The Legendary Token ORE Makes a Comeback — This Time It Surged 30x in a Month

ORE debuted in 2024 as the Solana Renaissance hackathon winner, where its proof-of-work system once overwhelmed the Solana network with excessive transaction volume.

After almost a year of dormancy, ORE has reemerged in the Solana ecosystem. Previously dubbed the “Solana Crasher” PoW mining protocol, it returns with a newly upgraded protocol. This drove the token price from $10 to over $600 within the past month and generated daily protocol revenues exceeding $1 million. ORE now ranks second in protocol income on Solana, trailing only Pump.fun, with nearly all growth happening on decentralized exchanges (DEX).

ORE was developed by the anonymous creator Hardhat Chad, whose approach to anonymity follows the tradition of Bitcoin’s Satoshi Nakamoto. In its early phase, Hardhat Chad single-handedly built ORE V1. Today, the team features members like Neil Shahani, who leads project growth and manages community relations.

The ORE team established Regolith Labs as the official development entity.

In September 2024, Regolith Labs—the team behind ORE—closed a $3 million seed funding round led by Foundation Capital, with Solana Ventures and others joining in. The funds are dedicated mainly to team expansion and technology advancement.

The project team then released the V2 protocol. However, the early V2 failed to resolve incentive misalignment, resulting in low mining rewards and a persistently depressed ORE price.

After a year of iteration, the team identified a fundamental value leakage in traditional PoW models and opted for a comprehensive redesign. On October 22, 2025, ORE announced its newly engineered protocol, which can now accumulate protocol revenue, enable sustainable tokenomics, and accelerate the goal of establishing Solana-native value storage.

