Gate Research: The Ecosystem Landscape and Convergence Trends of CEXs and DEXs

Introduction

In recent years, the evolving dynamics of the digital asset market have brought Centralized Exchanges (CEX) and Decentralized Exchanges (DEX) into the spotlight as a core topic for investors and researchers. While these two trading models are already widely recognized, their differences and respective impacts across various application scenarios warrant in-depth exploration.

Over the past two years, DEX adoption has risen significantly on a global scale. An increasing number of investors are engaging in on-chain trading and wallet management, gaining hands-on experience that reflects the growing prominence of decentralized trading. However, despite the rapid expansion of DEX, CEX continues to play an irreplaceable role. In terms of regulatory compliance, liquidity, and user experience, CEX retains clear advantages, and both enterprises and individual investors remain heavily reliant on centralized platforms—far more than is commonly recognized.

Thus, the “CEX vs. DEX” debate is not merely about choosing between trading tools but also a key judgment concerning industry structure and future market trends. This report adopts a multi-dimensional comparative approach to analyze their current state and potential, covering user adoption and market penetration, market structure and trading dynamics, security considerations, and global compliance developments. By examining both divergences and overlaps, we can better understand the prevalence, risks, and interactions between CEX and DEX in the global crypto market—ultimately providing valuable insights for future research and strategic decision-making.

