Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Strength of TOPIX at Fair Value | Strategy Report | Moneyクリ Moneyx Securities Investment Information and Media Useful for Money

Japanese stocks have completely shaken off the impact of the plummet caused by Trump’s tariffs.

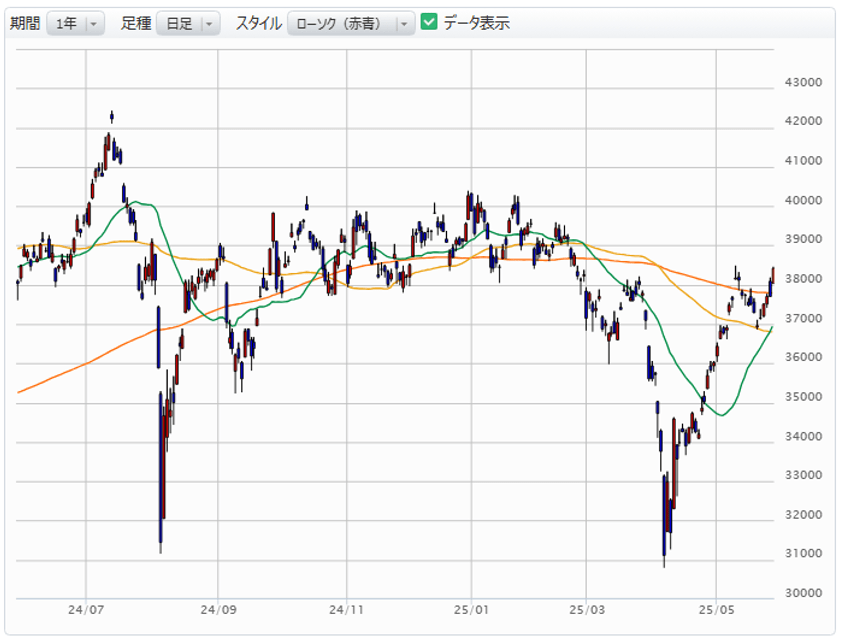

The Nikkei average closed almost at its high with a rise of over 700 yen. It broke above the 200-day moving average without being held back. The 25-day moving average achieved a golden cross by moving above the 75-day moving average from below, and the next golden cross with the 200-day line is now in sight.

[Nikkei Average and Moving Average Line Trends (Green: 25 days, Yellow: 75 days, Orange: 200 days)] Source: Monex Securities Site

Looking at it this way, it can be said that Japan stocks have completely dispelled the impact of the sharp decline due to the Trump tariffs. The reason for this, as I have said before, is that the limits of Trump’s policies are beginning to be seen. Yesterday’s sharp rise came after the U.S. Court of International Trade ruled that a blanket tax on imports was beyond the president’s authority, blocking most of the tariffs imposed by President Trump. At first, the world was confused by the announcement of a tariff policy that was too reckless, but in the end, Yomi is becoming mainstream because it will “settle down where it settles.”

Source: Monex Securities Site

Looking at it this way, it can be said that Japan stocks have completely dispelled the impact of the sharp decline due to the Trump tariffs. The reason for this, as I have said before, is that the limits of Trump’s policies are beginning to be seen. Yesterday’s sharp rise came after the U.S. Court of International Trade ruled that a blanket tax on imports was beyond the president’s authority, blocking most of the tariffs imposed by President Trump. At first, the world was confused by the announcement of a tariff policy that was too reckless, but in the end, Yomi is becoming mainstream because it will “settle down where it settles.”

