Gate Auto-Invest Analysis

Data-Driven Scientific Investment Method, Guiding You Through Bull and Bear Markets

Investing in the cryptocurrency market always involves volatility and timing challenges. Gate.io Auto-Invest provides investors with a simplified solution.

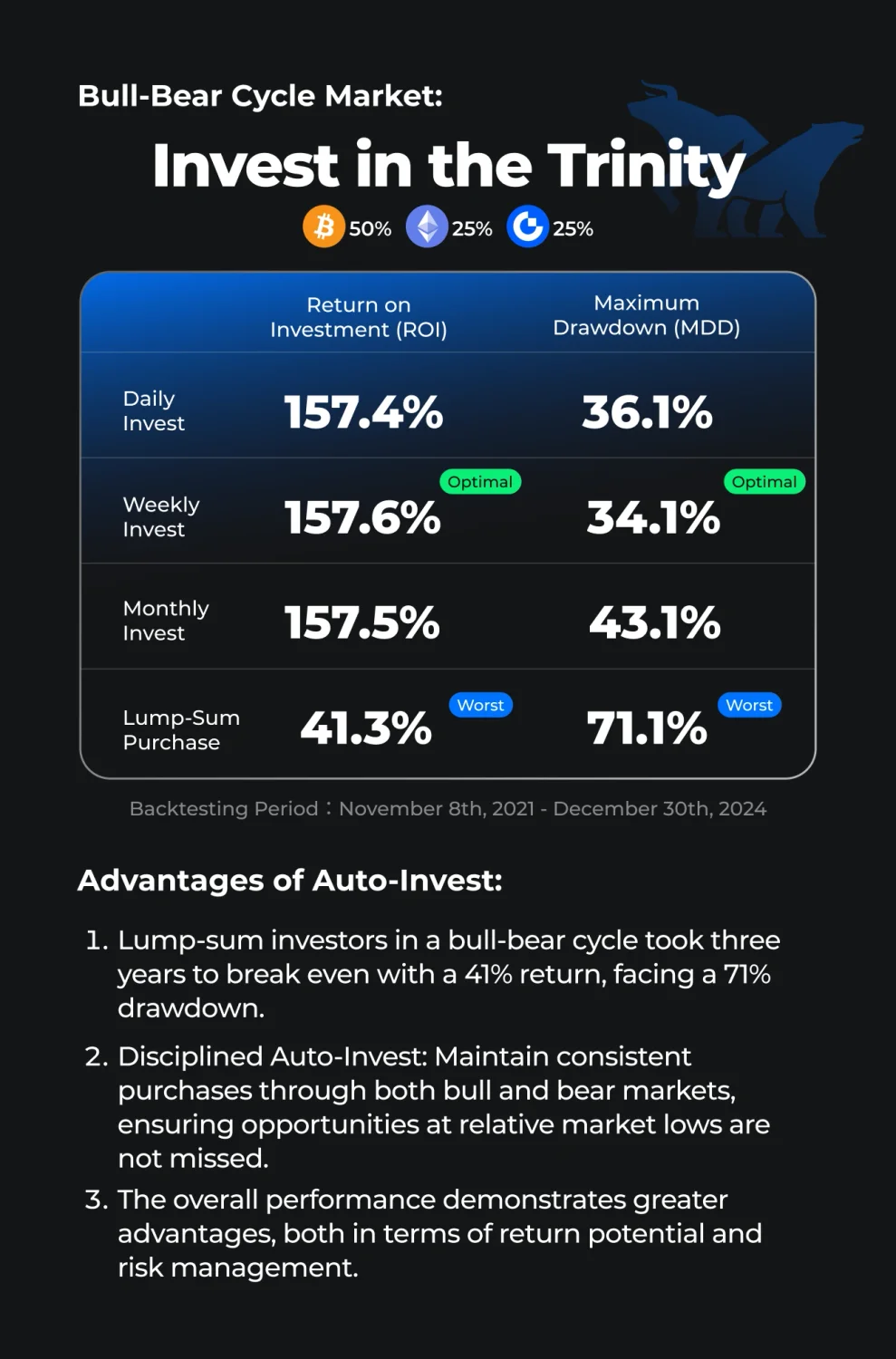

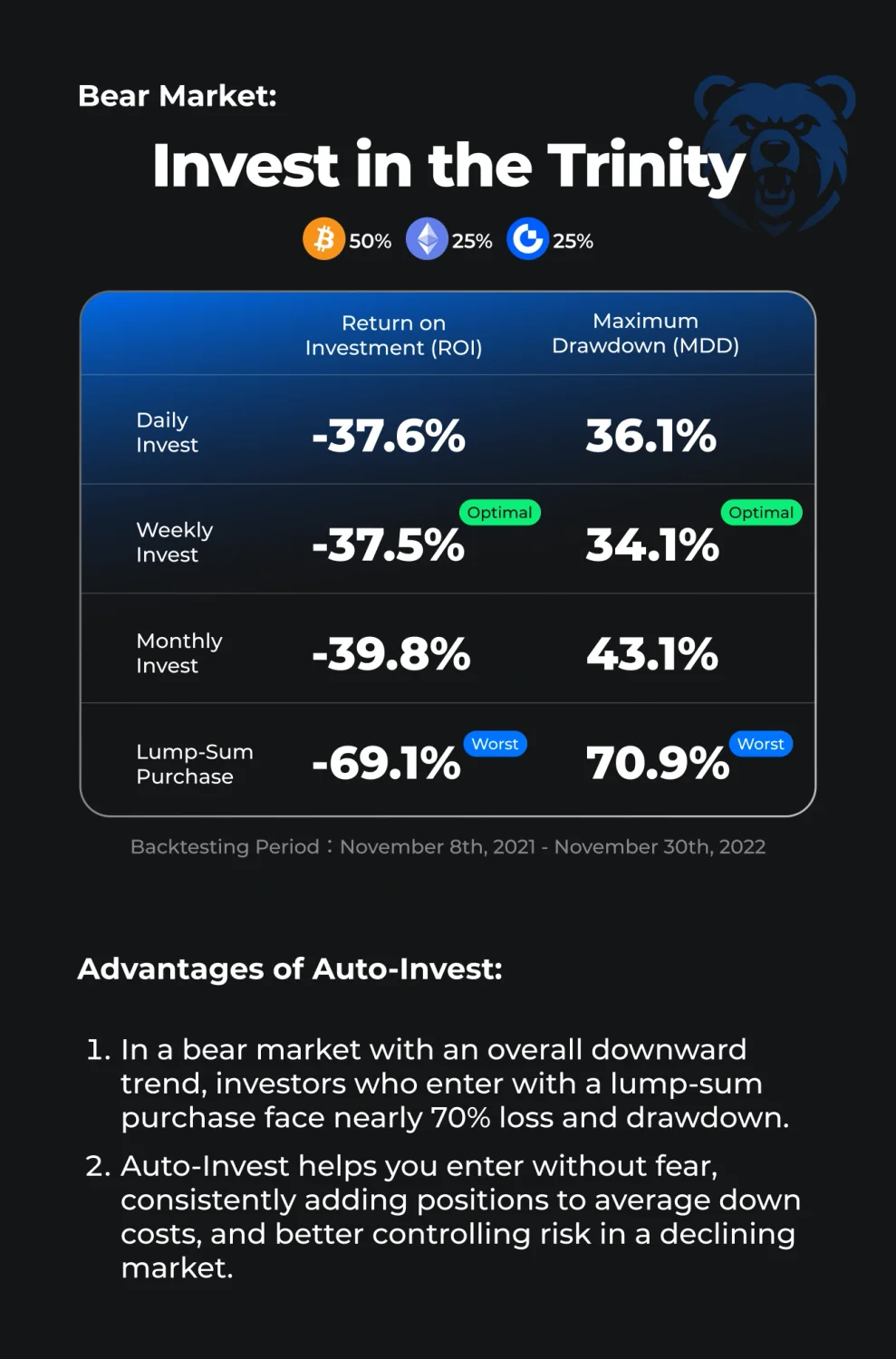

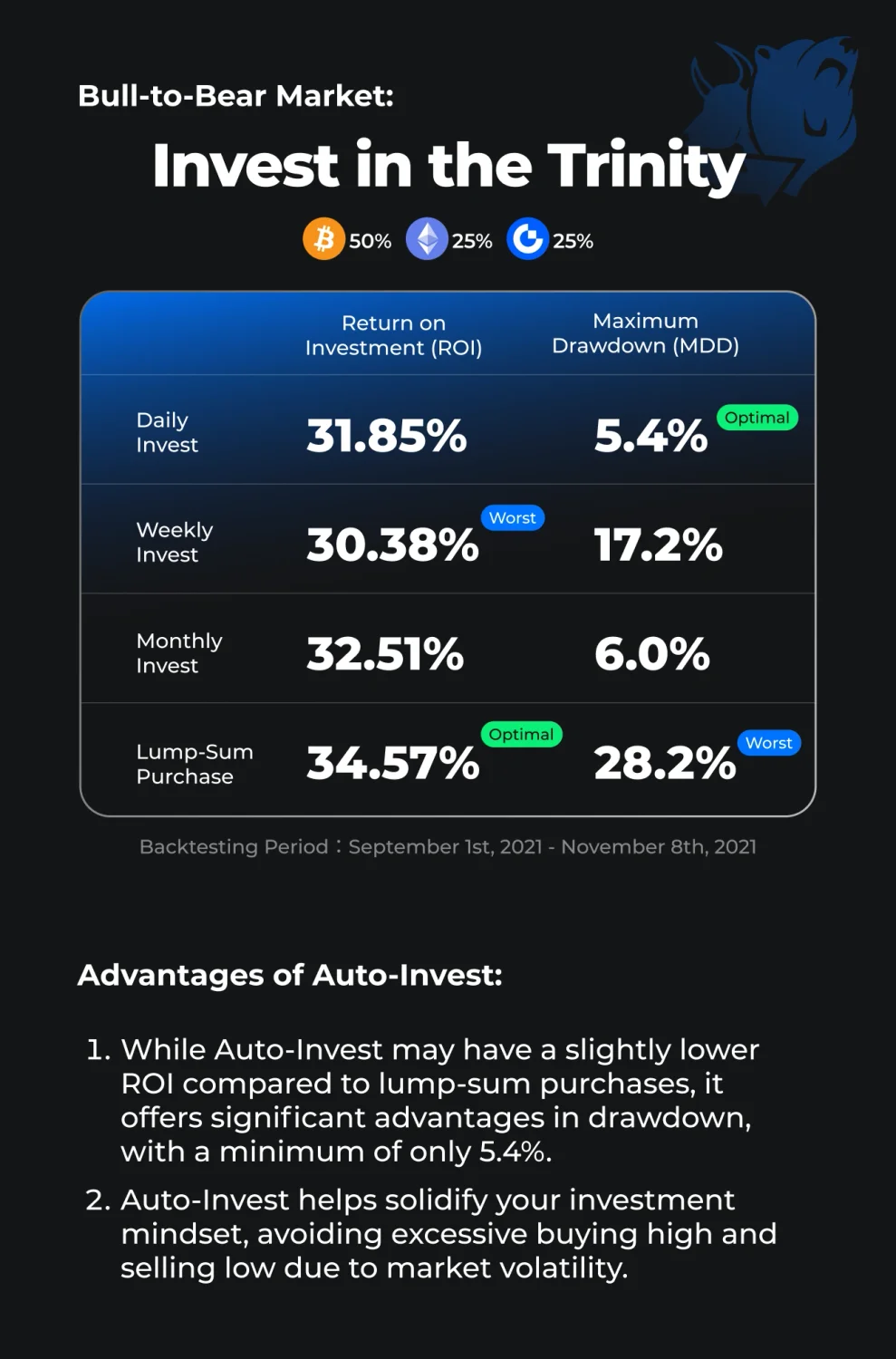

Recent backtesting of investments in BTC, ETH, and GT shows that regular, fixed-amount investing can not only reduce timing risks but also smooth out investment costs over the long term, achieving stable returns.

