Crypto funds have seen their principal halved after four years of investing in top-tier VCs. What's wrong with crypto funds?

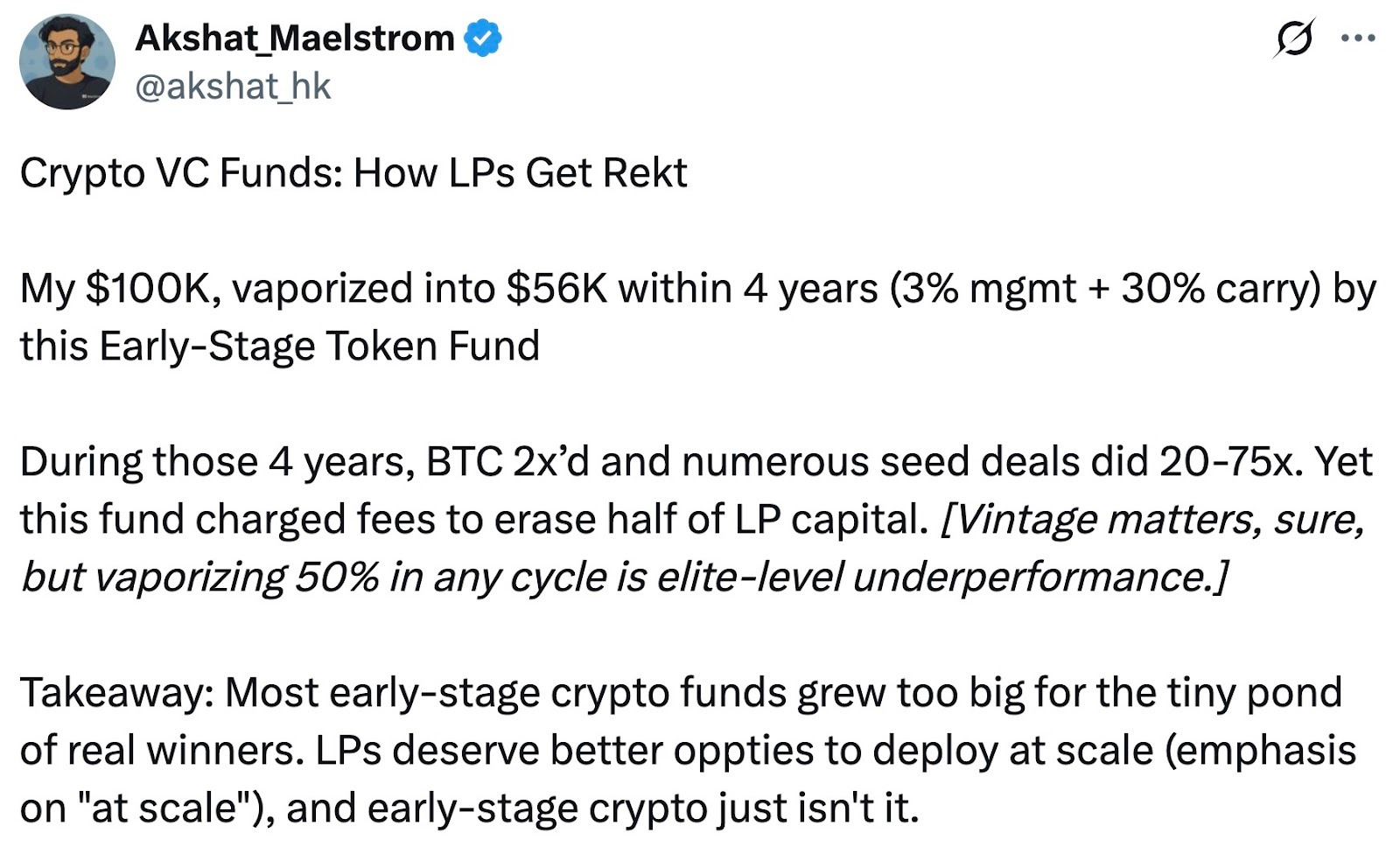

Recently, Akshat Vaidya, Co-Founder and Chief Investment Officer of Arthur Hayes’ family office Maelstrom, publicly shared disappointing investment results on X, drawing widespread attention across the crypto community.

Vaidya revealed that four years ago, he invested $100,000 in Pantera Capital’s Pantera Early-Stage Token Fund LP. That investment has now shrunk to just $56,000, losing nearly half its original value.

For context, Vaidya noted that during the same period, Bitcoin’s price approximately doubled, while returns from many seed-stage crypto projects soared as much as 20 to 75 times. He remarked, “While the entry year matters, losing 50% in any cycle is about as bad as it gets.” Vaidya’s pointed assessment challenged the fund’s track record and sparked vigorous debate within the industry over the performance and fee structures of major crypto funds.

