Plasma: A High-Performance Layer 1 for Zero-Fee Stablecoin Payments

What Is Plasma?

(Image source: PlasmaFDN)

Plasma is a high-performance Layer 1 blockchain engineered specifically for stablecoin payments and real-world settlement scenarios. It supports the Ethereum Virtual Machine (EVM) while incorporating Bitcoin-sidechain security principles, enabling a unique blend of programmability, performance, and decentralization.

The core vision of Plasma is to deliver zero-fee stablecoin transfers and scalable financial infrastructure that can be applied to everyday commerce, digital banking, cross-border payments, and institutional settlement.

Key Technical Features

1.PlasmaBFT Consensus

Plasma introduces PlasmaBFT, a customized consensus protocol derived from HotStuff. By streamlining the voting process and enabling parallel processing, Plasma achieves sub-second transaction finality and a throughput exceeding 2,000 transactions per second—sufficient for mass-market stablecoin settlement and merchant operations.

2.Full EVM Compatibility

The network operates on the Reth client, ensuring seamless compatibility with Solidity smart contracts and Ethereum’s widely adopted developer tooling, including MetaMask, Hardhat, and other frameworks.

Beyond account-based smart contracts, Plasma also supports Bitcoin’s UTXO model, enabling BTC to be used directly for gas payments.

3.Native Bitcoin Bridge

Plasma integrates a secure Bitcoin bridge that anchors chain state to the Bitcoin mainnet, enhancing transparency and security. This gives Plasma the decentralization guarantees of Bitcoin while retaining the programmability of Ethereum—merging two of the industry’s most trusted architectures.

Custom Gas Model

The network includes a dual gas system designed to meet different operational needs:

- Zero-fee stablecoin transfers for everyday payments

- Paid transaction channels for high-speed, high-priority usage

This flexible design enables cost-efficient settlement without sacrificing performance or sustainability.

Privacy with Regulatory Compliance

A privacy module is in development that allows users to shield transaction data while selectively revealing it for regulatory or auditing requirements. This balances transparency, compliance, and user privacy—critical for institutional adoption.

Use Cases and Applications

1.Zero-Fee Payments

Users can transfer USDT across Plasma with no transaction fees, making it ideal for daily payments, merchant settlements, and digital commerce.

2.Cross-Border Transfers

With fast settlement and minimal cost, Plasma is well-positioned for remittance corridors, especially in regions with unstable currencies or costly traditional banking rails.

3.Regulated Digital Finance

Plasma integrates cleanly with banks, fintechs, and payment companies seeking efficient stablecoin settlement without compromising compliance or reporting requirements.

4.Retail and Micropayments

Its low-cost structure supports small purchases, subscription billing, and digital services. Plasma has already been adopted by Yellow Card, Africa’s largest stablecoin infrastructure provider.

5.Stablecoin DeFi

Plasma is in discussions with major DeFi protocols including Curve, Maker, and Aave, laying the foundation for a multi-layered, stablecoin-driven financial ecosystem.