The fixed-amount investment strategy involves regularly purchasing assets at set intervals with a consistent amount, which helps reduce the impact of market fluctuations and averages out the investment costs.

Without needing to accurately predict market ups and downs, auto-investing automatically diversifies purchase timing, making investments more relaxed.

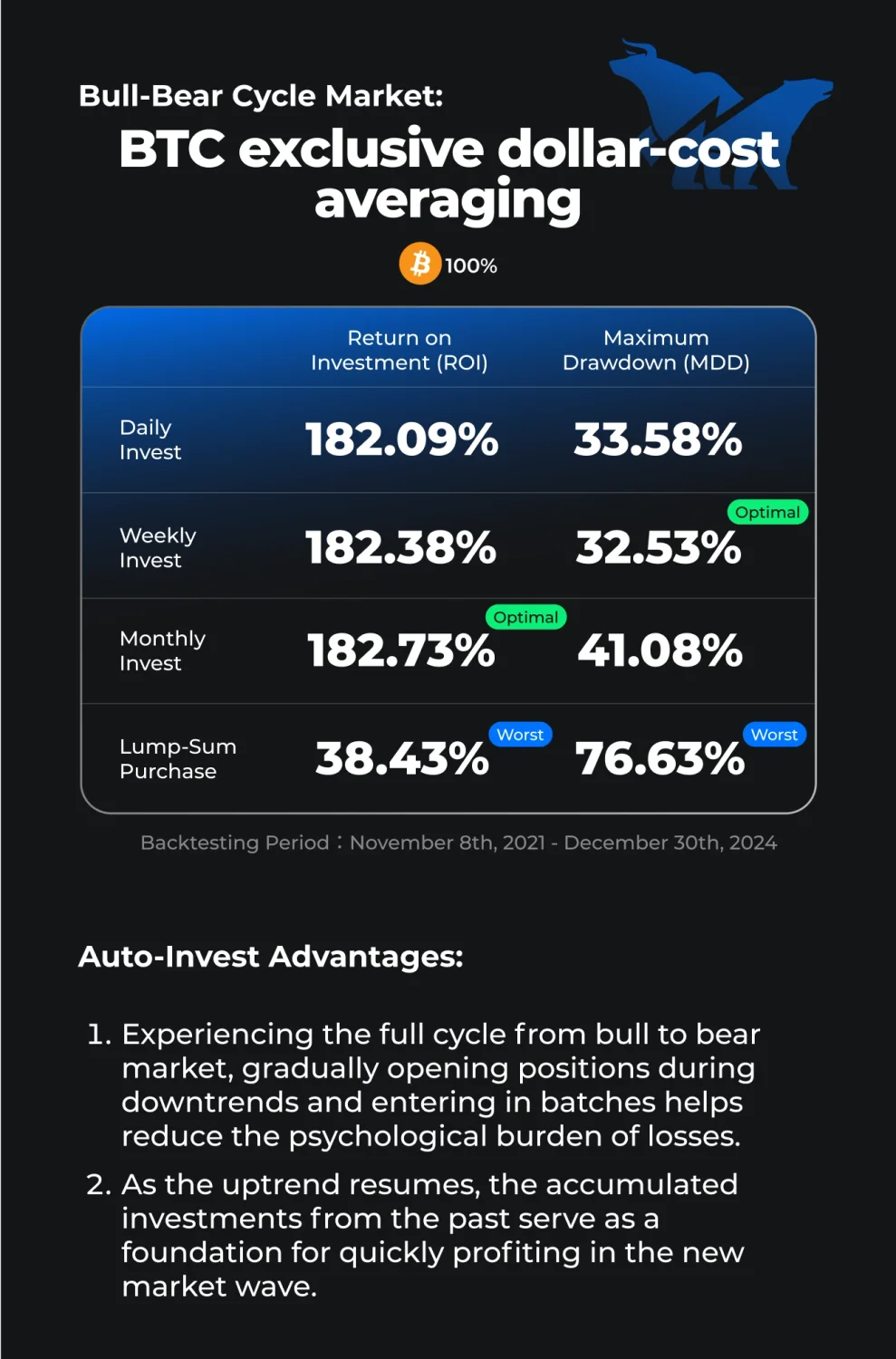

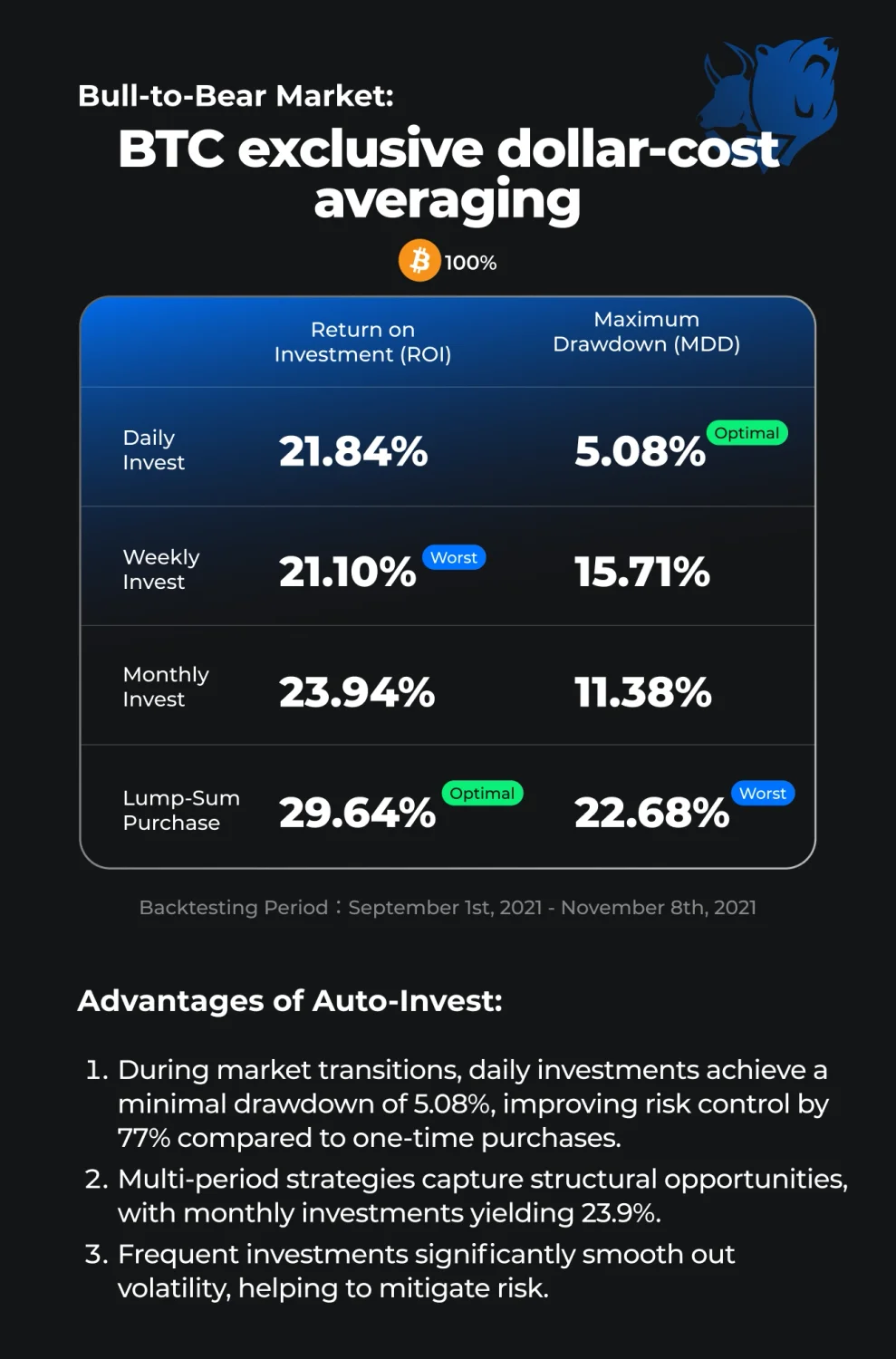

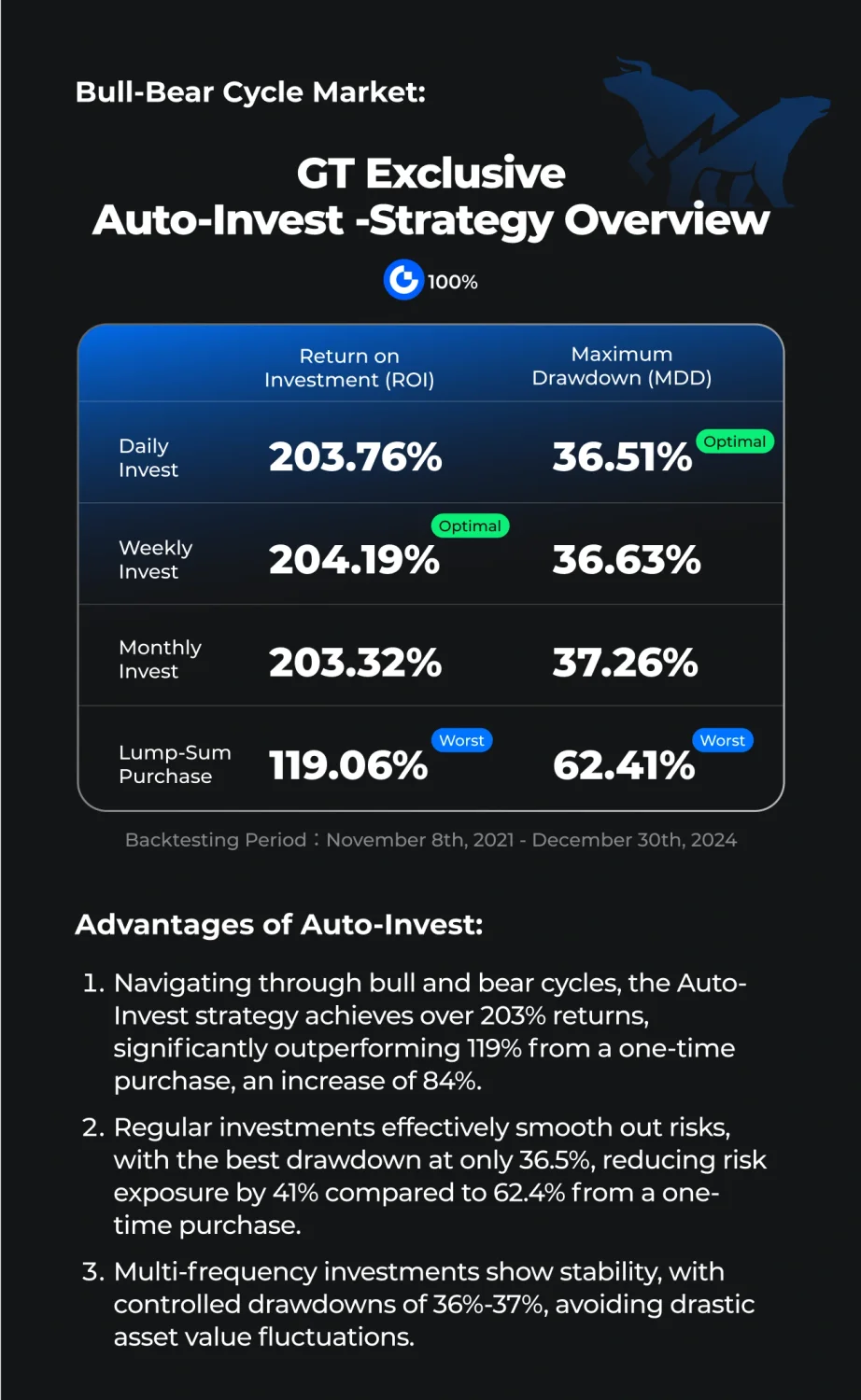