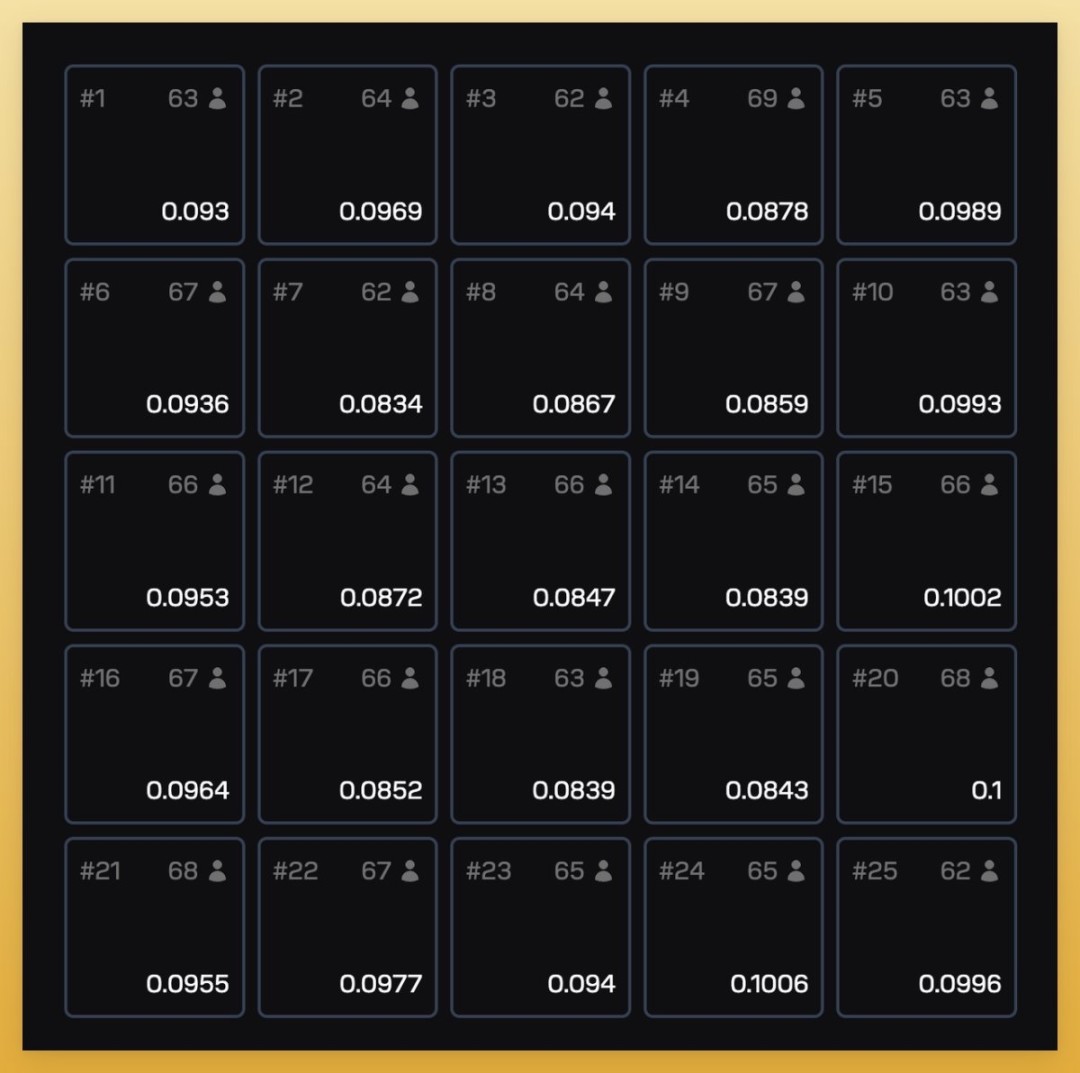

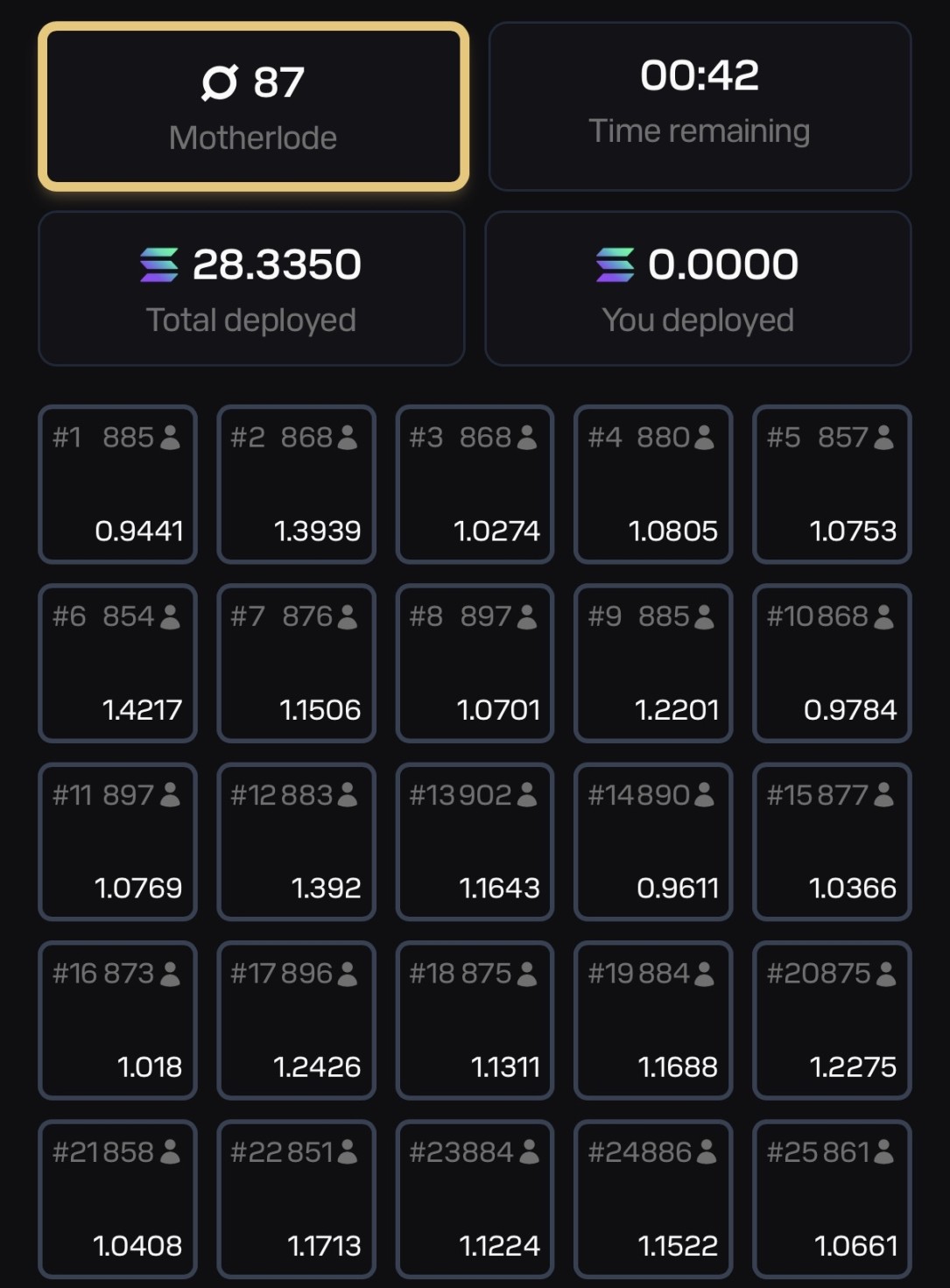

The new protocol introduces a 5×5 grid mining system. Each round lasts one minute, and miners stake SOL to occupy blocks on the grid. At the end of each round, a secure random number generator picks a winning block, and miners on that block split all SOL from the other 24 blocks proportionally. Additionally, one miner in the winning block has a chance to receive an extra ORE reward (about every three rounds). This mechanism transforms a zero-sum game into collective value redistribution, with all losing SOL flowing directly to winners—eliminating value leakage.

