2025 ALUPrice Prediction: Market Analysis and Future Outlook for Aluminum Commodity Trends

Introduction: Market Position and Investment Value of ALU

Altura (ALU), as a cross-chain application aiming to integrate blockchain and cryptocurrency into the gaming world, has been enabling communities to obtain NFTs that flow between different games since its inception. As of 2025, Altura's market capitalization has reached $22,245,300, with a circulating supply of approximately 990,000,000 tokens, and a price hovering around $0.02247. This asset, known as the "Gaming NFT Innovator," is playing an increasingly crucial role in the realm of blockchain gaming and NFT marketplaces.

This article will comprehensively analyze Altura's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ALU Price History Review and Current Market Status

ALU Historical Price Evolution Trajectory

- 2021: ALU reached its all-time high of $0.462652 on November 3, marking a significant milestone

- 2021: ALU hit its all-time low of $0.00255407 on July 19, showing extreme price volatility

- 2025: ALU price has stabilized around $0.02247, demonstrating a recovery from previous lows

ALU Current Market Situation

As of October 4, 2025, ALU is trading at $0.02247, with a market cap of $22,245,300. The token has shown mixed performance across different timeframes. In the past 24 hours, ALU has seen a modest gain of 0.67%. However, the 7-day performance is particularly noteworthy, with a significant increase of 25.47%, indicating strong short-term bullish momentum.

Despite the recent positive trend, ALU is still down 61.83% over the past 30 days, suggesting high volatility and potential market corrections. The 1-year performance shows a slight gain of 1.03%, indicating a relatively stable long-term trajectory.

ALU's current price is well below its all-time high, presenting a potential opportunity for investors who believe in the project's long-term potential. The token's circulating supply matches its total supply of 990,000,000 ALU, indicating full distribution.

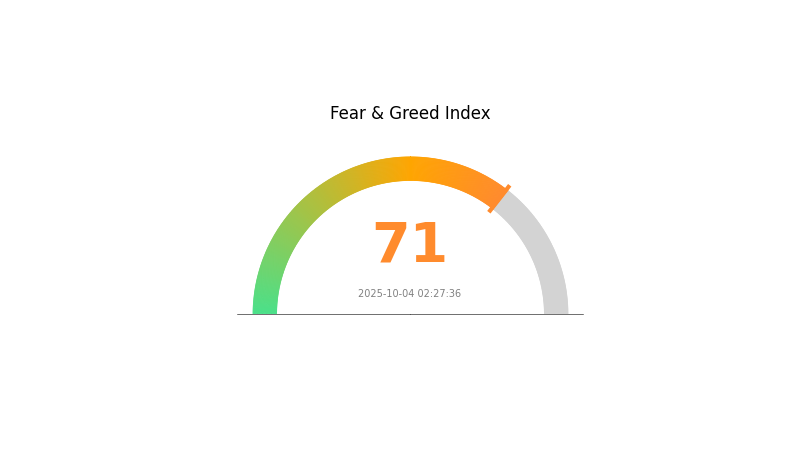

The current market sentiment for cryptocurrencies is characterized as "Greed" with a VIX score of 71, which may contribute to ALU's recent positive performance.

Click to view the current ALU market price

ALU Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 71. This indicates high investor optimism and potentially overheated market conditions. While positive sentiment can drive prices up, it's essential to remain cautious. Experienced traders may consider taking some profits or hedging positions. However, for long-term investors, this could be an opportunity to reassess portfolio allocations and ensure diversification. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.

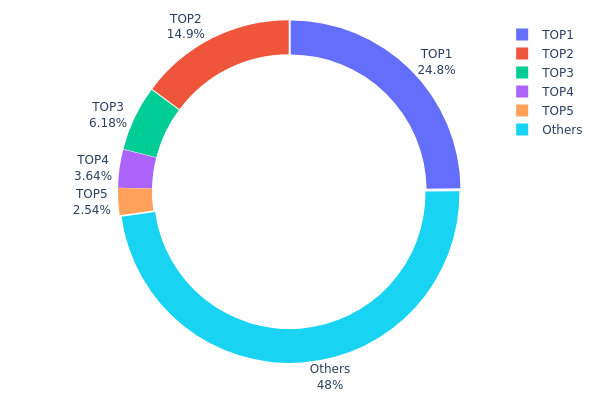

ALU Holdings Distribution

The address holdings distribution data for ALU reveals a relatively concentrated ownership structure. The top 5 addresses collectively hold 52% of the total supply, with the largest holder possessing 24.81% of ALU tokens. This concentration level suggests a potential risk of market manipulation and price volatility.

The second and third largest holders control 14.85% and 6.17% respectively, further contributing to the centralization of ALU's token distribution. While 48% of tokens are distributed among other addresses, the significant holdings of the top addresses indicate a less than ideal level of decentralization for the ALU network.

