Gate Research: Farewell to Idle Capital: How PayFi Ushers in the Era of Crypto Payment Yield

9/5/2025, 7:19:29 AM

Download the Full Report (PDF)

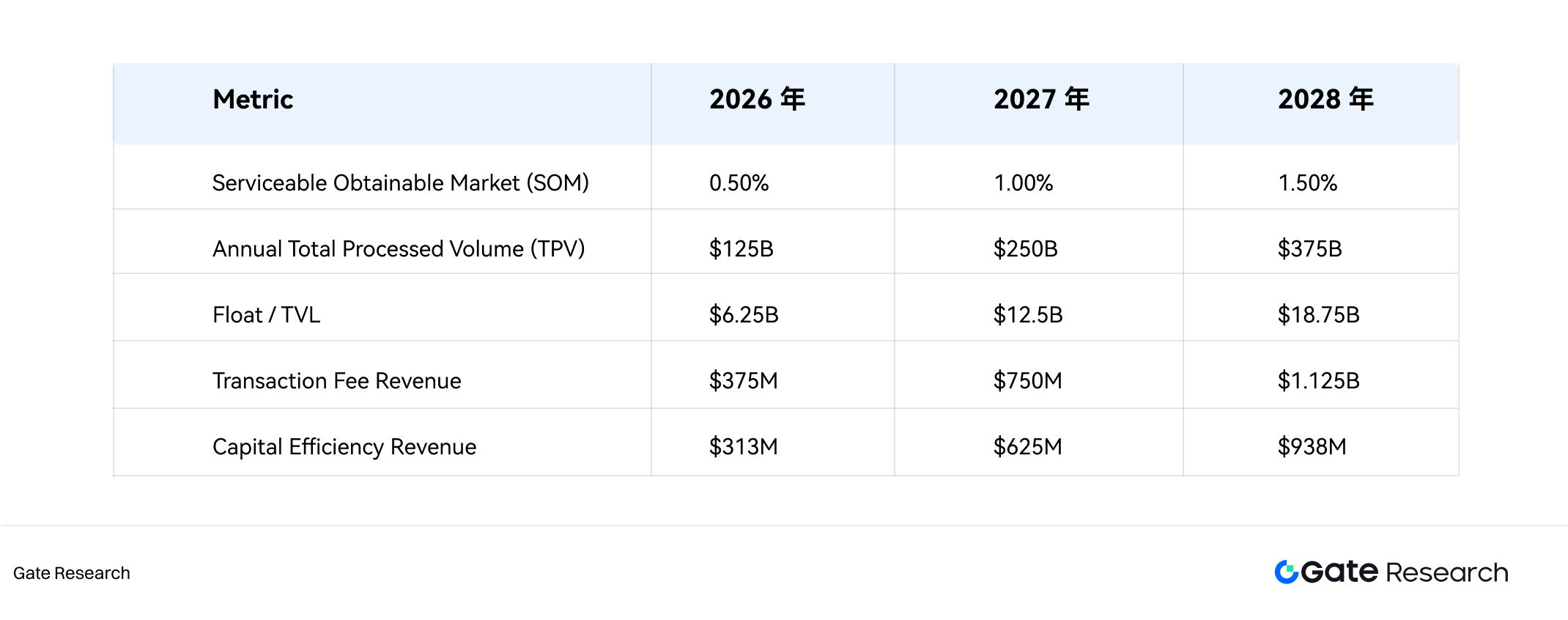

This report highlights that PayFi, leveraging stablecoins as its underlying medium, integrates accounts, clearing and settlement, yield management, and compliance into a unified framework—enabling a paradigm shift from “payments” to “finance.” Its innovative BNPN model allows payment flows to automatically generate yield, breaking the long-standing issue of “idle capital.” The report estimates that PayFi’s serviceable market could reach $25–30 trillion, with its obtainable market projected to achieve hundreds of billions in transaction volume and generate billions in revenue within the next 3–5 years. Powered by four core engines—low-fee high-frequency transactions, yield generation from settlement funds, institutional-grade financial services, and modular PaaS offerings—PayFi is poised to become the next-generation payment infrastructure bridging Web2 and Web3, ushering in a yield-driven era of crypto payments.Key Takeaways

- Core Positioning of PayFi: PayFi is a systematic financial framework for payments. It leverages stablecoins as the underlying medium, integrating account systems, clearing and settlement, yield management, and compliance layers. Its goal is to bring crypto payments into the mainstream and serve as a bridge between Web2 and Web3.

