2025 ALKIMI Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Advertising Token

Introduction: ALKIMI's Market Position and Investment Value

Alkimi (ALKIMI), as the first on-chain digital ad exchange, has made significant strides since its inception in 2021, processing over 2.5 billion transactions and forming partnerships with global brands such as Coca-Cola, Publicis, and Fox. As of 2025, Alkimi's market capitalization stands at $16,512,608, with a circulating supply of approximately 298,169,167 tokens, and a price hovering around $0.05538. This asset, often referred to as a "disruptor in digital advertising," is playing an increasingly crucial role in revolutionizing the $750 billion digital advertising market.

This article will provide a comprehensive analysis of Alkimi's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. ALKIMI Price History Review and Current Market Status

ALKIMI Historical Price Evolution

- 2023: Launch of Alkimi Exchange, price started at a low base

- 2024: Rapid growth in protocol fees, price reached ATH of $0.1654 on August 20

- 2025: Market correction, price dropped to ATL of $0.03835 on September 20

ALKIMI Current Market Situation

As of October 6, 2025, ALKIMI is trading at $0.05538, down 3.68% in the last 24 hours. The token has experienced significant volatility over the past year, with a 71.38% decrease from its previous highs. Despite this, ALKIMI has shown some signs of stabilization in recent weeks, with a modest 0.18% gain in the last hour.

The current market capitalization stands at $16,512,608, ranking ALKIMI at 1192 in the global cryptocurrency market. With a circulating supply of 298,169,167 ALKIMI tokens out of a total supply of 1,000,000,000, the project has a circulating ratio of 29.82%.

Trading volume in the last 24 hours reached $941,790, indicating moderate market activity. The token is currently trading 66.51% below its all-time high, suggesting potential room for growth if market conditions improve and the project continues to deliver on its roadmap.

Click to view the current ALKIMI market price

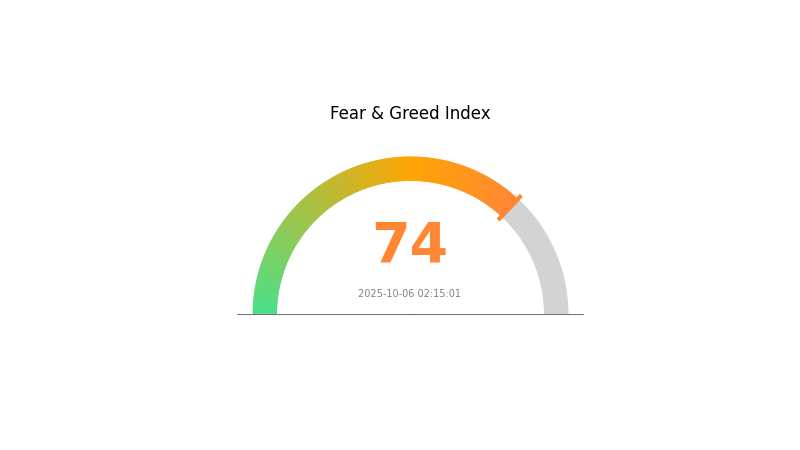

ALKIMI Market Sentiment Indicator

2025-10-06 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 74. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, such elevated levels of greed often precede market corrections. Traders should exercise caution and consider taking profits or setting stop-losses. It's crucial to maintain a balanced approach and not get carried away by excessive market enthusiasm. Remember, successful investing often involves going against the crowd.

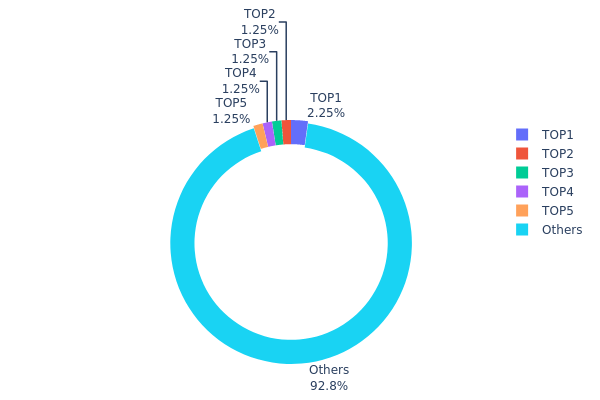

ALKIMI Holdings Distribution

The address holdings distribution chart for ALKIMI reveals a relatively decentralized token ownership structure. The top 5 addresses collectively hold only 7.24% of the total supply, with the largest single address owning 2.24%. This distribution pattern suggests a healthy level of decentralization, as no single entity or small group of holders has overwhelming control over the token supply.