The protocol also features a “Motherlode” prize pool, adding 0.2 ORE to the pool each round with a 1:625 chance to trigger the prize. If untriggered, the prize pool accumulates until a lucky miner wins it in a future round.

Economic Model: Deflationary Dynamics and Value Accumulation

ORE’s core innovation is its value capture mechanism. All mining rewards are subject to a 10% refining fee upon withdrawal; this amount is automatically distributed to other miners based on their unclaimed ORE holdings. The longer miners hold their mined ORE, the more they accumulate.

Critically, the protocol automatically collects 10% of SOL mining rewards as protocol income. It uses this income to buy back ORE tokens from the open market. In the past seven days, protocol revenue reached 21,529 SOL (about $3.6 million), powering buybacks of 10,381 ORE. Ninety percent of repurchased tokens are permanently burned, with the remaining 10% distributed to stakers.

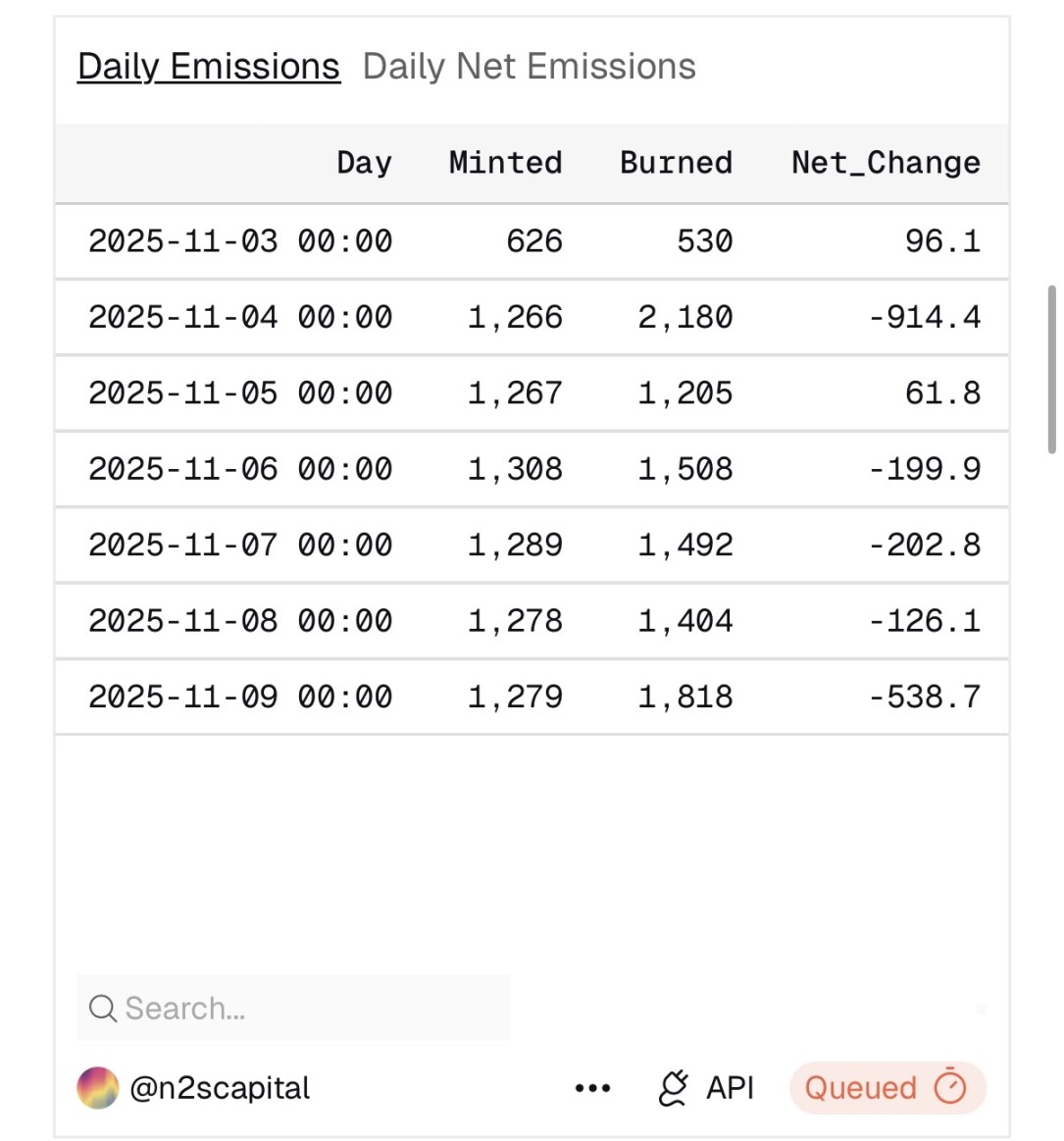

This structure allows ORE’s net issuance to flex dynamically between inflation and deflation. When protocol revenue is robust, the system enters a deflationary phase as a result.

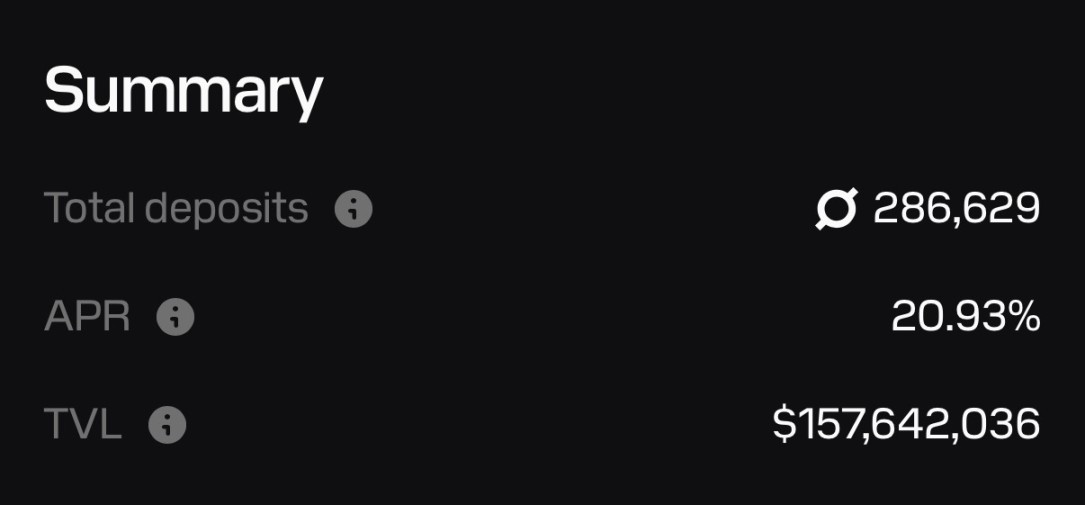

Currently, a total of 286,629 ORE are staked in the protocol, with TVL exceeding $150 million and APR at 20.93%.

Tokenomics

ORE maintains a hard cap of 5 million tokens and a stable average issuance rate of approximately 1 ORE per minute. However, with the introduction of protocol revenue and the automated burial mechanism, net issuance may fluctuate between limited inflation and unlimited deflation, contingent on protocol revenues. Dune data shows ORE was deflationary on five out of the past seven days.

Ecosystem Recognition: Solana’s Official Endorsement

