2025 APP Fiyat Tahmini: Mobil Yazılım Maliyetlerinin Geleceği ve Pazar Trendleri

Giriş: APP’in Piyasadaki Konumu ve Yatırım Değeri

RWAX (APP), Injective odaklı bir launchpad süper uygulaması olarak, kuruluşundan bu yana gelişmiş zincir üzeri alım satım botlarını bünyesine katmıştır. 2025 yılı itibarıyla RWAX’in piyasa değeri 2.696.913 ABD Doları’na ulaşmış, yaklaşık 1.985.944.981 adet dolaşımdaki token ile fiyatı 0,001358 ABD Doları civarında seyretmektedir. Yenilikçi zincir üstü alım satım yaklaşımı ile öne çıkan bu varlık, merkeziyetsiz finans ve otomatik alım satım alanlarında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, RWAX’in 2025-2030 dönemindeki fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik faktörler doğrultusunda kapsamlı biçimde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. APP Fiyat Geçmişi ve Güncel Piyasa Durumu

APP’in Tarihsel Fiyat Gelişimi

- 2024: İlk lansman, fiyat 0,051 ABD Doları ile zirveye ulaştı

- 2025: Piyasa düşüşü, fiyat 0,001266 ABD Doları’na kadar geriledi

APP Güncel Piyasa Durumu

14 Ekim 2025 itibarıyla APP, 0,001358 ABD Doları’ndan işlem görmekte ve son 24 saatte %13,8’lik ciddi bir düşüş yaşamıştır. Token’ın piyasa değeri 2.696.913 ABD Doları ile kripto piyasasında 2.174’üncü sıradadır. Son bir gündeki işlem hacmi ise 78.807 ABD Doları’na ulaşarak orta seviyede piyasa hareketliliği göstermektedir.

APP, farklı zaman dilimlerinde yüksek değer kaybı yaşadı. 7 günlük değişim %31,72 azalış gösterirken, 30 günlük ve 1 yıllık değişimler ise sırasıyla %47,9 ve %42,77 oranında daha sert düşüşlere işaret ediyor. Süregelen bu aşağı yönlü trend, token’a yönelik ayı piyasası algısının sürdüğünü göstermektedir.

Güncel 0,001358 ABD Doları fiyatı, APP’in tüm zamanların en düşüğü olan 0,001266 ABD Doları’na (13 Ekim 2025’te kaydedildi) çok yakındır. Bu dip seviyeye yakınlık, olası bir dönüş fırsatı arayan bazı yatırımcıların ilgisini çekebilir; ancak aynı zamanda token’ın şu anki zayıf piyasa konumunu da ortaya koymaktadır.

APP’in dolaşımdaki arzı yaklaşık 1,99 milyar adet olup, toplam 3 milyar token arzının yaklaşık %66,2’sini oluşturmaktadır. Tam seyreltilmiş piyasa değeri 4.074.000 ABD Doları’dır ve bu, güncel piyasa değerinden oldukça yüksektir. Bu fark, tüm token’lar piyasaya sürüldüğünde gelecekte olası bir değer seyrelmesine işaret etmektedir.

Token’ın piyasa hakimiyeti %0,000098 gibi düşük bir seviyededir ve bu da genel kripto piyasasında çok küçük bir paya sahip olduğunu gösterir. Düşük hakimiyet, APP’in piyasadaki genel yönelimleri etkileme gücünün sınırlı olduğunu ve büyük fiyat hareketlerine karşı daha hassas olabileceğini göstermektedir.