The majority of ALKIMI tokens (92.76%) are distributed among numerous other addresses, indicating a broad base of token holders. This widespread distribution can contribute to market stability and resilience against potential price manipulation. It also reflects a diverse community of stakeholders, which is generally considered positive for the project's long-term sustainability and governance.

While the top holders do have significant stakes, their individual holdings are not disproportionately large, ranging from 1.25% to 2.24% each. This balanced distribution may help mitigate risks associated with sudden large sell-offs and promote a more organic price discovery process in the market.

Click to view the current ALKIMI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb18a...b412bc | 22452.94K | 2.24% |

| 2 | 0x7dfc...abb235 | 12500.00K | 1.25% |

| 3 | 0x1c5b...226597 | 12500.00K | 1.25% |

| 4 | 0xa515...2665b5 | 12500.00K | 1.25% |

| 5 | 0xc0e7...6bc6bd | 12500.00K | 1.25% |

| - | Others | 927547.06K | 92.76% |

II. Core Factors Affecting ALKIMI's Future Price

Supply Mechanism

- Market Sentiment: Price action is often driven by market sentiment, as reflected in candlestick charts.

- Historical Pattern: Long-term holders (HODLers) tend to focus on fundamental analysis, while short-term traders are more influenced by market dynamics.

- Current Impact: News announcements and community sentiment can be significant price drivers for ALKIMI.

Technical Development and Ecosystem Building

- Ecosystem Applications: ALKIMI's utility token drives the platform, facilitating a secure environment for users.

III. ALKIMI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04929 - $0.05538

- Neutral prediction: $0.05538 - $0.06092

- Optimistic prediction: $0.06092 - $0.07000 (requires significant market adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.06300 - $0.09078

- 2028: $0.04518 - $0.11810

- Key catalysts: Increased adoption, technological advancements, and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.09868 - $0.10805 (assuming steady market growth)

- Optimistic scenario: $0.11743 - $0.12318 (assuming strong market performance)

- Transformative scenario: $0.13000 - $0.15000 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: ALKIMI $0.12318 (potentially reaching new all-time high)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06092 | 0.05538 | 0.04929 | 0 |

| 2026 | 0.07734 | 0.05815 | 0.0564 | 5 |

| 2027 | 0.09078 | 0.06774 | 0.063 | 22 |

| 2028 | 0.1181 | 0.07926 | 0.04518 | 43 |

| 2029 | 0.11743 | 0.09868 | 0.07894 | 78 |

| 2030 | 0.12318 | 0.10805 | 0.07132 | 95 |

IV. ALKIMI Professional Investment Strategies and Risk Management

ALKIMI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operational advice:

- Accumulate ALKIMI tokens during market dips

- Stake tokens to earn protocol fees

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor news and developments in the digital advertising industry

ALKIMI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. ALKIMI Potential Risks and Challenges

ALKIMI Market Risks

- High volatility: ALKIMI price may experience significant fluctuations

- Competition: Other blockchain-based advertising platforms may emerge

- Adoption rate: Slow uptake by advertisers could impact growth

ALKIMI Regulatory Risks

- Uncertain regulations: Changing cryptocurrency regulations may affect ALKIMI

- Advertising industry compliance: New ad tech regulations could impact operations

- Cross-border transactions: International regulatory differences may pose challenges

ALKIMI Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability challenges: Ability to handle increasing transaction volumes

- Blockchain interoperability: Potential issues with Sui blockchain integration

VI. Conclusion and Action Recommendations

ALKIMI Investment Value Assessment

ALKIMI presents a compelling long-term value proposition in the digital advertising space, with strong growth in protocol fees and partnerships. However, short-term volatility and adoption risks remain significant considerations.

ALKIMI Investment Recommendations

✅ Beginners: Consider small, long-term positions with a focus on learning ✅ Experienced investors: Implement a dollar-cost averaging strategy and actively stake tokens ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

ALKIMI Trading Participation Methods

- Spot trading: Buy and sell ALKIMI tokens on Gate.com

- Staking: Participate in ALKIMI's staking program to earn protocol fees

- DeFi integration: Explore ALKIMI-related DeFi opportunities as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is Alkimi coin worth?

As of October 2025, Alkimi coin is worth $0.0564. The price has seen minor fluctuations recently, with a slight decline in the past hour.

What is the Trump coin prediction for 2026?

Based on current trends, the Trump coin price prediction for 2026 is estimated at €0.00, assuming a 5% price change. Market conditions may vary.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $140,652. Chainlink follows with a high prediction of $62.60.

What is alkimi crypto?

Alkimi (ADS) is a decentralized platform using blockchain to transform digital advertising by tokenizing ad impressions and merging real-world assets with decentralized finance. It aims to tokenize the $600 billion digital ads market.

Share

Content