2025 AE Price Prediction: Analyzing Potential Growth and Market Trends for Aeternity

Introduction: AE's Market Position and Investment Value

Aeternity (AE), as a pioneering blockchain platform for smart contracts, has made significant strides since its inception in 2016. As of 2025, Aeternity's market capitalization has reached $2,556,364, with a circulating supply of approximately 436,686,724 tokens, and a price hovering around $0.005854. This asset, often referred to as the "Ethereum Godfather's Project," is playing an increasingly crucial role in developing scalable and efficient smart contract applications.

This article will provide a comprehensive analysis of Aeternity's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AE Price History Review and Current Market Status

AE Historical Price Evolution

- 2018: AE reached its all-time high of $5.69 on April 29, 2018, marking a significant milestone in its price history.

- 2020-2021: The cryptocurrency market experienced a bull run, with AE price showing volatility in line with overall market trends.

- 2022-2023: Market downturn, AE price declined from previous highs, following the broader cryptocurrency market correction.

AE Current Market Situation

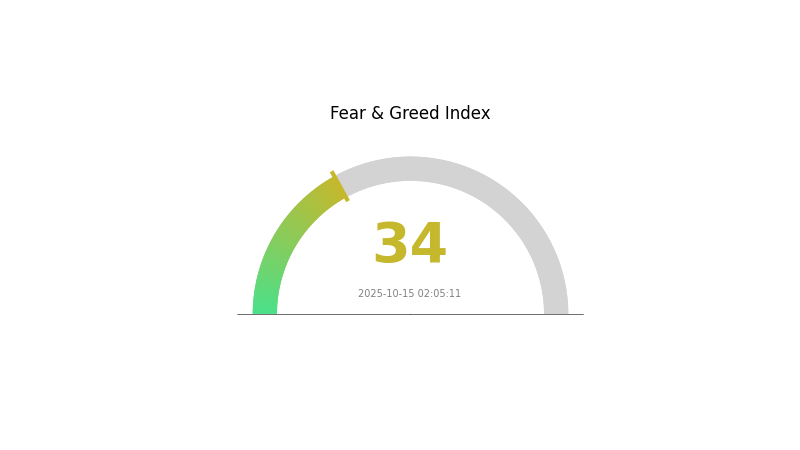

As of October 15, 2025, AE is trading at $0.005854, with a 24-hour trading volume of $20,051.87. The current price represents a 99.89% decrease from its all-time high. AE has shown recent signs of recovery, with a 13.38% increase over the past 7 days and a 36.67% increase over the last 30 days. However, it's still down 74.35% compared to a year ago. The market capitalization stands at $2,556,364, ranking AE at 2197 in the overall cryptocurrency market. The current market sentiment for AE, as indicated by the Fear and Greed Index, is "Fear" with a value of 34, suggesting cautious investor behavior.

Click to view the current AE market price

AE Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a sense of fear, with the Fear and Greed Index standing at 34. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Gate.com offers a range of tools to help you navigate these market conditions effectively.

AE Holdings Distribution

The address holdings distribution data for AE reveals a relatively decentralized ownership structure. Without specific large holders dominating the token supply, the distribution appears to be spread across a wider base of addresses. This pattern suggests a more equitable distribution of AE tokens among participants in the network.

The absence of highly concentrated holdings by individual addresses indicates a reduced risk of market manipulation or sudden price volatility caused by large holders. This distribution structure potentially contributes to a more stable market environment for AE, as it minimizes the impact of individual whales on token price movements.

Overall, the current address distribution of AE reflects a relatively high degree of decentralization and a balanced on-chain structure. This characteristic aligns well with the principles of distributed networks and may foster a more resilient ecosystem for the AE project in the long term.

Click to view the current AE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting AE's Future Price

Supply Mechanism

- Market Supply: The supply of AE sensors is influenced by industry growth trends and market demand forecasts.

- Historical Pattern: Past market data analysis shows a correlation between supply changes and price fluctuations.

- Current Impact: Future market capacity growth trends are expected to impact AE sensor prices.

Institutional and Major Holder Dynamics

- Corporate Adoption: Companies in the AE sensor industry are key players influencing market dynamics.

Macroeconomic Environment

- Geopolitical Factors: International events and public reactions to them can impact market sentiment and industry development.

Technological Development and Ecosystem Building

- Industry Research: Comprehensive market research reports on the AE sensor industry provide insights into technological advancements and market trends.

- Market Analysis: In-depth industry surveys and future market predictions contribute to understanding the technological landscape.

- Ecosystem Applications: The AE sensor industry's overall operational status and market environment play crucial roles in ecosystem development.

III. AE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0038 - $0.00585

- Neutral prediction: $0.00585 - $0.00670

- Optimistic prediction: $0.00670 - $0.00755 (requires positive market sentiment and project development)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00533 - $0.00998

- 2028: $0.00816 - $0.01076

- Key catalysts: Technological advancements, increased partnerships, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.00959 - $0.01131 (assuming steady growth and adoption)

- Optimistic scenario: $0.01131 - $0.01304 (with accelerated ecosystem expansion)

- Transformative scenario: $0.01304 - $0.01391 (with breakthrough innovations and mass adoption)

- 2030-12-31: AE $0.01391 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00755 | 0.00585 | 0.0038 | 0 |

| 2026 | 0.00697 | 0.0067 | 0.00483 | 14 |

| 2027 | 0.00998 | 0.00684 | 0.00533 | 16 |

| 2028 | 0.01076 | 0.00841 | 0.00816 | 43 |

| 2029 | 0.01304 | 0.00959 | 0.00824 | 63 |

| 2030 | 0.01391 | 0.01131 | 0.01052 | 93 |

IV. Professional AE Investment Strategies and Risk Management

AE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate AE tokens during market dips

- Store tokens in secure wallets for extended periods

- Regularly monitor project developments and market trends

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Implement strict stop-loss orders to manage risk

AE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Dollar-cost averaging: Regularly invest fixed amounts to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for AE

AE Market Risks

- High volatility: AE price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

AE Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting AE

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Adapting to evolving regulatory requirements

AE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability challenges: May face issues with network congestion

- Oracle reliability: Dependence on accurate and timely external data

VI. Conclusion and Action Recommendations

AE Investment Value Assessment

Aeternity (AE) presents a unique value proposition with its focus on scalability and oracles, but faces significant competition and market risks. Long-term potential exists, but short-term volatility and adoption challenges remain key concerns.

AE Investment Recommendations

✅ Newcomers: Consider small, experimental positions to understand the project ✅ Experienced investors: Implement a balanced approach with defined risk management ✅ Institutional investors: Conduct thorough due diligence and consider AE as part of a diversified crypto portfolio

AE Trading Participation Methods

- Spot trading: Direct purchase and holding of AE tokens

- Staking: Participate in network validation for potential rewards

- DeFi integration: Explore decentralized finance opportunities using AE tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is AE worth?

As of October 15, 2025, AE (Aeternity) is worth $3.75 per token, with a market cap of $1.5 billion and 24-hour trading volume of $150 million.

How much is aethir in 2030?

Based on current forecasts, Aethir is expected to reach approximately $0.070194 by 2030.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach between $90 and $120. This forecast marks a significant milestone for its future. Predictions are based on current market trends.

What is the price of AE coin today?

As of 2025-10-15, the price of AE coin is $0.005771, showing a 13.40% increase in the last 24 hours. The trading volume is $18,721.88.

Share

Content