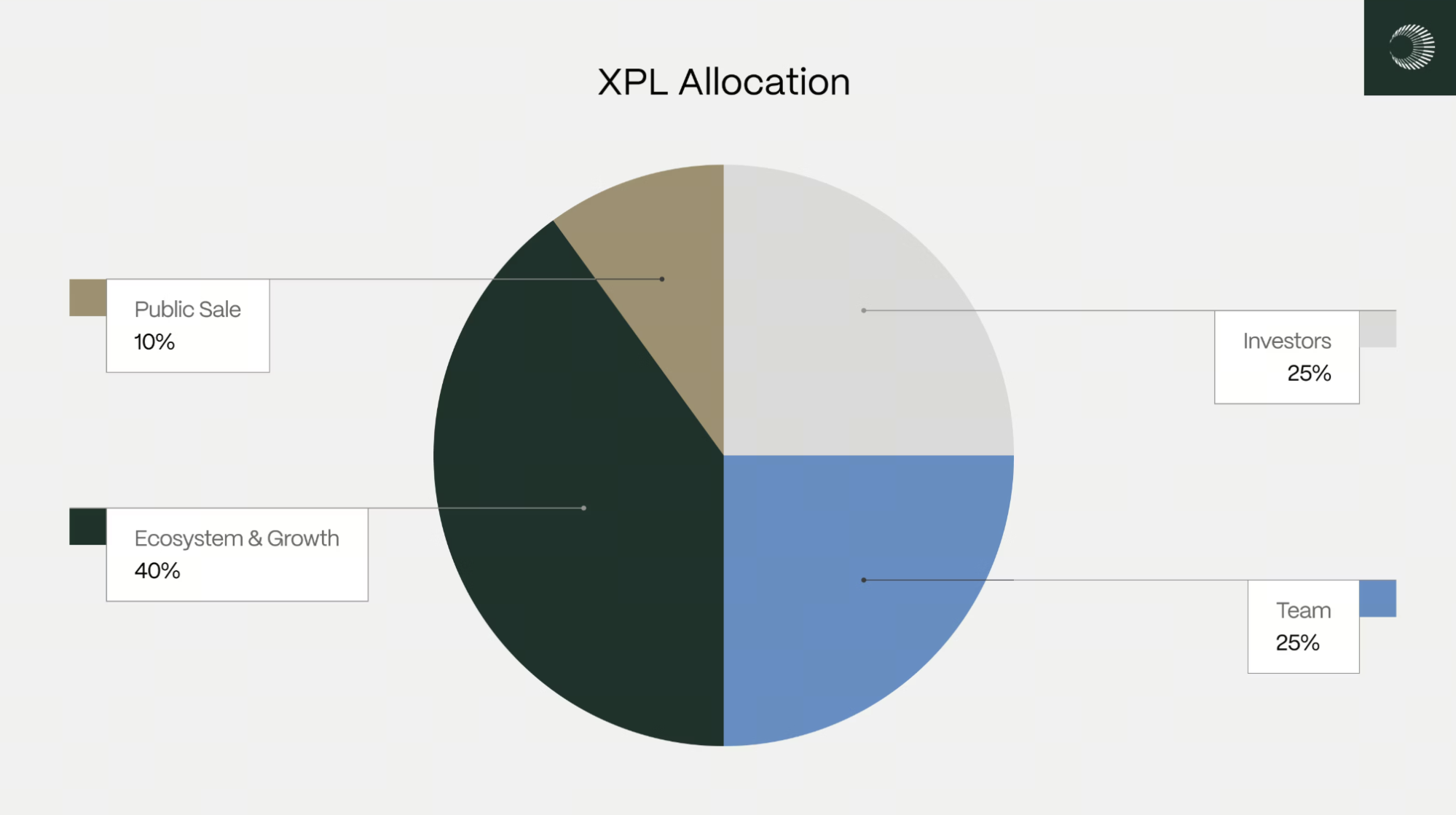

XPL Tokenomics

XPL launched with an initial supply of 10 billion tokens during Plasma’s Mainnet Beta phase. Future issuance adjusts dynamically based on validator performance and network participation. The allocation is structured as follows:

Public Sale – 10%

One billion XPL is dedicated to the public sale, designed as an extension of early ecosystem participation.

- Non-U.S. participants: Tokens unlock fully at Mainnet Beta launch

- U.S. participants: Subject to a 12-month lock, fully unlocking on July 28, 2026

Ecosystem & Growth – 40%

Four billion XPL supports ecosystem expansion and adoption across DeFi, liquidity programs, exchange integrations, and strategic user growth.

- 8% released immediately at Mainnet Beta

- 32% unlocks monthly over three years to sustain long-term development

Team – 25%

To incentivize long-term development, 25% of token supply is reserved for contributors.

- One-third unlocks after a 12-month cliff

- The remainder vests monthly across the following two years

Investors – 25%

Plasma is supported by major institutional backers, including Founders Fund, Framework, and Bitfinex. Investor allocations follow the same vesting structure as the team, aligning long-term incentives.

(Image source: docs.plasma)

Utility and Value of XPL

XPL is both the network’s gas token and its governance asset. Holders can:

- Pay for transaction fees and network usage

- Stake to participate in consensus and network security

- Vote on protocol upgrades, treasury use, and ecosystem direction

This ensures the token remains central to both economic and governance functions.

Conclusion

Plasma differentiates itself through a rare combination of zero-fee stablecoin payments, Bitcoin-anchored security, and full EVM programmability—positioning it as a purpose-built settlement layer for real-world finance. Supported by leading institutions and growing integration with projects like Ethena and Yellow Card, Plasma is rapidly expanding its ecosystem footprint.

As global stablecoin usage accelerates, Plasma has the potential to become a core infrastructure layer for universal transaction settlement. Whether it can scale into a major industry standard will depend on adoption momentum, ecosystem growth, and its ability to deliver lasting network effects in the world of decentralized finance.

Related Articles

Understanding Creditlink ($CDL): On‑Chain Credit Infrastructure & RootData Airdrop Explained

Virtuals Protocol: Powering the Future of On-Chain AI Agents

Bless: Building a Decentralized Edge Computing Network for the AI Era

Common Protocol Explained: Building the Future of Community and AI Collaboration

Salamanca (DON): The Meme Cartel Token That’s Making Waves in 2025