Crypto User Data Analysis: Market Penetration and Growth Trends

Exponential Growth of Global Crypto Users

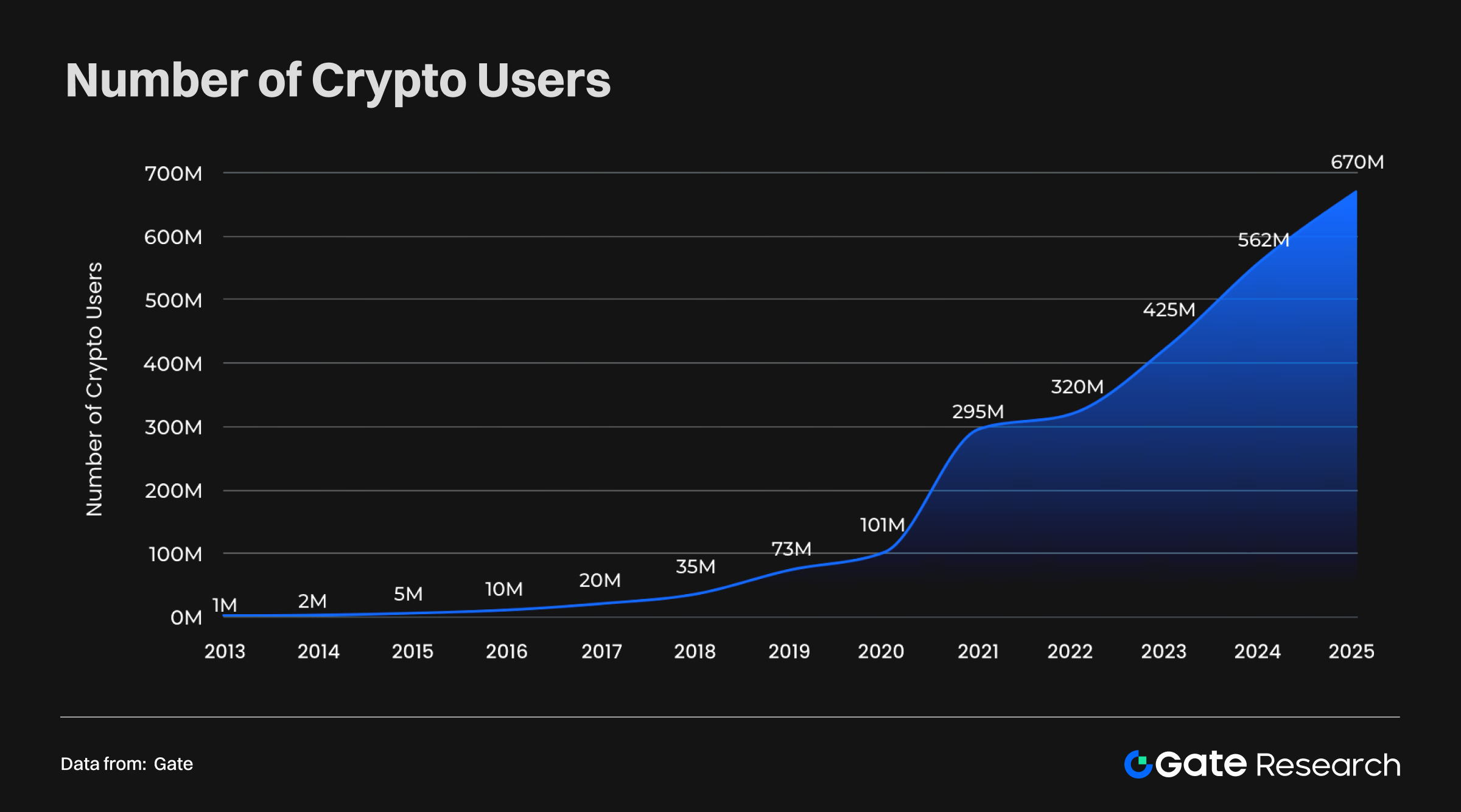

According to data from Crypto penetration metrics, adoption trends, and Demandsafe forecasts, the global crypto user base has grown exponentially over the past decade. From just around 1 million users in 2013, the number surged to 670 million in 2025, marking an extraordinary compound annual growth rate. Particularly since 2020, the growth curve has steepened dramatically, signaling the transition from early adoption to large-scale mainstream usage.

This trend highlights that cryptocurrencies have evolved from niche experiments into a significant force within the global financial system. The expanding user base not only provides a solid foundation for emerging sectors such as DeFi, NFTs, and Web3, but also strengthens network effects and market liquidity. As adoption continues to scale, the potential for crypto applications in financial inclusion, cross-border payments, and digital identity will be further unlocked—ushering in a more mature and widespread digital economy.

