2025 SPX Price Prediction: Bull Run or Bear Market? Analyzing Key Factors Shaping the S&P 500's Future

Introduction: SPX's Market Position and Investment Value

SPX6900 (SPX) as a valueless meme cryptocurrency token, has been making waves in the crypto space since its inception. As of 2025, SPX's market capitalization has reached $1,059,004,630, with a circulating supply of approximately 930,993,081 tokens, and a price hovering around $1.1375. This asset, dubbed as "the parody of traditional finance," is playing an increasingly crucial role in challenging financial conventions and inspiring a new perspective on cryptocurrency investments.

This article will provide a comprehensive analysis of SPX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SPX Price History Review and Current Market Status

SPX Historical Price Evolution Trajectory

- 2025 March: SPX reached its all-time low of $0.2531, marking the beginning of its market presence

- 2025 July: SPX hit its all-time high of $2.2811, showcasing significant growth in a short period

- 2025 October: The market entered a correction phase, with the price settling around $1.1375

SPX Current Market Situation

As of October 16, 2025, SPX is trading at $1.1375, experiencing a 4.71% decrease in the last 24 hours. The token has seen significant volatility, with a 24-hour high of $1.2498 and a low of $1.0988. Despite the recent dip, SPX has shown impressive long-term performance, with a 62.10% increase over the past year.

The current market capitalization stands at $1,059,004,630, ranking SPX at 96th position in the overall cryptocurrency market. With a circulating supply of 930,993,081 SPX tokens, representing 93.09% of the total supply, the token maintains a relatively high circulation ratio.

The trading volume in the last 24 hours reached $5,135,567, indicating active market participation. However, the token is currently trading at about half of its all-time high, suggesting potential for recovery if market conditions improve.

Click to view the current SPX market price

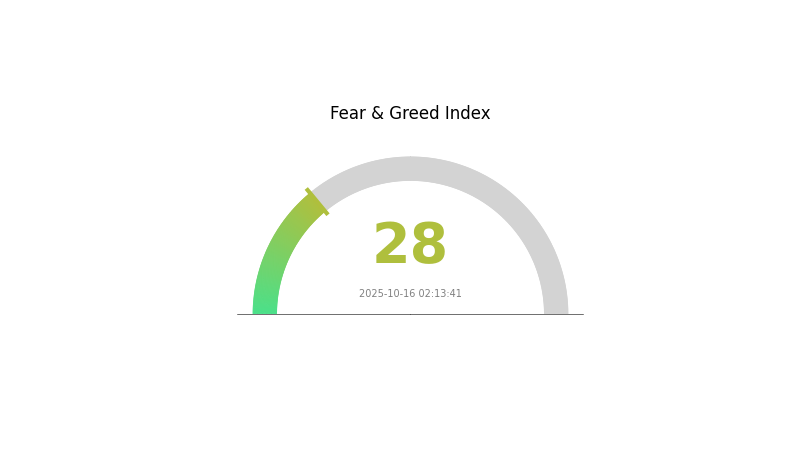

SPX Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 28, indicating a state of Fear. This suggests investors are adopting a more risk-averse approach. During such periods, some traders may view it as a potential buying opportunity, adhering to the contrarian strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

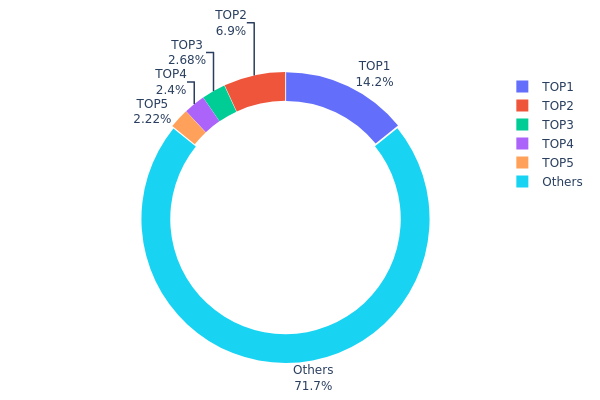

SPX Holdings Distribution

The address holdings distribution data provides critical insights into the concentration of SPX tokens among various addresses. Analysis of this data reveals a moderately concentrated distribution pattern. The top address holds 14.15% of the total supply, while the top 5 addresses collectively control 28.33% of SPX tokens. This level of concentration, while notable, does not indicate excessive centralization.

The presence of a significant "Others" category, accounting for 71.67% of holdings, suggests a relatively diverse distribution among smaller holders. This distribution pattern contributes to market stability and reduces the risk of price manipulation by large holders. However, the considerable holdings of the top addresses still warrant attention, as sudden movements from these wallets could potentially impact market dynamics.

Overall, the current SPX address distribution reflects a balance between major stakeholders and a broader base of smaller holders. This structure suggests a moderate level of decentralization and chain stability, which are generally positive indicators for the token's ecosystem and long-term sustainability.