- Paradigm Shift from Payment to Finance: By introducing the BNPN model, PayFi combines payment behavior with capital appreciation, enabling every unit of capital to generate yield—fundamentally transforming the traditional model of “idle capital.”

- Solving Industry Pain Points: PayFi addresses three structural challenges of traditional payment systems: high fees (reducing costs to less than one-tenth of traditional rails via on-chain settlement), long clearing cycles (enabling T+0 instant settlement), and financial exclusion (offering “accountless” access so the unbanked population worldwide can participate in financial services).

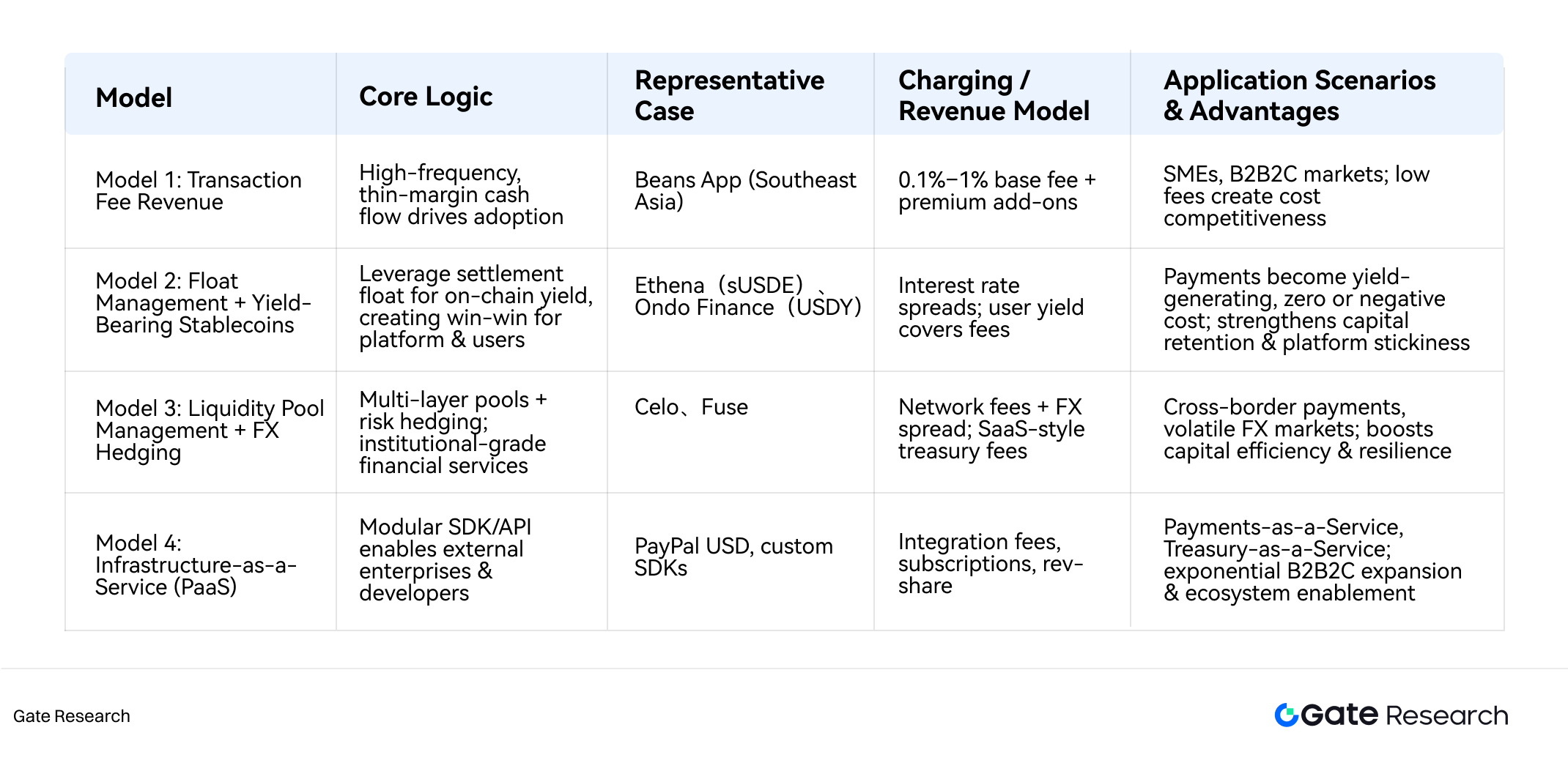

- Four Core Business Models: PayFi’s multi-layered, progressive business model drives revenue through four engines. First, it builds stable cash flow with ultra-low transaction fees under a “small margin, high frequency” strategy. Second, it reinvests settlement float into yield-bearing stablecoins, creating a profitability flywheel for both the platform and users. Third, it provides institutional-grade services such as liquidity pool management and FX hedging to capture higher-value revenues. Finally, it modularizes core capabilities into Payment-as-a-Service (PaaS) solutions, empowering external enterprises and driving ecosystem expansion.

- Three-Phase Rollout Strategy: PayFi’s roadmap follows a three-step strategy: Phase 1 (within 1 year) focuses on building core cash flow and user adoption; Phase 2 (1–2 years) expands financial services and API capabilities; Phase 3 (2–3 years) evolves into an industry-level infrastructure provider, enabling broader ecosystem growth.

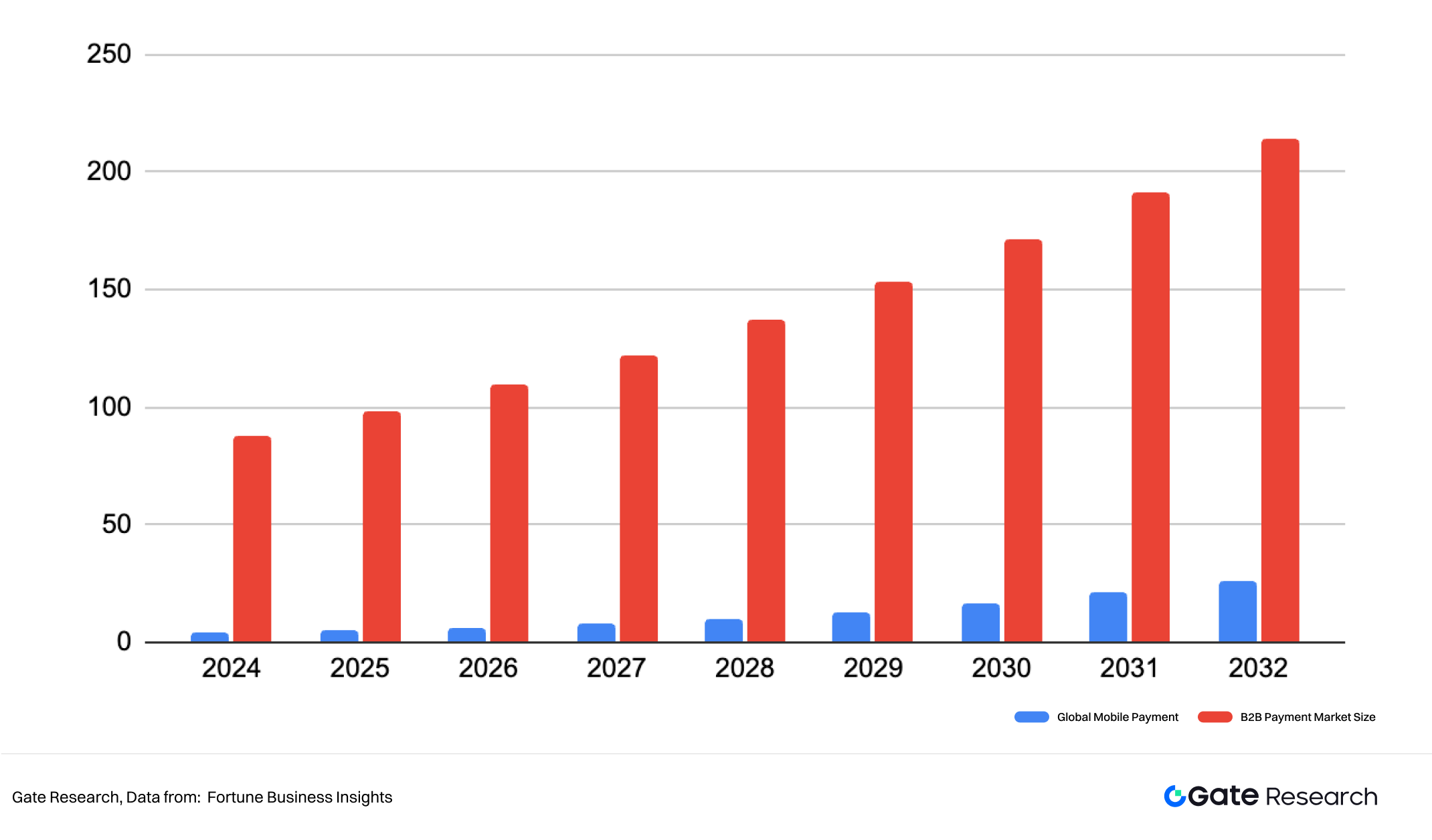

- Market Potential: PayFi targets the multi-trillion-dollar global payments market. By 2032, the digital payments and B2B payments markets are projected to reach $26.53 trillion and $213.28 trillion, respectively. Within key segments, PayFi’s serviceable market is estimated at $25–30 trillion. As crypto payment adoption accelerates, PayFi’s serviceable obtainable market (SOM) could reach hundreds of billions in transaction volume over the next 3–5 years, generating multi-billion-dollar revenue opportunities.

- Opportunities and Challenges: PayFi benefits from regulatory clarity around stablecoins and advances in infrastructure technologies . However, it also faces challenges such as regulatory uncertainty, security risks, and user onboarding barriers, which must be addressed through compliance and technological innovation.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Ember

Reviewer(s): Puffy, Shirley

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Beginner

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Yala inherits the security and decentralization of Bitcoin while using a modular protocol framework with the $YU stablecoin as a medium of exchange and store of value. It seamlessly connects Bitcoin with major ecosystems, allowing Bitcoin holders to earn yield from various DeFi protocols.

11/29/2024, 10:10:11 AM

Beginner

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

This article explores the development trends, applications, and prospects of cross-chain bridges.

12/27/2023, 7:44:05 AM

Advanced

Solana Need L2s And Appchains?

Solana faces both opportunities and challenges in its development. Recently, severe network congestion has led to a high transaction failure rate and increased fees. Consequently, some have suggested using Layer 2 and appchain technologies to address this issue. This article explores the feasibility of this strategy.

6/24/2024, 1:39:17 AM

Intermediate

Sui: How are users leveraging its speed, security, & scalability?

Sui is a PoS L1 blockchain with a novel architecture whose object-centric model enables parallelization of transactions through verifier level scaling. In this research paper the unique features of the Sui blockchain will be introduced, the economic prospects of SUI tokens will be presented, and it will be explained how investors can learn about which dApps are driving the use of the chain through the Sui application campaign.

8/13/2025, 7:33:39 AM

Advanced

Navigating the Zero Knowledge Landscape

This article introduces the technical principles, framework, and applications of Zero-Knowledge (ZK) technology, covering aspects from privacy, identity (ID), decentralized exchanges (DEX), to oracles.

1/4/2024, 4:01:13 PM

Beginner

What is Tronscan and How Can You Use it in 2025?

Tronscan is a blockchain explorer that goes beyond the basics, offering wallet management, token tracking, smart contract insights, and governance participation. By 2025, it has evolved with enhanced security features, expanded analytics, cross-chain integration, and improved mobile experience. The platform now includes advanced biometric authentication, real-time transaction monitoring, and a comprehensive DeFi dashboard. Developers benefit from AI-powered smart contract analysis and improved testing environments, while users enjoy a unified multi-chain portfolio view and gesture-based navigation on mobile devices.

5/22/2025, 3:13:17 AM