Global Penetration and Regional Distribution: The Rise of Emerging Markets

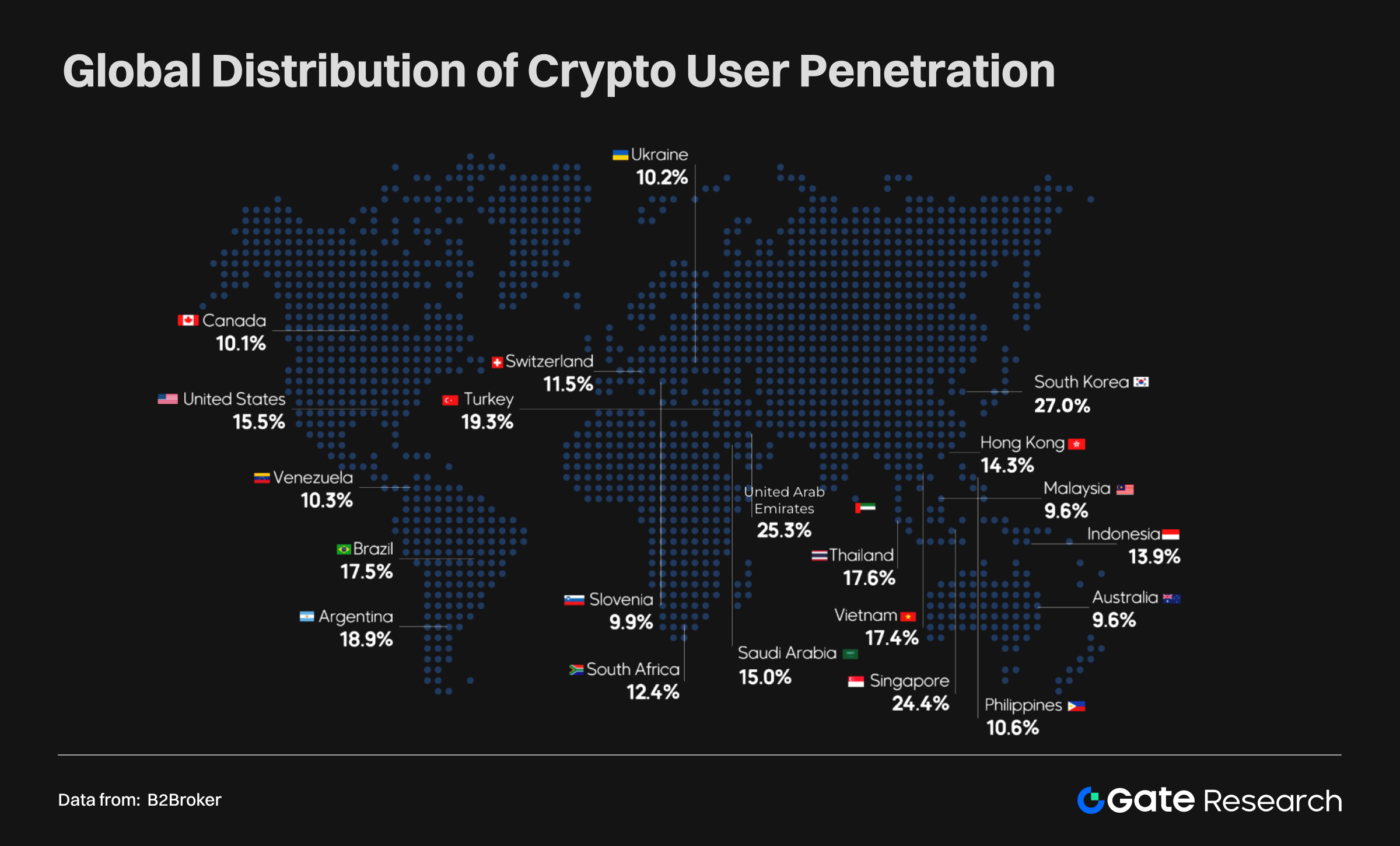

User penetration rates vary significantly across regions:

- High-penetration markets: South Korea (27%), UAE (25.3%), Singapore (24.4%), and Turkey (19.3%)—indicating that crypto adoption is already highly mainstream.

- Emerging markets: Argentina (18.9%), Thailand (17.6%), Brazil (17.5%), Vietnam (17.4%), and Indonesia (13.9%) all report penetration rates above the global average, where crypto is increasingly viewed as a tool for financial inclusion.

- Developed markets: The U.S. (15.5%) and Canada (10.1%) show relatively moderate penetration, yet remain central to the global market due to capital strength, technological leadership, and institutional adoption.

This distribution underscores the varied drivers of adoption: financial substitution and inclusion needs dominate in emerging markets, while institutional participation and innovation drive adoption in developed economies. In short, the globalization of crypto adoption is accelerating under multiple forces.

