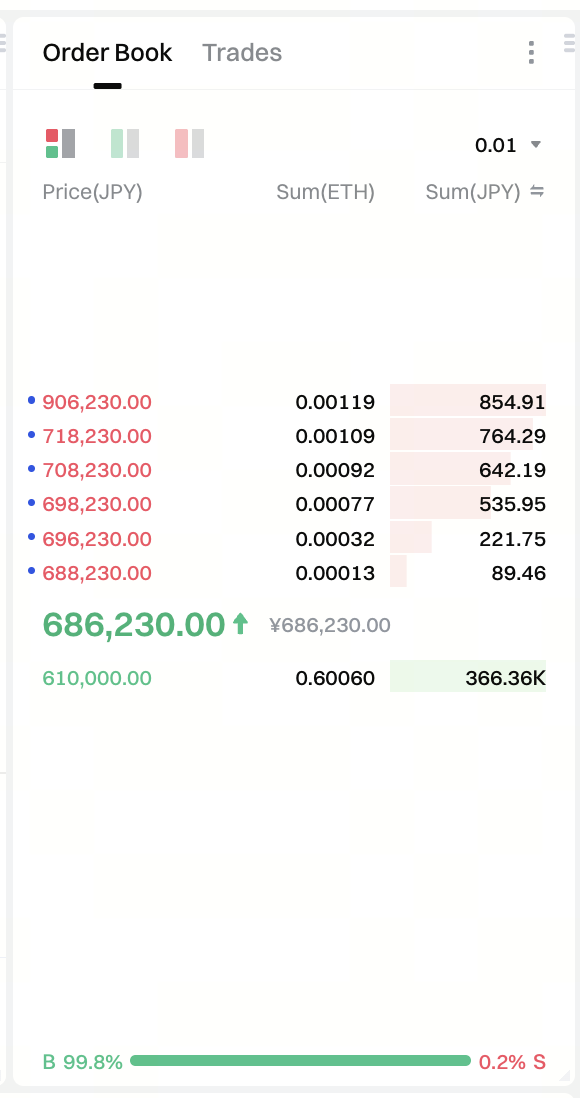

The order book is essentially a list that contains the current buy orders (Bids) and sell orders (Asks) for a specific asset in the market. It displays both the prices buyers and sellers are willing to accept, and the order amounts at each price.

- Sell orders (Asks): Typically, the top of the order book shows the sell orders, where the order with the lowest price is called the Lowest Ask or Sell 1.

- Buy orders (Bids): The bottom of the order book shows the buy orders, where the order with the highest price is called the Highest Bid or Buy 1.

Order matching principle

The matching system executes orders based on Price-Time Priority rule:

- The best price: For buy orders, the highest-priced order is matched first; for sell orders, the lowest-priced order is matched first.

- The earliest time: When two orders have the same price, the order placed earlier will be executed first. In actual trading, if an order with the same price as your order price is executed but your order remains unfilled, it indicates that there are orders placed earlier with the same price.

Different types of order matching

When a user places an order, the exchange will place the order in the corresponding position in the order book based on its order type and price, and execute the matching process.

- Market order: Executed immediately at the best available price by matching against existing orders in the order book.

- Limit order: Executed at your specified price or better. If no match is found, it remains in the order book until matched or canceled.