Click to view the current SPX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ee1...8fa585 | 141536.68K | 14.15% |

| 2 | 0x0000...00dead | 69006.92K | 6.90% |

| 3 | 0x7daf...706f83 | 26755.65K | 2.67% |

| 4 | 0xf8f0...fc4002 | 24000.01K | 2.40% |

| 5 | 0xdf5e...67671b | 22193.33K | 2.21% |

| - | Others | 716507.40K | 71.67% |

II. Key Factors Affecting Future SPX Price

Supply Mechanism

- Corporate Earnings: Strong earnings growth drives stock prices upward

- Historical Pattern: S&P 500 earnings grew 11.8% year-over-year in Q2 2025

- Current Impact: Continued earnings growth expected to support stock prices

Institutional and Large Investor Trends

- Institutional Holdings: Major banks showing strong Q2 profits, attracting investors

- Corporate Adoption: Tech giants like Microsoft, Apple, and Amazon reporting better-than-expected results

- Government Policies: Recent tax cuts and potential interest rate cuts boosting market sentiment

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve maintaining 4.25-4.50% interest rate, with potential cuts expected

- Inflation Hedging Properties: Core PCE at 2.7%, slightly above 2% target, affecting market expectations

- Geopolitical Factors: Trade policy uncertainties creating market volatility

Technological Development and Ecosystem Building

- AI and Cloud Computing: Driving growth for tech companies like Microsoft, Palantir, and Google

- Digital Transformation: Accelerating adoption across industries, boosting tech sector performance

- Ecosystem Applications: Growing interest in cryptocurrency ETFs, with $12 billion inflow in July 2025

III. SPX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.80073 - $1.1439

- Neutral prediction: $1.1439 - $1.33836

- Optimistic prediction: $1.33836 - $1.50 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $1.07978 - $1.27837

- 2027: $1.17157 - $1.59988

- Key catalysts: Increasing adoption and market expansion

2030 Long-term Outlook

- Base scenario: $1.75362 - $1.80786 (assuming steady market growth)

- Optimistic scenario: $1.80786 - $1.95249 (with strong market performance)

- Transformative scenario: $1.95249 - $2.10 (under extremely favorable conditions)

- 2030-12-31: SPX $1.80786 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.33836 | 1.1439 | 0.80073 | 0 |

| 2026 | 1.27837 | 1.24113 | 1.07978 | 9 |

| 2027 | 1.59988 | 1.25975 | 1.17157 | 10 |

| 2028 | 1.68718 | 1.42981 | 0.7578 | 25 |

| 2029 | 2.05722 | 1.5585 | 1.12212 | 37 |

| 2030 | 1.95249 | 1.80786 | 1.75362 | 58 |

IV. SPX Professional Investment Strategies and Risk Management

SPX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Accumulate SPX tokens during market dips

- Hold for extended periods to potentially benefit from long-term price appreciation

- Store tokens in secure hardware wallets for maximum security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor social media sentiment as it can significantly impact meme token prices

- Set strict stop-loss orders to manage downside risk

SPX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Options strategies: Use put options for downside protection when available

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and never share private keys

V. Potential Risks and Challenges for SPX

SPX Market Risks

- High volatility: Meme tokens are subject to extreme price swings

- Liquidity risk: Trading volumes may decrease suddenly, affecting ability to exit positions

- Market sentiment shifts: Rapid changes in investor sentiment can lead to sharp price movements

SPX Regulatory Risks

- Increased scrutiny: Regulators may impose stricter rules on meme tokens

- Potential bans: Some jurisdictions may prohibit trading of speculative cryptocurrencies

- Tax implications: Unclear or changing tax regulations may affect investment returns

SPX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying token contract

- Network congestion: High transaction fees and delays during peak trading periods

- Technological obsolescence: Newer meme tokens may capture market attention

VI. Conclusion and Action Recommendations

SPX Investment Value Assessment

SPX6900 represents a high-risk, speculative investment within the meme token ecosystem. While it offers potential for significant short-term gains, it also carries substantial downside risk. The long-term value proposition remains uncertain, as it relies heavily on community engagement and market sentiment.

SPX Investment Recommendations

✅ Beginners: Limit exposure to a small portion of overall portfolio, if any ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

SPX Trading Participation Methods

- Spot trading: Buy and sell SPX tokens on Gate.com's spot market

- Futures trading: Engage in leveraged trading of SPX derivatives on Gate.com (if available)

- Staking: Participate in yield-generating opportunities if offered by the project or exchanges

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SPX price prediction?

SPX price prediction forecasts the future value of the S&P 500 index. Analysts expect SPX to reach $8435.14 by end of 2029, based on current market trends and economic factors.

Can SPX6900 reach $100?

While ambitious, SPX6900 could potentially reach $100 in the long-term, possibly by 2040-2050. This would require massive adoption and market growth.

What is the SPX prediction for 2025?

Based on current market trends and analyst forecasts, the SPX prediction for 2025 suggests a potential decline. Experts anticipate mixed performance, with some projecting a bearish outlook for the S&P 500 index.

How much will SPX6900 cost in 2030?

Based on current market predictions, SPX6900 is estimated to cost between $6.69 and $7.70 by 2030, representing a potential increase of 371% to 442%.

Share

Content