Güncel APP piyasa fiyatını görmek için tıklayın

APP Piyasa Duyarlılığı Göstergesi

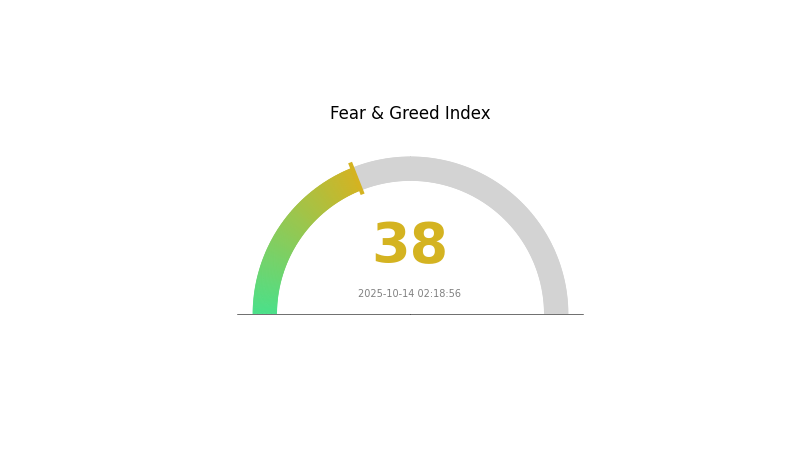

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında temkinli bir hava hâkim; Korku ve Açgözlülük Endeksi 38 ile korku seviyesinde. Bu, yatırımcıların çekingen davrandığını ve potansiyel alım fırsatlarını kolladığını gösterir. Böyle dönemlerde güncel kalmak ve rasyonel adımlar atmak kritik önemdedir. Piyasa döngülerinin doğal olduğunu ve korkunun genellikle toparlanmadan önce geldiğini unutmayın. Portföyünüzü çeşitlendirin ve güçlü temellere sahip projelere odaklanın. Her zaman kendi araştırmanızı yapın (DYOR) ve sorumlu bir şekilde yatırım yapın.

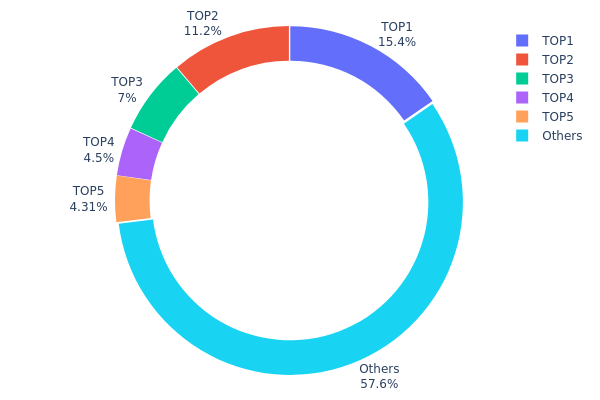

APP Token Dağılımı

Adres bazlı token dağılımı, APP varlıklarının farklı cüzdanlara nasıl dağıldığı konusunda kritik bilgiler sunar. Analiz, başlıca adreslerde yüksek bir yoğunlaşma olduğunu gösteriyor. İlk 5 adres, toplam APP arzının %42,39’unu elinde bulundururken, en büyük sahip tüm token’ların %15,39’una sahiptir.

Bu kadar yoğunlaşma, piyasa istikrarı ve fiyat dalgalanması riskine işaret eder. Büyük sahiplerin toplu hareketleri, fiyat ve piyasa dinamiklerinde önemli değişikliklere neden olabilir. Ancak token’ların %57,61’i diğer adreslere yayılmış durumda, bu da daha geniş bir dağılıma işaret eder.

Mevcut dağılım yapısı, APP sahipliğinde orta düzeyde merkezileşme olduğunu gösteriyor. Bu durum kısa vadede fiyat dalgalanmasını ve piyasa algısını etkileyebilir ancak büyük sahiplerin davranışlarının izlenmesinin önemini de ortaya koyuyor. Genel olarak dağılım, tam merkeziyetsiz bir yapı oluşturmasa da, sahiplik tabanının giderek genişlediğini gösteriyor.

