Shib Coin On-Chain Activity and Technical Outlook: New Insights into Whales and Trading Volume

7/27/2025, 9:53:30 AM

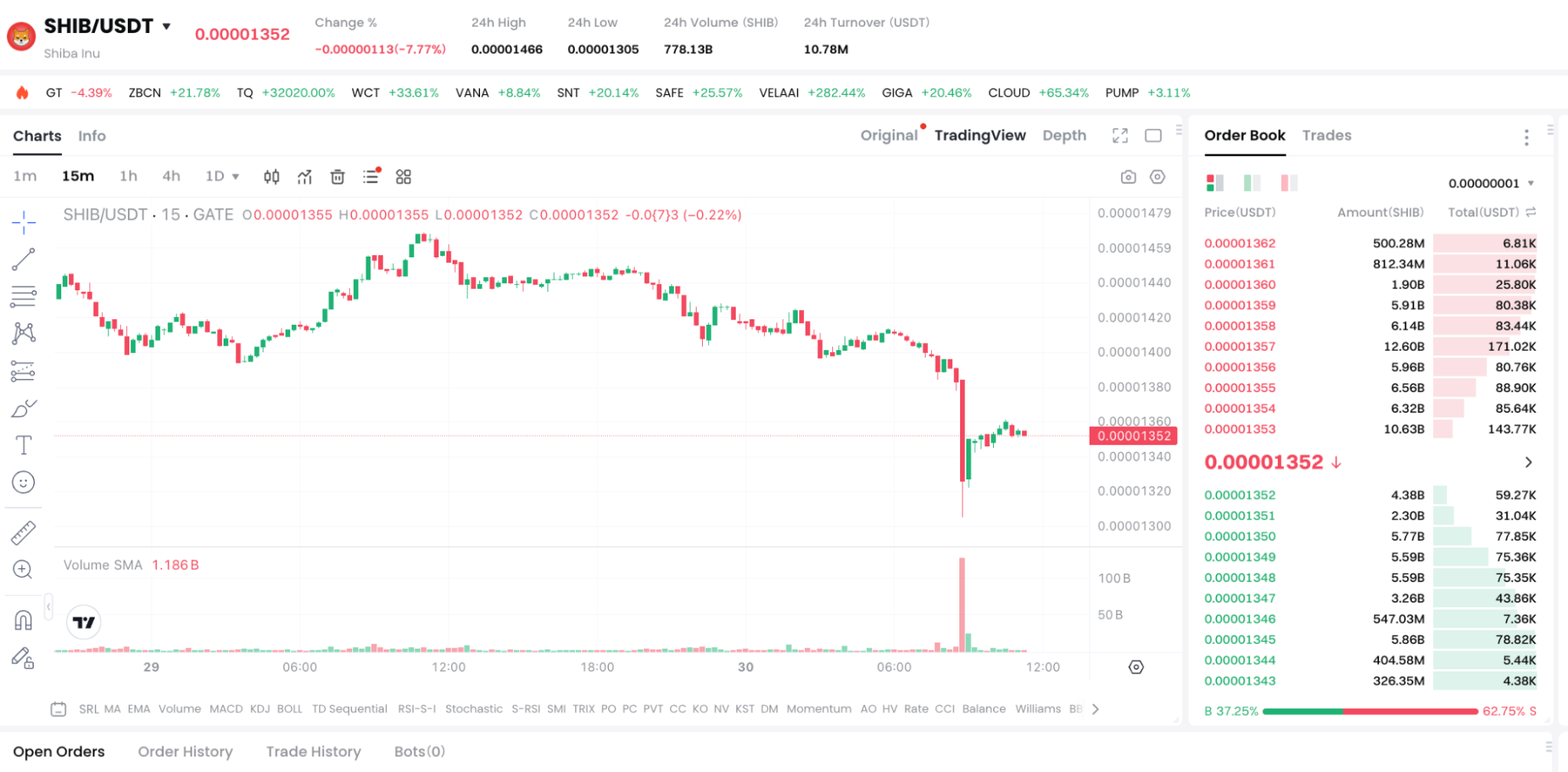

Overview of today’s price and Trading Volume

Figure:https://www.gate.com/trade/SHIB_USDT

- Price: $0.00001351 (Gate)

- 24h Trading Volume: Approximately 78.59 billion SHIB ($10.9M USDT), an increase of 18% compared to the previous period.

- Trading range: highest $0.00001369, lowest $0.00001305

Whale Positions and Large Transaction Changes

- In the past 24 hours, the Whale addresses’ holdings rebounded from 727.8 trillion SHIB to 749.6 trillion, an increase of about 3%.

- The number of large transactions (>10B SHIB) has slightly increased, indicating that some whales are accumulating at low levels.

- At the same time, the large sell-off volume has not shown a large-scale outbreak, which helps stabilize in the short term.

Technical Formation: Rebound Signal and Downward Channel

- The daily chart is still operating within a descending channel, but today it formed a bullish candlestick with a long lower shadow, suggesting that bulls are attempting to defend the market.

- The KDJ indicator is about to golden cross, indicating a potential technical rebound of 2%–4%.

- Be cautious if the lower channel support at $0.00001330 is not maintained, as it will restart a new round of downward exploration.

Key Ranges: Support and Resistance

- Support: $0.00001330 — lower channel boundary and previous low position

- Resistance: $0.00001370 — Short-term consolidation high and 50-day moving average

Investor Operation Recommendations

- Cautious observation, waiting for rebound confirmation: If the closing remains above $0.00001350, consider a small position entry.

- Reasonable Stop Loss: Stop loss and exit if it falls below $0.00001330 to prevent downward break risk.

- On-chain tracking tools: Use Santiment and Glassnode to monitor whale addresses and large transactions in real time.

- Monitor market sentiment: Adjust positions based on the Fear & Greed Index and social media dynamics.

* ข้อมูลนี้ไม่ได้มีเจตนาชักนำ และไม่ใช่คำแนะนำด้านการเงินหรือคำแนะนำอื่นใดที่ Gate เสนอให้หรือรับรอง

เริ่มตอนนี้

สมัครและรับรางวัล

$100