2025 ALI Price Prediction: Navigating Market Trends and Growth Potential for Alibaba's Digital Currency

Introduction: ALI's Market Position and Investment Value

Artificial Liquid Intelligence (ALI), as a decentralized protocol for creating interactive and intelligent NFTs (iNFTs), has been making significant strides in the blockchain and AI intersection since its inception. As of 2025, ALI's market capitalization has reached $48,991,503, with a circulating supply of approximately 9,118,091,184 tokens, and a price hovering around $0.005373. This asset, often referred to as the "pioneer of iNFT standards," is playing an increasingly crucial role in the fields of AI-powered NFTs and metaverse applications.

This article will provide a comprehensive analysis of ALI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. ALI Price History Review and Current Market Status

ALI Historical Price Evolution

- 2023: ALI reached its all-time high of $0.084641 on February 9, marking a significant milestone

- 2023: On the same day, February 9, ALI hit its all-time low of $0.0034, demonstrating extreme volatility

- 2025: Current market cycle, price stabilized around $0.005373

ALI Current Market Situation

As of September 30, 2025, ALI is trading at $0.005373, with a market capitalization of $48,991,503.93. The token has seen a 3.26% increase in the last 24 hours, indicating short-term positive momentum. However, looking at longer timeframes, ALI has experienced significant declines, with a 23.36% decrease over the past 30 days and a substantial 57.17% drop over the last year.

The current price is considerably below its all-time high of $0.084641, suggesting that the token has faced significant downward pressure since its peak. The trading volume in the last 24 hours stands at $26,443.38, which is relatively low compared to its market cap, indicating moderate market activity.

ALI's fully diluted valuation is $53,036,365.76, with a circulating supply of 9,118,091,184 ALI tokens, representing 92.37% of the total supply. This high circulation ratio suggests that a large portion of the tokens are already in the market.

Click to view the current ALI market price

ALI Market Sentiment Indicator

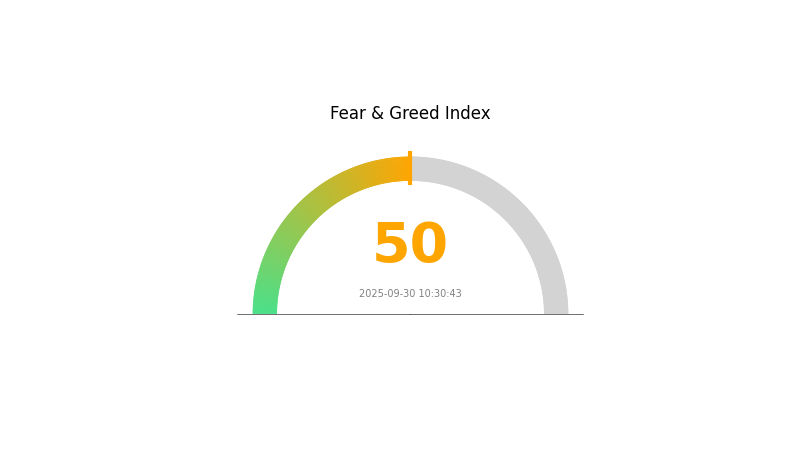

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index standing at 50, indicating a neutral state. This equilibrium suggests that investors are neither overly optimistic nor pessimistic about the market's direction. While caution is still advised, the current sentiment may present opportunities for both buyers and sellers. Traders should continue to monitor market trends and conduct thorough research before making any investment decisions on Gate.com or other platforms.

ALI Holdings Distribution

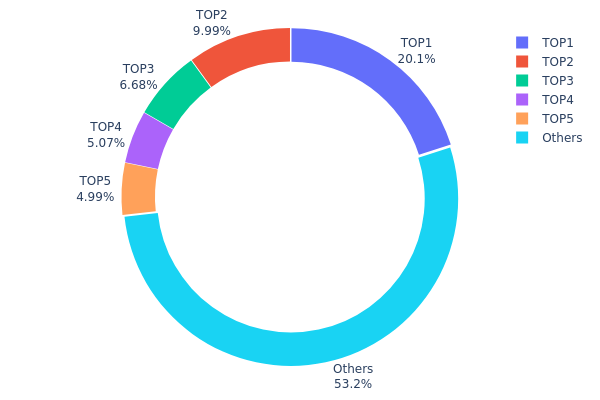

The address holdings distribution data for ALI reveals a moderately concentrated ownership structure. The top holder possesses 20.06% of the total supply, while the top 5 addresses collectively control 46.76% of ALI tokens. This concentration level is significant but not extreme for a cryptocurrency project.

The distribution pattern suggests a balanced ecosystem, with a substantial 53.24% of tokens held by addresses outside the top 5. This diversification can contribute to market stability and reduce the risk of price manipulation by individual large holders. However, the presence of a dominant top holder with over 20% ownership warrants attention, as it could potentially influence market dynamics.