The “3/30” Fee Era in Crypto’s Boom

Vaidya singled out the “3/30” fee structure, which means charging a 3% annual management fee and taking a 30% performance fee. This significantly exceeds the standard “2/20” model typical in hedge and venture funds—2% management, 20% performance fee.

At the height of the crypto bull market, several well-known institutional funds—with broad access to projects and impressive track records—charged fees above the industry average, such as 2.5% or 3% for management and as much as 25% or 30% for performance. Pantera, the fund Vaidya criticized, exemplifies this premium pricing.

As the market matured, crypto fund fee models began evolving. After riding out boom-and-bust cycles and facing pressure from LPs and fundraising challenges, funds increasingly shifted to lower fee structures. Recently launched crypto funds have started offering concessions—for example, dropping management fees to 1–1.5% or charging higher performance fees only on excess returns—in an effort to better align with investor interests.

Today, most crypto hedge funds use the classic “2% management, 20% performance” fee split, but overall fee averages have declined due to pressure to allocate capital efficiently. Crypto Insights Group reports that current management fees average around 1.5%, while performance fees, depending on strategy and liquidity, have trended toward 15% to 17.5%.

Why Scaling Crypto Funds Remains Elusive

Vaidya’s post also reignited debate over the scalability of crypto funds. He argued bluntly that, except for a few outliers, most large crypto venture funds generate poor returns and undermine their limited partners. He aimed to use data to remind and educate the community that scaling crypto venture capital simply doesn’t work—even top brands with elite backers aren’t immune.

Many agree, arguing that excessive fundraising by early crypto funds has actually weighed down performance. Leading firms like Pantera, a16z Crypto, and Paradigm have each raised multi-billion-dollar funds in recent years, but deploying such vast capital efficiently in an early-stage crypto market is extremely challenging.

With a limited pool of projects, big funds are forced to spread investments across numerous startups, resulting in small allocations per project and uneven quality. As a result, over-diversification makes it much harder to achieve outsized returns.

By contrast, smaller funds and family offices, with more modest capital, can rigorously select investments and concentrate on higher-quality deals. Supporters argue this “small and nimble” strategy is better suited to outperform the market. Vaidya himself commented in replies that he favors the view: “The issue isn’t early-stage tokens, it’s fund size,” and “the ideal early crypto fund must be small and flexible.”

However, some dissenting voices challenge this sweeping claim. They argue that while large funds may face diminishing returns chasing early-stage projects, their broader industry contributions shouldn’t be negated by a single poor investment. Large crypto funds typically have deep resources, specialized teams, and extensive networks. They offer post-investment support and drive ecosystem growth—advantages unavailable to individual investors or smaller funds.

Moreover, large funds can participate in much bigger funding rounds or infrastructure projects, providing the deep capital the industry needs. Public blockchains, exchanges, and similar ventures often require investments in the hundreds of millions—only large crypto funds can meet those demands. Thus, big funds have a justified role, but should calibrate fund size to market opportunity and avoid overexpansion.

Some observers view Vaidya’s criticism as partly a marketing play. As the head of Arthur Hayes’ family office, he’s actively developing a differentiated fund strategy and raising capital—Maelstrom is preparing a new fund exceeding $250 million, aiming to acquire mid-sized crypto infrastructure and data firms.