This concentration of holdings could impact market dynamics, potentially leading to increased price volatility if large holders decide to sell or accumulate more tokens. It also raises concerns about the network's resilience and governance, as a small number of addresses could exert substantial influence over the project's direction.

Click to view the current ALU holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2255...da51e2 | 330000.00K | 24.81% |

| 2 | 0xc882...84f071 | 197583.41K | 14.85% |

| 3 | 0xaa18...d45965 | 82190.59K | 6.17% |

| 4 | 0x2e8f...725e64 | 48390.24K | 3.63% |

| 5 | 0x2933...fa4625 | 33816.03K | 2.54% |

| - | Others | 638019.73K | 48% |

II. Key Factors Affecting ALU's Future Price

Supply Mechanism

- Seasonal Inventory Changes: Aluminum inventory levels are significantly affected by seasonal factors, which can influence price fluctuations.

- Historical Patterns: Historical data suggests that inventory levels have a correlation with aluminum price movements, although the relationship is not always straightforward.

- Current Impact: Recent changes in inventory levels and supply pressures have contributed to price volatility in the aluminum market.

Macroeconomic Environment

- Monetary Policy Impact: Energy costs play a significant role in aluminum production, with recent trends showing a decrease in energy prices potentially leading to cheaper aluminum production.

- Inflation Hedging Properties: As a commodity, aluminum prices are sensitive to global economic conditions and may be viewed as a potential hedge against inflation.

- Geopolitical Factors: Geopolitical events and trade policy adjustments have been observed to influence international aluminum price trends.

Technological Development and Ecosystem Building

- Sustainability Initiatives: Growing demand for sustainable and recycled aluminum is driving market changes and influencing price dynamics.

- Environmental Regulations: Environmental policies and regulations are impacting market trends, potentially affecting production costs and supply.

- Ecosystem Applications: The aluminum industry is adapting to "carbon neutrality" goals, which may present both challenges and opportunities for future development and pricing.

III. ALU Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.0164 - $0.02246

- Neutral forecast: $0.02246 - $0.02673

- Optimistic forecast: $0.02673 - $0.03099 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.0153 - $0.03897

- 2028: $0.02951 - $0.03968

- Key catalysts: Technological advancements, partnerships, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.03680 - $0.04434 (assuming steady growth and adoption)

- Optimistic scenario: $0.04434 - $0.05189 (assuming strong market performance and project success)

- Transformative scenario: $0.05189 - $0.05587 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: ALU $0.05587 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03099 | 0.02246 | 0.0164 | 0 |

| 2026 | 0.031 | 0.02673 | 0.02005 | 18 |

| 2027 | 0.03897 | 0.02887 | 0.0153 | 28 |

| 2028 | 0.03968 | 0.03392 | 0.02951 | 50 |

| 2029 | 0.05189 | 0.0368 | 0.02134 | 63 |

| 2030 | 0.05587 | 0.04434 | 0.04301 | 97 |

IV. ALU Professional Investment Strategies and Risk Management

ALU Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ALU during market dips

- Set price targets for partial profit-taking

- Store ALU in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor ALU's correlation with the broader crypto market

- Set stop-loss orders to manage downside risk

ALU Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Plans

- Diversification: Spread investments across various crypto assets and traditional markets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ALU

ALU Market Risks

- High volatility: ALU price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades without impacting price

- Competition: Other gaming and NFT projects may impact ALU's market share

ALU Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on NFTs and gaming tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws may affect ALU transactions and holdings

ALU Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: May face issues as the Altura ecosystem grows

- Interoperability concerns: Challenges in integrating with other blockchain networks or games

VI. Conclusion and Action Recommendations

ALU Investment Value Assessment

ALU presents a unique proposition in the gaming and NFT space, with potential for long-term growth. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

ALU Investment Recommendations

✅ Newcomers: Start with small positions and focus on education about the gaming NFT market ✅ Experienced investors: Consider a balanced approach, allocating a portion of the crypto portfolio to ALU ✅ Institutional investors: Conduct thorough due diligence and consider ALU as part of a diversified crypto strategy

ALU Trading Participation Methods

- Spot trading: Buy and sell ALU on Gate.com's spot market

- Staking: Participate in staking programs if available to earn additional rewards

- NFT trading: Engage with Altura's NFT marketplace to gain exposure to the ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and PEPENODE (PEPENODE) are predicted to 1000x based on current market trends.

Can Algo Coin reach $100?

While $100 is unlikely short-term, Algo Coin has long-term growth potential. Analysts predict prices between $0.7 and $4 in the future.

What is the all time high for Alu coin?

The all-time high price for Alu coin is $0.46. This peak was reached on a specific date in the past.

Which alt coins to buy in 2025?

MYX, ASTER, and Mantle are promising alt coins to consider in 2025, with potential for growth due to expected Binance listing.

Share

Content