CEX vs. DEX: User Scale Comparison

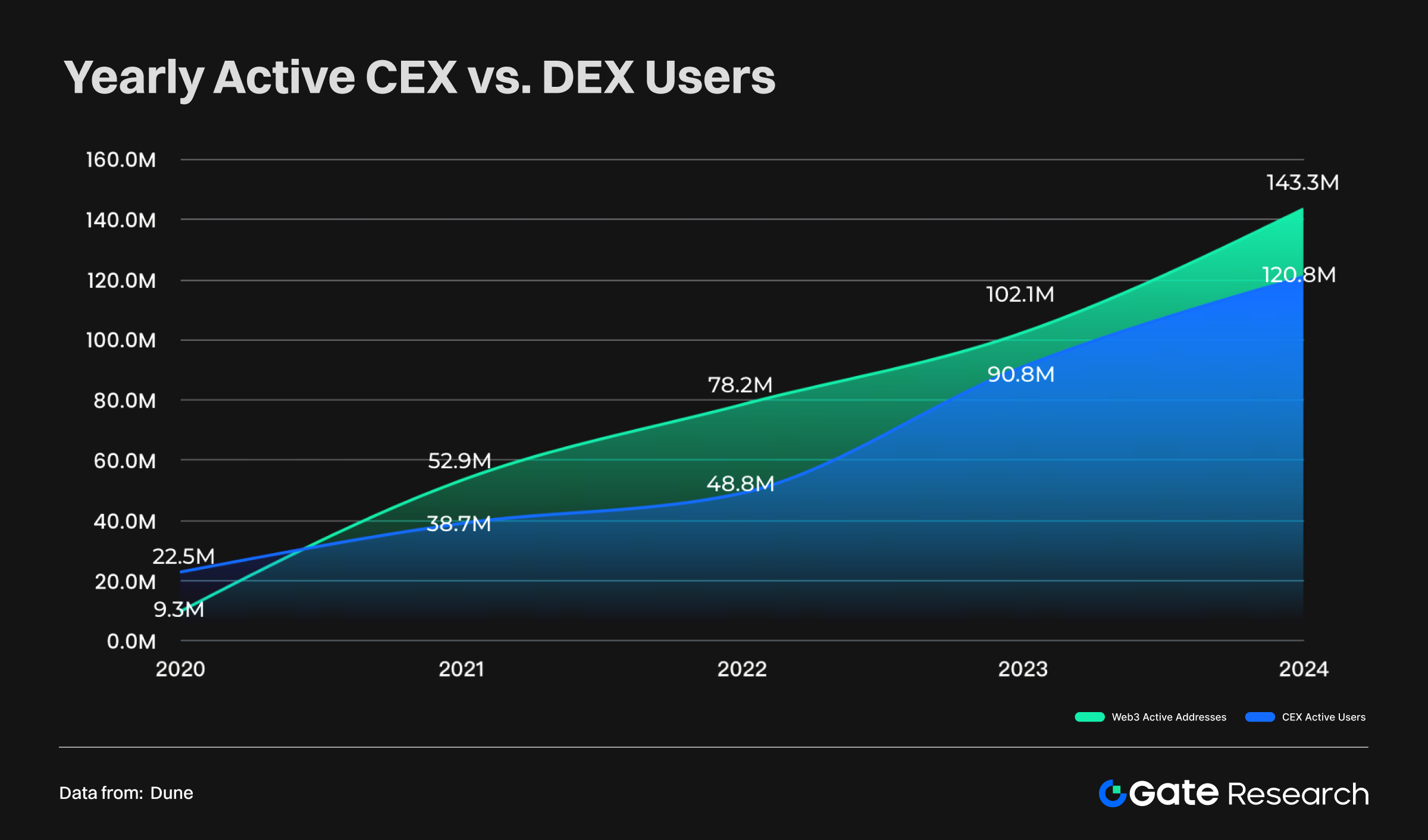

Between 2020 and 2024, both CEX and DEX saw rapid user growth:

- DEX users: Annual active addresses grew from 9.3 million in 2020 to 143 million in 2024, marking more than a 10x increase.

- CEX users: Annual active users expanded from 22.5 million in 2020 to 120 million in 2024, confirming that centralized platforms remain a critical pillar of the crypto ecosystem.

- Trend evolution: Prior to 2020, CEX consistently held a larger user base. However, since 2021, DEX users began to surpass CEX, creating a notable gap by 2022. Although the gap narrowed afterward, DEX once again widened its lead in 2024.

These dynamics highlight:

- Shifting user preferences: More crypto users are leaning toward DEX, seeking greater transparency and autonomy.

- Diversified market structure: While CEX remains the primary gateway, the rise of Web3 and decentralized applications is reshaping user allocation.