The Difference in Stock Price Trends Between the Nikkei Average and TOPIX Lies in the Strength of Earnings Forecasts

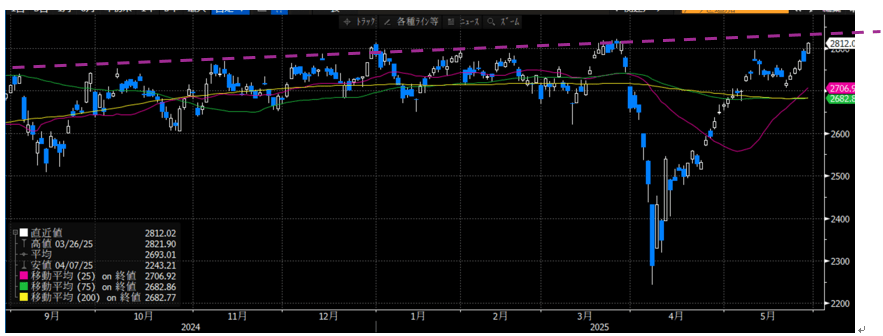

The TOPIX chart is looking even better. Since the plummet in the summer of 2024, the movement from the end of August shows a gradual but upward trend. It is just 10 points shy of the recent high of 2821 points reached in late March. If it surpasses this level, the upward trend will strengthen even further.

[TOPIX Movement] (Source: Boomberg)

While the Nikkei Average has not yet reached the consolidation range for autumn 2024, the strength of the TOPIX is prominent. This difference is due to the disparity in the robustness of earnings forecasts.

(Source: Boomberg)

While the Nikkei Average has not yet reached the consolidation range for autumn 2024, the strength of the TOPIX is prominent. This difference is due to the disparity in the robustness of earnings forecasts.

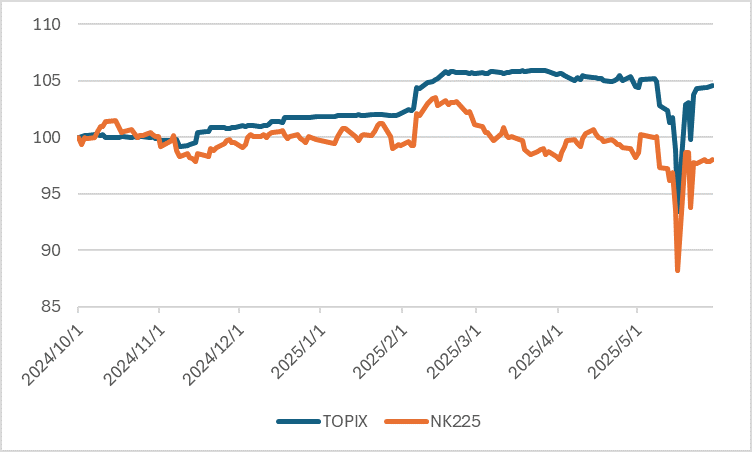

When comparing the forecasted EPS (earnings per share) for the Nikkei Average and TOPIX, using October 1, 2024, as the baseline of 100, the EPS for the Nikkei Average has not fully escaped its downward trend since peaking in February, whereas TOPIX has nearly returned to its highest value and is positioned higher than last autumn.

The differences in stock price trends honestly reflect the performance.

While the Nikkei Average is influenced by the high-priced semiconductor stocks, the strength of the domestic sector, led by the strong performance of banks in particular, seems to more than offset the significant decline in profits of the automobile sector.

[Comparison of the expected EPS of the Nikkei Average and TOPIX] (Source: Created by Monex Securities from QUICK data)

Attention is being drawn to long-term interest rates, but I will comment on this at another time. Although the benchmark 10-year government bond yield remains elevated, it has not reached a new high.

(Source: Created by Monex Securities from QUICK data)

Attention is being drawn to long-term interest rates, but I will comment on this at another time. Although the benchmark 10-year government bond yield remains elevated, it has not reached a new high.

[Japan Government Bond Yield Trends] (Source: Bloomberg)

If we discount the forecast EPS of TOPIX with the current 10-year bond yield plus a 5% risk premium, it amounts to 2780 points. It can be said that the current level of TOPIX is roughly at fair value.

(Source: Bloomberg)

If we discount the forecast EPS of TOPIX with the current 10-year bond yield plus a 5% risk premium, it amounts to 2780 points. It can be said that the current level of TOPIX is roughly at fair value.