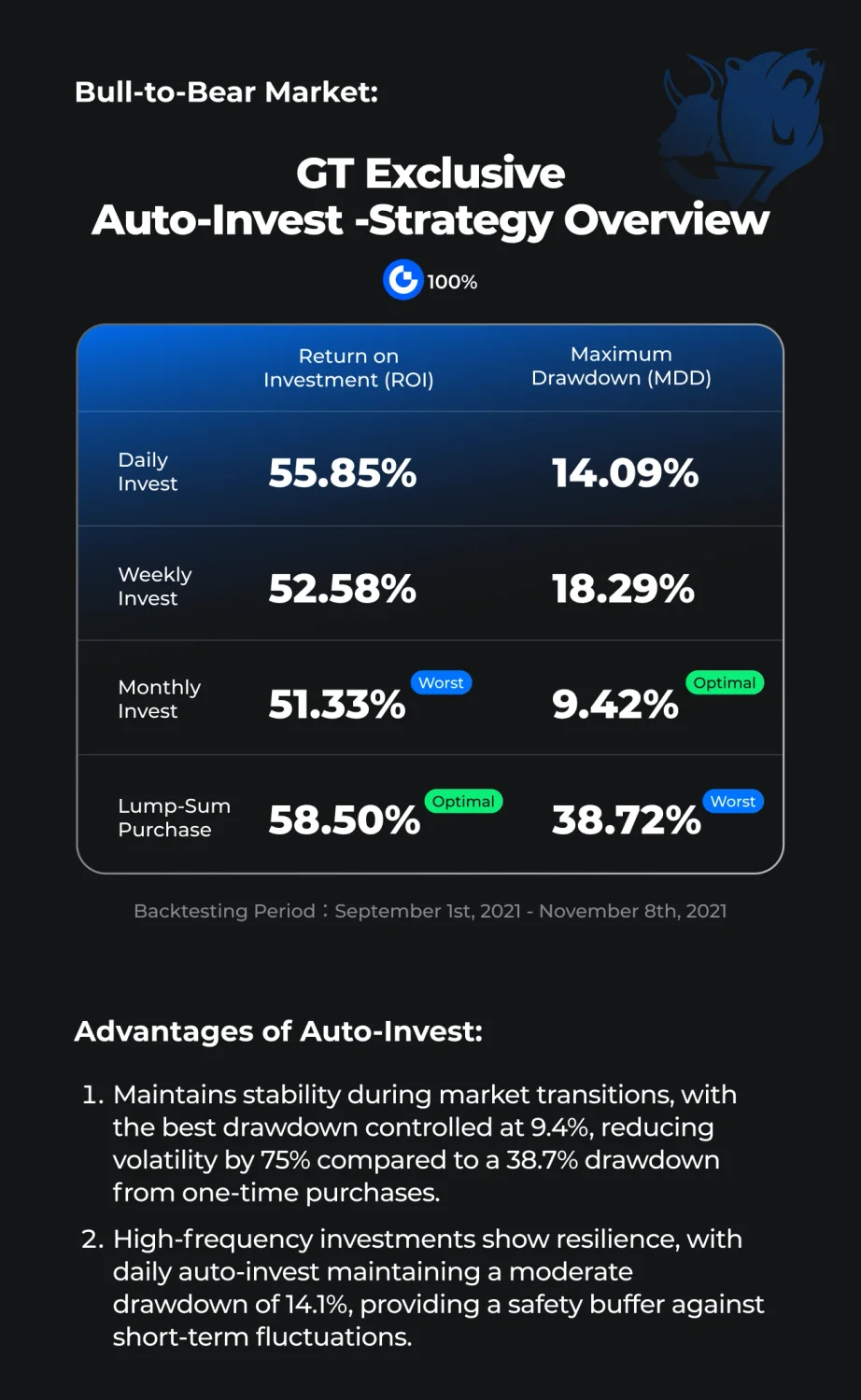

Backtesting data from 2021 to 2024 shows that auto-invest strategies outperform lump-sum investment strategies in most market phases.