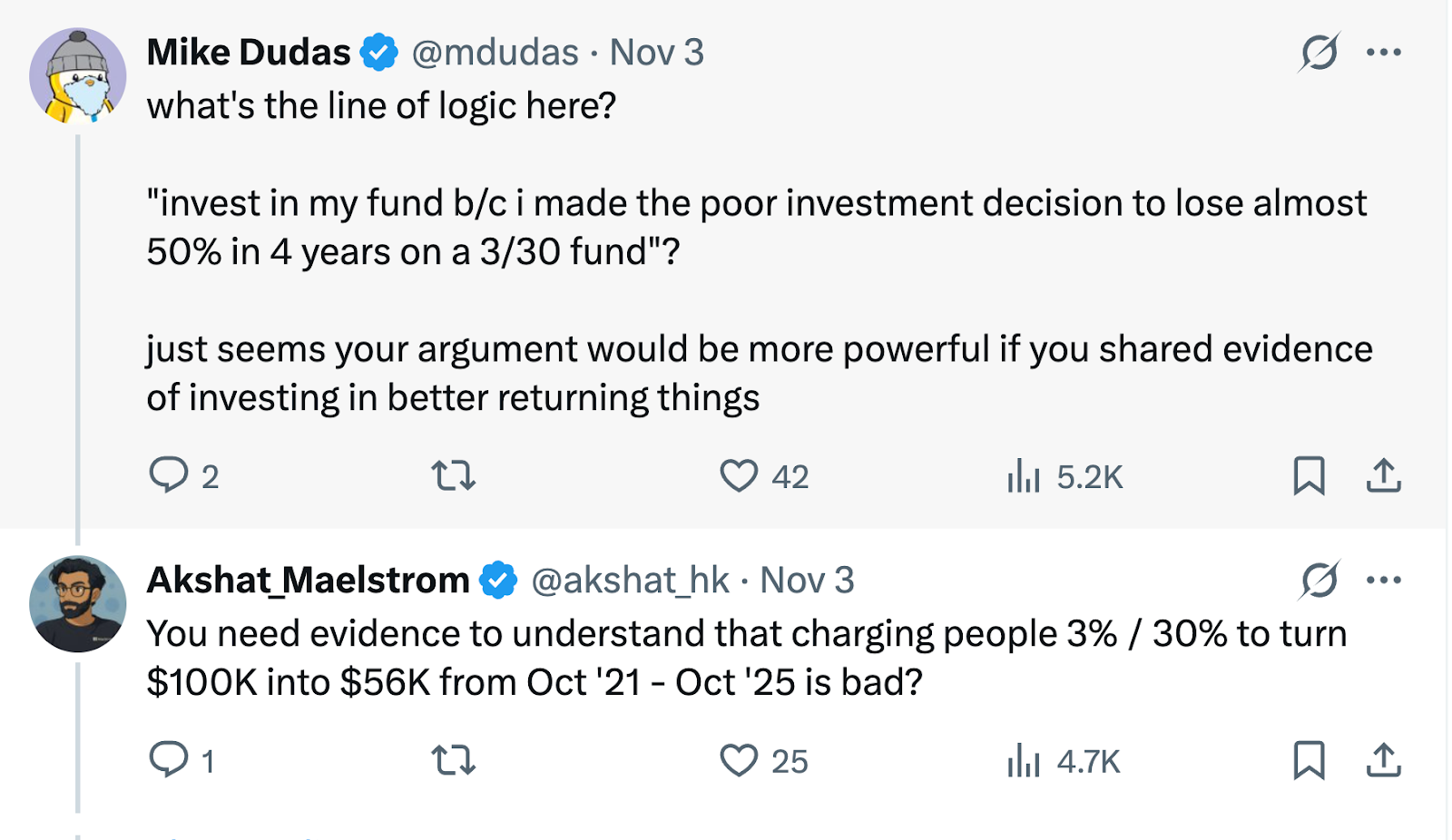

So, Vaidya’s critique may also serve to emphasize Maelstrom’s unique focus on value investing and cash flow. Mike Dudas, Co-Founder of 6th Man Ventures, noted that if Vaidya wants to promote his family office’s new fund, he should showcase his own performance rather than attack others to grab attention.

“No Strategy Beats Buying BTC”

Drawing on personal experience, Vaidya compared fund returns with the simple strategy of holding Bitcoin, raising a familiar question: Would investors be better off just buying Bitcoin than handing their money to a crypto fund?

The answer depends on the market cycle.

In past bull runs, some leading crypto funds sharply outperformed Bitcoin. During the frenzies of 2017 and 2020–2021, savvy managers secured returns far above Bitcoin’s by moving early into new projects or deploying leverage.

Top funds also offer professional risk management and downside protection. In bear markets, when Bitcoin is cut in half or worse, certain hedge funds can avoid massive losses—and even post gains—by employing short-selling and quantitative risk management, reducing volatility for investors.

For institutions and high-net-worth individuals, crypto funds offer diversified exposure and professional access. In addition, funds unlock opportunities often unavailable to individuals—like private token rounds, early equity stakes, and DeFi yield strategies. Many of the seed deals Vaidya referenced, which delivered 20–75x returns, are inaccessible at early valuations to individual investors—assuming, of course, fund managers have true skill in sourcing and executing top deals.

In the fast-moving crypto market, professional investing and passive holding both have their place, depending on one’s goals and risk appetite.

For crypto professionals and investors, the Pantera fund controversy offers a valuable moment to rationally assess and select an investment approach that fits their own strategy—maximizing wealth in an ever-shifting market landscape.

Disclaimer:

- This article is reprinted from [PANews]. Copyright belongs to the original author [PANews, Zen]. For any reprint concerns, please contact the Gate Learn team for assistance following our standard process.

- Disclaimer: The views expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Please cite Gate when sharing or referencing translated articles.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices