Current Price: $84,960 (As of November 22, 10:14 AM)

24-hour change: -1.99%

24-hour range: $81,051 - $86,684

Market Cap: 1.697 trillion USD

Short-term Outlook: The technical indicators show a clear bearish trend, but the deeply oversold condition suggests the possibility of a rebound. The RSI on the daily chart has dropped to 23 (deeply oversold area), while the ADX above 43 indicates that the strong downward trend continues. The derivatives market shows that bulls are still under pressure, with 77% of liquidations in the last 24 hours being long positions.

Key Support:

Strong support level: $82,254 (1-hour Bollinger Bands lower band + large cluster of long liquidations)

Minor support: $81,283 (4-hour Bollinger Band lower band)

Key Resistance:

Recent resistance: $84,701 (1-hour EMA12)

Strong Resistance Level: $85,994 (1-hour Bollinger Band Upper Band + Short Squeeze Dense Area)

Technical Analysis

Multi-Cycle Trend Status

Time Frame

Trend Direction

RSI

MACD

Key Signals

1 hour

Bearish

47

Histogram +300 (Bullish Divergence)

Neutral momentum, price close to the middle band of the Bollinger Bands

4 Hours

Bearish

35

Histogram -249 (Bearish)

Approaching Oversold, Below All Moving Averages

Daily

Bearish

23

Histogram -1267 (Bearish)

Deeply oversold, strong downtrend

Key Price Structure

Currently, BTC is in a strong downtrend, having confirmed a “death cross” signal (50-day EMA crossing below 200-day EMA), technically entering the confirmation phase of a bear market. The price is at the lower band of the Bollinger Bands on both the 4-hour and daily charts, indicating an extreme oversold condition.

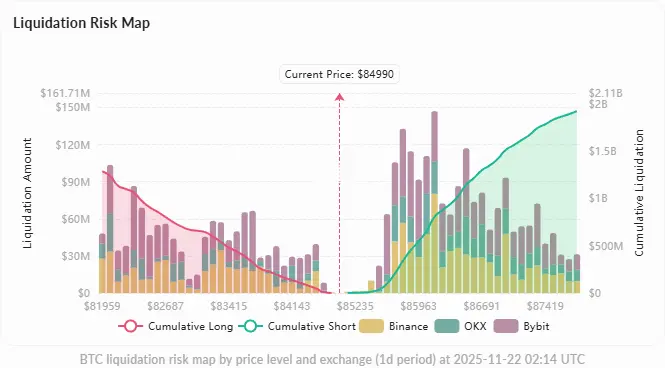

Liquidation Risk Analysis: The total liquidation volume in the last 24 hours reached $880 million, with 77% being long liquidations. The forward-looking liquidation map shows a cumulative long exposure of $1.28 billion below $82,000, while there is only $1.9 billion of short exposure above $87,000, creating a clear asymmetric downside risk.

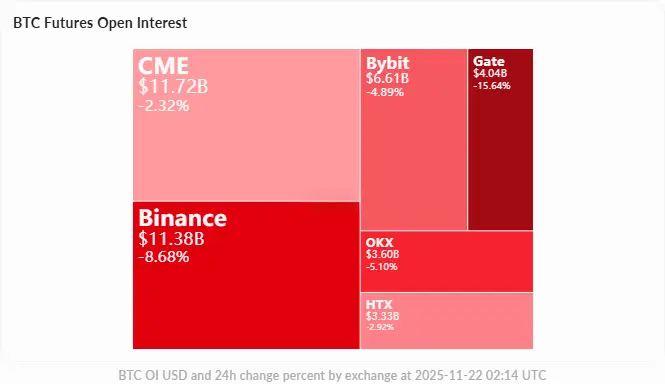

Derivatives Market: The open interest has decreased by 10.42% over the past 24 hours, and the funding rate remains positive at +0.0038% (longs pay shorts), reflecting a bearish market sentiment, with overly leveraged longs facing ongoing cost pressures.

Market Drivers

macroeconomic environment pressure

The uncertainty of the Federal Reserve's policy has become a major drag factor. The probability of a rate cut in December has plummeted from 98% a month ago to about 40%, as officials express concerns over stubborn inflation and the resilience of the labor market. This “hawkish turn” has triggered a sell-off in risk assets, with the correlation between BTC and tech stocks reaching a six-month high of 80%.

Institutional Capital Flow

The US Bitcoin ETF saw an outflow of $903 million (the second largest in history), with BlackRock's IBIT experiencing a single-day outflow of $1.6 billion. The futures open interest has decreased by 35% from the October peak of $94 billion, with forced liquidations and institutional rebalancing putting pressure on prices.