Overall, the crypto user base is expanding from traditional centralized platforms into decentralized, open Web3 ecosystems—pushing the market toward greater diversity and decentralization.

Global Asset Market Trends: The Rise of Cryptocurrency

Cryptocurrency’s Path to Becoming a Core Global Asset (2013–2025)

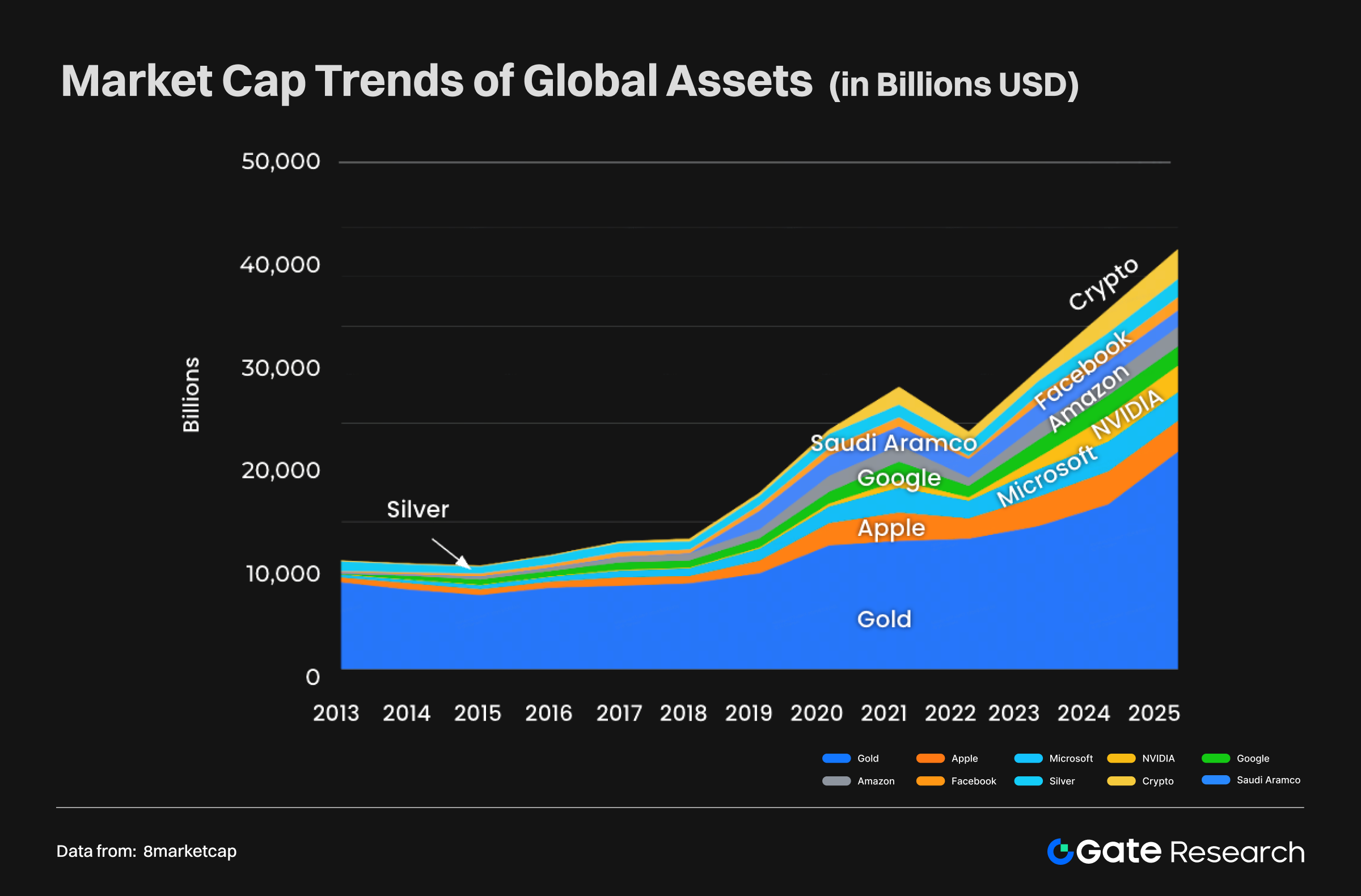

Between 2013 and 2025, the global asset market landscape underwent a profound transformation. Traditional hard assets such as gold and silver continued their steady growth, but their pace slowed and their dominance gradually diluted. Meanwhile, technology giants saw explosive market cap expansion—most notably Microsoft and Nvidia after 2020—highlighting how frontier technologies such as artificial intelligence and cloud computing have become the primary engines of global economic growth.

Most notably, cryptocurrencies have experienced exponential growth since 2020, rapidly entering the mainstream of global asset markets. By 2025, their total market capitalization reached $3.02 trillion, surpassing Apple to become the world’s fourth-largest asset class, behind only gold, Nvidia, and Microsoft. Within this category, Bitcoin (BTC) alone accounted for $2.35 trillion, overtaking Amazon and silver; Ethereum (ETH) reached nearly $980 billion; while stablecoins collectively amounted to $260 billion.

Overall, the global asset core is shifting from traditional hard assets toward high-growth, innovation-driven assets. The rise of cryptocurrencies not only underscores the vast potential of digital finance but also marks their elevation to a status on par with gold and tech stocks—establishing themselves as a new pillar of global capital allocation.