Solana’s official team has paid special attention to the protocol’s profitability. On November 10, Solana’s official account quoted a tweet from ORE’s growth lead Neil Shahani, expressing astonishment at daily revenues surpassing $1 million.

Solana co-founder toly stated directly, “Ore is money,” and retweeted, highlighting its ongoing miner incentives, staking yields sourced from protocol income instead of inflation, and how fee rebates strengthen the ecosystem.

ORE’s integration with new platforms is also expanding. Solana Mobile’s Seeker device now supports ORE applications, enabling users to mine directly from their phones.

Community Response

Some community members remain cautious regarding ORE’s comeback. Some users argue that participating in the mining game may be a negative-return proposition, with genuine profits accruing to ORE holders. The mining mechanism is essentially zero-sum: the SOL contributed by losing miners flows entirely to winners. As participation grows, the cost of mining (SOL outlay) increases significantly.

Miners who “mine and immediately sell” face price volatility risks under the high refining fee. Long-term holders, on the other hand, can offset costs—and potentially realize net gains—through the refining fee, staking rewards, and deflationary appreciation. This has led more users to choose holding tokens directly over actively mining.

Statement:

- This article is reproduced from [Foresight News]. Copyright remains with the original author [Nicky, Foresight News]. If you have objections to this reprint, please contact the Gate Learn team, who will address concerns according to relevant procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, transmitted, or plagiarized without citing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?