Technical deterioration

BTC has fallen below the 50-week moving average (approximately $85,000), which is a classic bear market signal. The Fear and Greed Index has dropped to 15/100 (extreme fear), with a monthly decline of about 23%, marking the worst performance since June 2022.

Social Sentiment Analysis

Despite the obvious bearish signals from a technical perspective, social media sentiment remains relatively optimistic. Well-known supporters like Michael Saylor continue to promote the “buy the dip” philosophy, describing volatility as “a gift from Satoshi to his loyal followers.” The narratives of institutional adoption and long-term value storage remain strong in the community, with most discussions viewing the current pullback as a buying opportunity rather than a structural reversal.

Trading Strategy Recommendations

Rebound Trading (Medium Probability)

Entry Range: $84,500-$84,800

Target Price: $85,800

Stop Loss: $83,900

Risk-Reward Ratio: 1.53

Logic: Deeply oversold RSI + liquidation exhaustion may trigger a technical rebound

Support Breakthrough: A drop below $82,254 will trigger a bullish liquidation cascade.

RSI Divergence: 4-hour level RSI divergence confirmation signal

Open Interest Rebound: Accompanied by an increase in trading volume, OI rises.

Funding Rate Turns Negative: An important signal of a shift in bullish sentiment

Conclusion: The short-term outlook for BTC remains bearish, with strong downward momentum pointing to a test of the $82,000 support level. However, the deeply oversold conditions and on-chain capital outflow patterns suggest that if $84,701 holds, the probability of a rebound to $86,000 is increasing.

This page may contain third-party content, which is provided for information purposes only (not representations/warranties) and should not be considered as an endorsement of its views by Gate, nor as financial or professional advice. See Disclaimer for details.

November 22 | BTC trend analysis

Core Viewpoints

Current Price: $84,960 (As of November 22, 10:14 AM)

Short-term Outlook: The technical indicators show a clear bearish trend, but the deeply oversold condition suggests the possibility of a rebound. The RSI on the daily chart has dropped to 23 (deeply oversold area), while the ADX above 43 indicates that the strong downward trend continues. The derivatives market shows that bulls are still under pressure, with 77% of liquidations in the last 24 hours being long positions.

Key Support:

Key Resistance:

Technical Analysis

Multi-Cycle Trend Status

Key Price Structure

Currently, BTC is in a strong downtrend, having confirmed a “death cross” signal (50-day EMA crossing below 200-day EMA), technically entering the confirmation phase of a bear market. The price is at the lower band of the Bollinger Bands on both the 4-hour and daily charts, indicating an extreme oversold condition.

Liquidation Risk Analysis: The total liquidation volume in the last 24 hours reached $880 million, with 77% being long liquidations. The forward-looking liquidation map shows a cumulative long exposure of $1.28 billion below $82,000, while there is only $1.9 billion of short exposure above $87,000, creating a clear asymmetric downside risk.

Derivatives Market: The open interest has decreased by 10.42% over the past 24 hours, and the funding rate remains positive at +0.0038% (longs pay shorts), reflecting a bearish market sentiment, with overly leveraged longs facing ongoing cost pressures.

Market Drivers

macroeconomic environment pressure

The uncertainty of the Federal Reserve's policy has become a major drag factor. The probability of a rate cut in December has plummeted from 98% a month ago to about 40%, as officials express concerns over stubborn inflation and the resilience of the labor market. This “hawkish turn” has triggered a sell-off in risk assets, with the correlation between BTC and tech stocks reaching a six-month high of 80%.

Institutional Capital Flow

The US Bitcoin ETF saw an outflow of $903 million (the second largest in history), with BlackRock's IBIT experiencing a single-day outflow of $1.6 billion. The futures open interest has decreased by 35% from the October peak of $94 billion, with forced liquidations and institutional rebalancing putting pressure on prices.

Technical deterioration

BTC has fallen below the 50-week moving average (approximately $85,000), which is a classic bear market signal. The Fear and Greed Index has dropped to 15/100 (extreme fear), with a monthly decline of about 23%, marking the worst performance since June 2022.

Social Sentiment Analysis

Despite the obvious bearish signals from a technical perspective, social media sentiment remains relatively optimistic. Well-known supporters like Michael Saylor continue to promote the “buy the dip” philosophy, describing volatility as “a gift from Satoshi to his loyal followers.” The narratives of institutional adoption and long-term value storage remain strong in the community, with most discussions viewing the current pullback as a buying opportunity rather than a structural reversal.

Trading Strategy Recommendations

Rebound Trading (Medium Probability)

Trend continuation (high probability)

Key Observations

Conclusion: The short-term outlook for BTC remains bearish, with strong downward momentum pointing to a test of the $82,000 support level. However, the deeply oversold conditions and on-chain capital outflow patterns suggest that if $84,701 holds, the probability of a rebound to $86,000 is increasing.