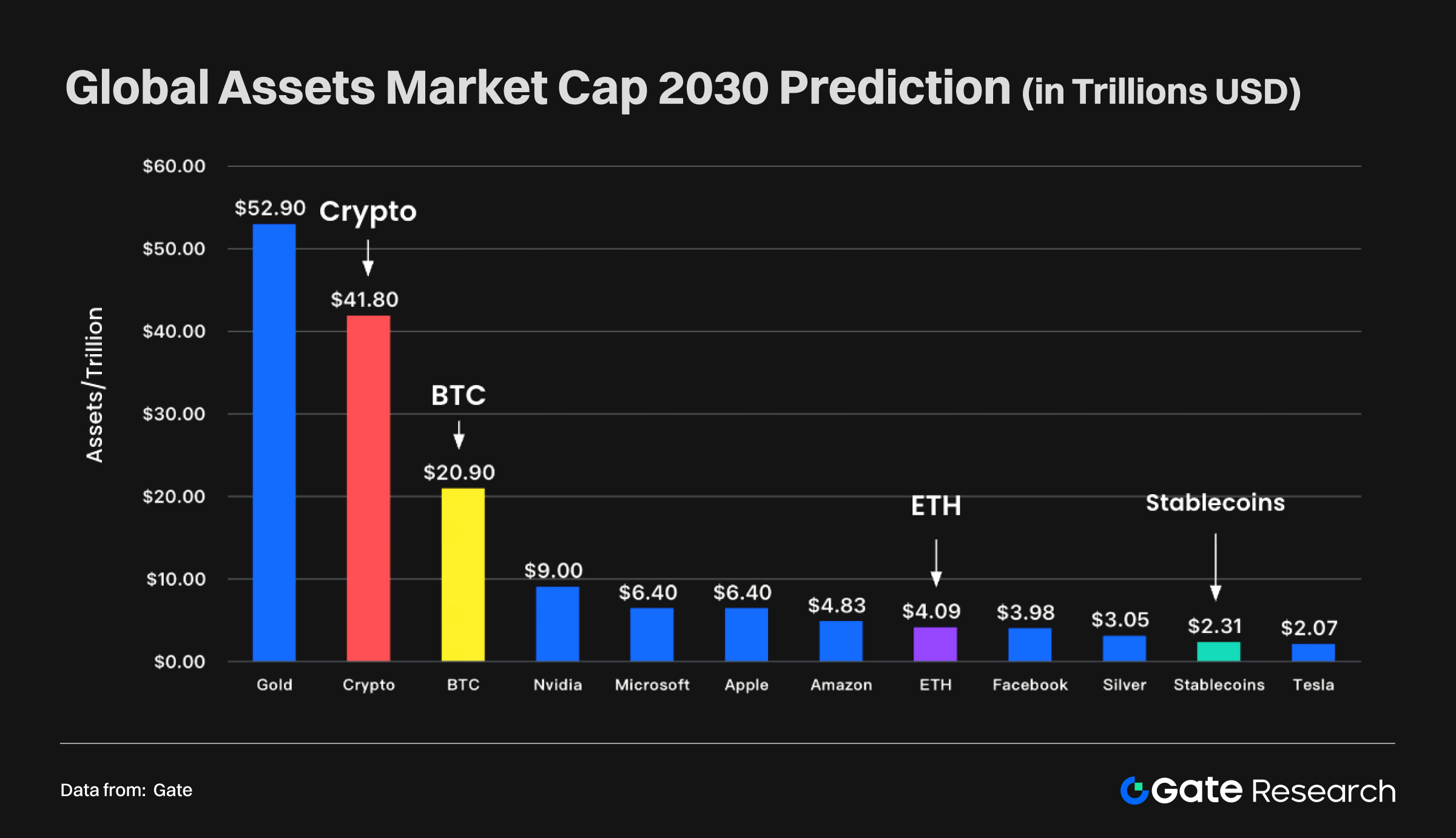

Phased Shifts in Global Asset Market Structure and Future Outlook (2022–2025–2030)

By analyzing snapshots at key time points, we can clearly trace how cryptocurrencies have evolved from a marginal asset into a core category rivaling the world’s top technology companies.

- August 2022: The global asset hierarchy was still dominated by traditional assets. Gold led with $11.77 trillion, followed by Apple and Microsoft. At that time, cryptocurrencies totaled $1.08 trillion—a sizable figure but still on par with silver ($1.38 trillion) and positioned as a secondary asset class.

- August 2025: In just three years, the landscape shifted dramatically. Fueled by the AI boom and a crypto bull cycle, the global asset map was redrawn. Gold rose to $22.93 trillion; Nvidia, powered by its leadership in AI, soared to $4.24 trillion. Cryptocurrencies stood out with $3.02 trillion in total market cap, surpassing silver and Amazon, firmly entering the global top tier.

- 2030 (forecast): This trend is expected to deepen further. Forward-looking estimates suggest that cryptocurrencies may reach $41.8 trillion, positioning them as the world’s second-largest asset class after gold. Bitcoin alone is projected at $20.9 trillion, surpassing multiple global tech giants, while Ethereum could exceed $4 trillion, and stablecoins may grow beyond $2.3 trillion.

This exponential rise reflects a massive reallocation of global capital to adapt to the digital era. The composition of top-tier assets is shifting from traditional hard assets to a diversified triad of traditional assets, technology giants, and digital assets.