Güncel APP Token Dağılımı için tıklayın

| Top | Adres | Tutan Adet | Tutan (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 461.838,58K | 15,39% |

| 2 | 0x5ddd...cc6cfb | 336.000,00K | 11,20% |

| 3 | 0xe190...170182 | 210.000,00K | 7,00% |

| 4 | 0xe459...c5d02f | 135.000,03K | 4,50% |

| 5 | 0xf89d...5eaa40 | 129.239,59K | 4,30% |

| - | Diğerleri | 1.727.921,81K | 57,61% |

II. APP’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın (Fed) ekim ayında faiz indirimlerine devam etmesi bekleniyor; çoğu Fed yetkilisi yıl sonuna kadar en az iki ek faiz indirimi öngörüyor.

- Enflasyona Karşı Koruma: Çin ithalatına yönelik olası ek gümrük vergileri, Fed yetkilileri arasında enflasyon etkileri konusunda farklı görüşlere yol açabilir.

- Jeopolitik Faktörler: Jeopolitik gerilimlerin artması ve Çin-ABD ticaret sürtüşmelerinin yeniden gündeme gelmesi muhtemel. Ukrayna ve Orta Doğu’daki çatışmaların ise önemli ölçüde tırmanması beklenmiyor.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Yapay Zeka Entegrasyonu: Özellikle işlem gücü ve robotik uygulamalarda yapay zekâ teknolojilerinin entegrasyonu, ilgili sektörlerde büyümeyi hızlandıracak.

- Ekosistem Uygulamaları: Başlıca DApp/ekosistem projeleri, yapay zekâ uygulamaları, tüketici elektroniği, yarı iletkenler ve oyun alanlarına odaklanıyor.

III. 2025-2030 Dönemi için APP Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00096 - 0,00137 ABD Doları

- Tarafsız tahmin: 0,00137 - 0,00152 ABD Doları

- İyimser tahmin: 0,00152 - 0,00167 ABD Doları (olumlu piyasa havası gerektirir)

2026-2028 Görünümü

- Piyasa evresi: Kademeli büyüme dönemi

- Fiyat aralığı tahminleri:

- 2026: 0,00105 - 0,00223 ABD Doları

- 2027: 0,00159 - 0,00223 ABD Doları

- 2028: 0,00154 - 0,00211 ABD Doları

- Kilit katalizörler: Artan benimseme, teknolojik gelişmeler ve genel kripto piyasası toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00202 - 0,00238 ABD Doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00269 - 0,00324 ABD Doları (güçlü piyasa performansı ve artan kullanım varsayımıyla)

- Dönüştürücü senaryo: 0,00324+ ABD Doları (yaygın benimseme ve büyük iş birlikleri gibi olağanüstü olumlu koşullar altında)

- 31 Aralık 2030: APP 0,00324 ABD Doları (iyimser projeksiyona göre olası zirve)

| Yıl | En Yüksek Tahmin | Ortalama Tahmin | En Düşük Tahmin | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00167 | 0,00137 | 0,00096 | 0 |

| 2026 | 0,00223 | 0,00152 | 0,00105 | 11 |

| 2027 | 0,00223 | 0,00187 | 0,00159 | 37 |

| 2028 | 0,00211 | 0,00205 | 0,00154 | 51 |

| 2029 | 0,00269 | 0,00208 | 0,00202 | 53 |

| 2030 | 0,00324 | 0,00238 | 0,00122 | 75 |

IV. APP İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

APP Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Sabırlı, yüksek risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde APP biriktirin

- Kısmi kâr realizasyonu için fiyat hedefleri koyun

- Token’ları güvenli donanım cüzdanlarında muhafaza edin

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumlarını izler

- Kısa vadeli al-sat için önemli noktalar:

- Fiyatın direnç seviyelerinin üzerine çıkıp çıkmadığını takip edin

- Risklerinizi yönetmek için zararı durdur emirleri verin

APP Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto varlıklarına yayın

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonları değerlendirin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanları kullanın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler oluşturun

V. APP’in Karşılaşabileceği Temel Riskler ve Zorluklar

APP Piyasa Riskleri

- Yüksek volatilite: APP fiyatında sert dalgalanmalar yaşanabilir

- Likitide riski: Düşük işlem hacmi pozisyon kapatmayı zorlaştırabilir

- Rakip riski: Daha gelişmiş projeler piyasaya çıkabilir

APP Regülasyon Riskleri

- Belirsiz yasal ortam: DeFi projelerine yönelik daha sıkı regülasyonlar gündeme gelebilir