Overall, the current ALI holdings distribution reflects a moderate level of decentralization. While there is some concentration among top holders, the substantial distribution among other addresses indicates a relatively healthy on-chain structure. This balance may help maintain market stability, though investors should remain aware of the potential impact large holders could have on short-term price movements.

Click to view the current ALI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6c63...0ec75c | 1980159.51K | 20.06% |

| 2 | 0x404f...79c770 | 985833.33K | 9.98% |

| 3 | 0x26aa...7603c8 | 659062.52K | 6.67% |

| 4 | 0x9812...4ef859 | 500000.00K | 5.06% |

| 5 | 0x7871...6f2a1d | 492701.64K | 4.99% |

| - | Others | 5253146.74K | 53.24% |

II. Key Factors Affecting ALI's Future Price

Supply Mechanism

- Supply and Demand: The balance between resource supply and demand is a crucial factor influencing ALI's price. When demand for a resource increases, supply constraints can lead to price rises; conversely, when demand decreases, oversupply can drive prices down.

Institutional and Whale Dynamics

- Corporate Adoption: Alibaba's cloud business growth is seen as a positive factor, with Morgan Stanley raising its target price based on accelerated cloud business growth and sustained momentum in core businesses.

Macroeconomic Environment

- Monetary Policy Impact: The uncertainty in future policy space due to rising core inflation rates may affect ALI's price. Central banks' inflation targets and potential policy adjustments could influence market dynamics.

- Geopolitical Factors: The stability of the trade environment and the delicate balance between China and the US are crucial for maintaining market trends. Events such as the APEC meeting in October and China's Fourth Plenum are important validation points for the market.

Technological Development and Ecosystem Building

- Cloud Technology Advancements: Alibaba's cloud business is showing accelerated growth, which is viewed positively by market analysts and could drive future price movements.

- AI Competition: The intensifying technological competition between Chinese and US companies, particularly in AI, could lead to significant commercial opportunities. The potential spread of AI competition from cloud to edge devices may reshape the mobile internet application ecosystem.

III. ALI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00468 - $0.00532

- Neutral prediction: $0.00532 - $0.00600

- Optimistic prediction: $0.00600 - $0.00633 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00640 - $0.00919

- 2028: $0.00589 - $0.01058

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.00624 - $0.01114 (assuming steady market growth)

- Optimistic scenario: $0.01114 - $0.01393 (assuming strong market performance)

- Transformative scenario: $0.01393 - $0.01500 (assuming breakthrough innovations)

- 2030-12-31: ALI $0.01393 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00633 | 0.00532 | 0.00468 | -1 |

| 2026 | 0.0081 | 0.00582 | 0.00309 | 8 |

| 2027 | 0.00919 | 0.00696 | 0.0064 | 29 |

| 2028 | 0.01058 | 0.00807 | 0.00589 | 50 |

| 2029 | 0.01296 | 0.00933 | 0.00737 | 73 |

| 2030 | 0.01393 | 0.01114 | 0.00624 | 107 |

IV. ALI Professional Investment Strategies and Risk Management

ALI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in AI and blockchain technologies

- Operational suggestions:

- Accumulate ALI tokens during market dips

- Stay informed about Alethea AI's project developments and partnerships

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for breakouts from consolidation patterns

- Set stop-loss orders to manage downside risk

ALI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ALI

ALI Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the AI and NFT space

- Market sentiment: Susceptible to shifts in overall crypto market sentiment

ALI Regulatory Risks

- Regulatory uncertainty: Potential changes in cryptocurrency regulations

- NFT regulations: Evolving legal landscape for NFTs and digital assets

- AI governance: Potential regulatory challenges in AI development

ALI Technical Risks

- Smart contract vulnerabilities: Potential security issues in the protocol

- Scalability challenges: Possible limitations in handling increased network load

- Technological obsolescence: Rapid advancements in AI may outpace development

VI. Conclusion and Action Recommendations

ALI Investment Value Assessment

ALI presents a unique proposition at the intersection of AI and blockchain technology. While it offers long-term potential in the evolving AI and NFT landscape, short-term volatility and regulatory uncertainties pose significant risks.

ALI Investment Recommendations

✅ Beginners: Start with small, diversified positions and focus on education ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider ALI as part of a broader AI/blockchain strategy

ALI Trading Participation Methods

- Spot trading: Buy and sell ALI tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance options involving ALI tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Analysts predict Dogecoin (DOGE) could reach $14.60 by July 2025, potentially gaining over 1000x from current prices. This forecast is based on current trends and market analysis.

Will AI Doge reach $1?

AI Doge is unlikely to reach $1 in 2025. A 500-600% surge is needed, which may take another year to achieve.

What is the prediction for Ali stocks?

ALI is predicted to trade between $0.003716 and $0.005316 in 2025, based on current market analysis.

What is the price prediction for ALAI crypto in 2030?

Based on current market analysis, the price prediction for ALAI crypto in 2030 is $0.000004, with an expected growth rate of 27.63%.

Share

Content