 ABD doları seviyesine ulaşabileceğini gösterecek kadar olumlu. Çok yüksek fiyat beklentileri olmasa da, proje istikrarlı gelişim ve devam eden piyasa ilgisiyle dikkat çekiyor.

2025 için APT fiyat tahmini nedir?

Mevcut projeksiyonlara göre 2025'te APT fiyatının yaklaşık 20,17 ABD doları olması ve bugünkü seviyelere göre %300’ün üzerinde yükseliş göstermesi bekleniyor.

Aptos uzun vadeli yatırım için uygun mu?

Evet; Aptos’un sınırlı arzı ve kontrollü dağıtım modeli, değerini koruma ve zamanla seyrelme riskini azaltma avantajı sağlayarak uzun vadeli yatırım için cazip bir seçenek sunuyor.

2025 KAS Fiyat Öngörüsü: Kaspa'nın Gelecekteki Değerini Etkileyen Başlıca Faktörlerin Derinlemesine Analizi

2025 MOVE Fiyat Tahmini: Gelişen kripto para ekosisteminde büyüme faktörleri ve piyasa trendlerinin analizi

2025 SAGA Fiyat Tahmini: Gelişen Blockchain Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Kaspa (KAS) iyi bir yatırım mı?: Yüksek işlem kapasitesine sahip bu blockchain projesinin potansiyelini analiz etmek

FOXY ve APT: Kurumsal güvenlik ortamlarında modern tehdit tespit sistemlerinin karşılaştırılması

LOFI ve APT: Siber Güvenlik Tehdit İstihbaratına Farklı Yaklaşımların Analizi

Kripto varlıklarınızı güvence altına almak için özel anahtarları anlamak: Güvenlik önerileri

Ethereum ölçeklenebilirliğini geliştirmek amacıyla Layer 2 çözümlerini keşfetmek

Blockchain Node İşlevselliğini Anlamak: Yeni Başlayanlar İçin Rehber

Taproot teknolojisini destekleyen en güvenli Bitcoin cüzdanları

Ethereum İşlem Maliyetlerinin Yapısını Kavramak ve Bunları Azaltma Yöntemleri