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- KYC/AML gereklilikleri: Daha sıkı kimlik doğrulama süreçleri uygulanabilir

APP Teknik Riskleri

- Akıllı kontrat açıkları: Sömürü veya saldırı riski bulunur

- Ölçeklenebilirlik sorunları: Yoğun talep anında ağ tıkanıklığı yaşanabilir

- Birlikte çalışabilirlik: Diğer blok zincirlerle entegrasyon sorunları ortaya çıkabilir

VI. Sonuç ve Eylem Önerileri

APP Yatırım Değeri Analizi

APP, yenilikçi zincir üstü alım satım özellikleri sunuyor; ancak ciddi rekabet ve düzenleyici belirsizliklerle karşı karşıya. Uzun vadede potansiyel barındırsa da kısa vadede yüksek volatilite beklenmelidir.

APP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi anlamak için küçük ve deneysel pozisyonlar alın

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle dolar-maliyet ortalaması stratejisi uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve çeşitlendirilmiş kripto portföyünün bir parçası olarak değerlendirin

APP İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com ve diğer desteklenen borsalarda işlem yapılabilir

- Limit emirleri: İstenilen giriş/çıkış fiyatlarını belirleyerek işlemleri otomatikleştirin

- Staking: Proje tarafından sunuluyorsa staking fırsatlarını değerlendirin

Kripto para yatırımları oldukça yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

APPS alınmaya değer bir hisse mi?

Evet, APPS güçlü al önerisiyle değerlendiriliyor. Mevcut fiyatı 6,25 ABD Doları ve büyüme potansiyeli sunuyor. Yatırım kararı öncesi piyasa trendlerini ve hedeflerinizi mutlaka analiz edin.

AppLovin hissesi 2030’da ne kadar olacak?

AppLovin hissesi, mevcut piyasa trendleri ve şirket performansına göre 2030 yılında 1.498 – 2.777 ABD Doları aralığına ulaşabilir.

En iyi alım satım tahmin uygulaması hangisi?

Kalshi, 2025 yılında önde gelen tahmin uygulamasıdır. Siyaset ve spor dahil birçok piyasada doğru öngörüler sağlar.

APPS hissesi için hedef fiyat nedir?

APPS hissesi için hedef fiyat, kısa vadeli güncel tahminlere göre 14 Ekim 2025 itibarıyla 6,75 ABD Dolarıdır.

LOT vs GRT: Sıfır-Şut Akıl Yürütme Görevlerinde Dil Modellerinin Yetkinliklerinin Karşılaştırılması

2025 MAV Fiyat Tahmini: Merkeziyetsiz Havacılık Token’leri İçin Piyasa Trendleri ve Gelecek Potansiyeli Analizi

COAI Token Piyasasında zincir üstü veri analizi, balina davranışlarını nasıl ortaya çıkarır?

2025 Yılında Chainlink'in Fiyatına İlişkin Türev Piyasa Sinyalleri Ne Anlatıyor?

## Stage 2: Native Excellence & Cultural Adaptation SwissCheese (SWCH) Fiyatını 24 Saat İçinde %22,58 Artıran Faktörler Nelerdir?

Dash Kripto Para Biriminde Karşılaşılan Temel Güvenlik Riskleri ve Zafiyetler Nelerdir?

Yapay Zekâ ile Sanat Oluşturma: NFT Üretimi İçin En İyi Araçlar

Konsorsiyum Blockchain'i Anlamak: Temel Özellikler ve Avantajlar

Delegated Proof of Stake (DPoS) Kavramının İncelenmesi

Kripto Kopya Ticaretinde En İyi Platformlar: Başlangıç Seviyesine Uygun Alternatifler

Kripto muslukları üzerinden ücretsiz kripto para kazanabileceğiniz en iyi uygulamalar