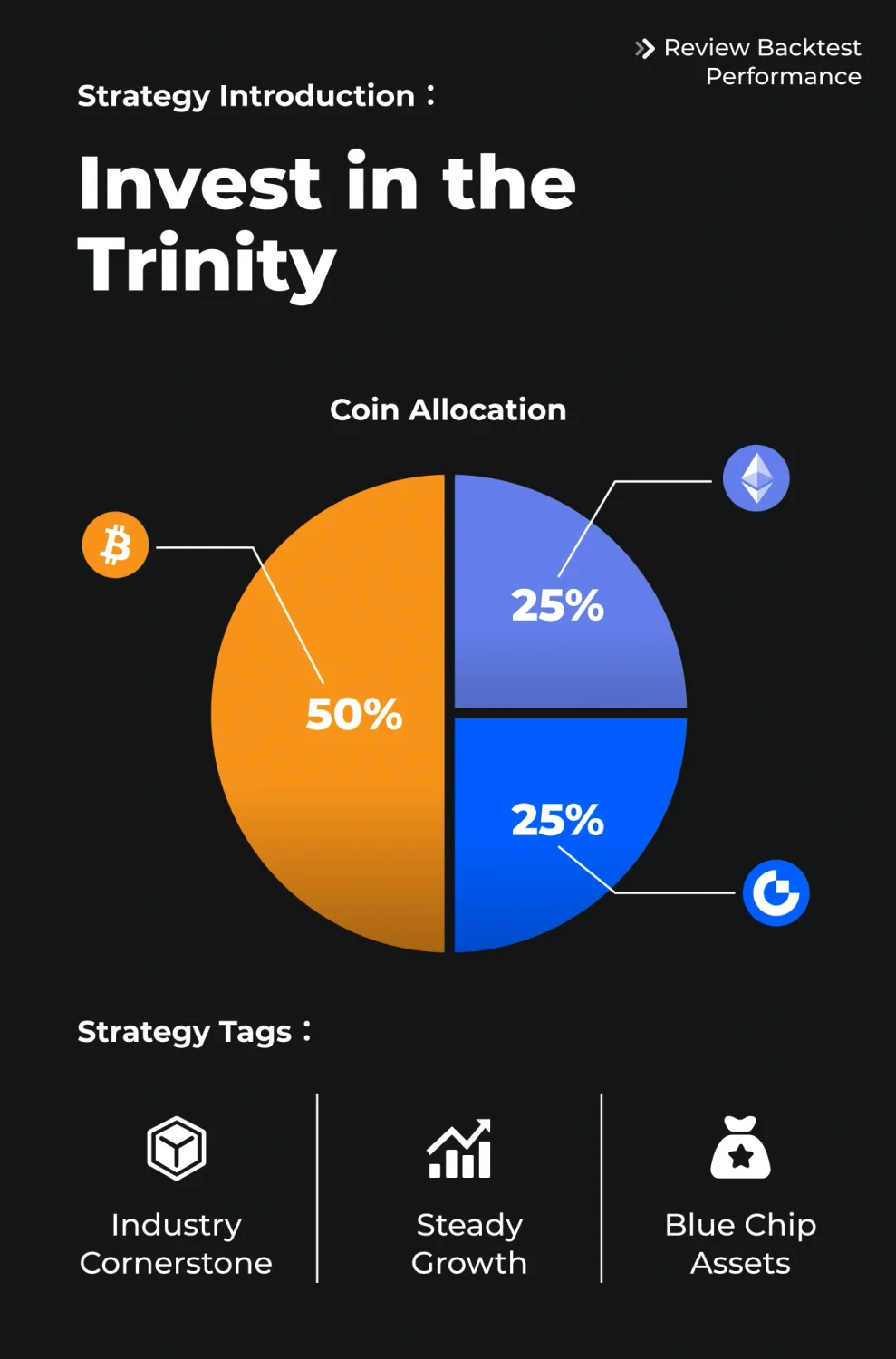

Data indicates that a multi-asset portfolio strategy (such as 50% BTC + 25% ETH + 25% GT) achieves a balance of high returns and low risk through diversified investments.