Evolution of Crypto Market Structure: The Dynamic Balance Between CEX and DEX

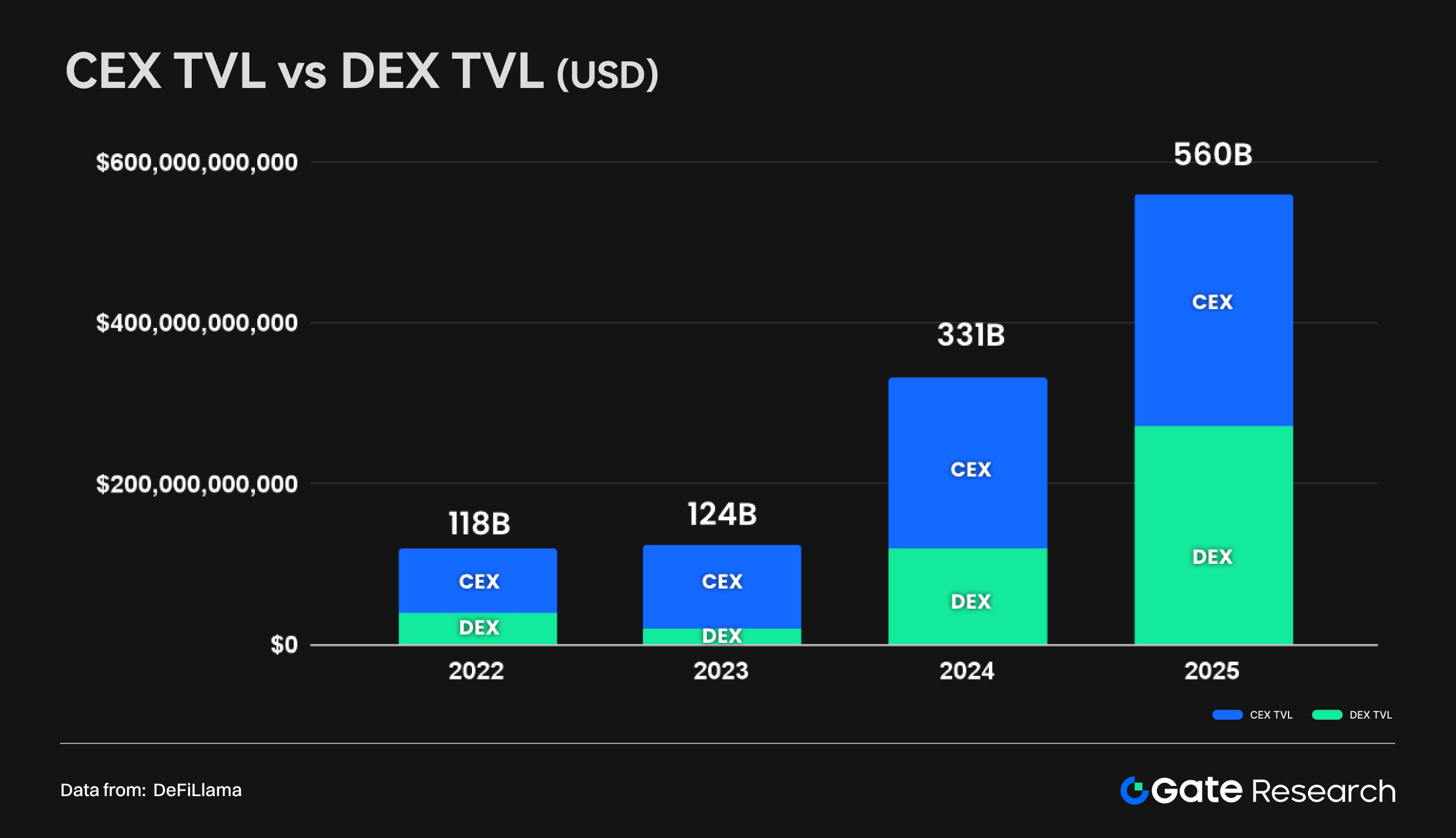

At the same time, the internal structure of the crypto market is maturing and balancing. In earlier years, custody and liquidity relied almost entirely on centralized exchanges (CEX). By 2025, however, the landscape evolved into a dual-track model, with CEX and decentralized exchanges (DEX) standing side by side.

- 2022: CEX and DEX combined held around $118 billion in total reserves, with CEX in clear dominance.

- 2025: Total reserves surged to $560 billion, while DEX total value locked (TVL) grew substantially, nearly equaling CEX reserves.

This structural shift does not imply the weakening of CEX, but rather signals the maturity of the crypto market. On one hand, overall market expansion created growth opportunities for both. On the other, DEX’s rising share reflects DeFi’s prosperity, technological advancements, and growing user preference for self-custody and on-chain transparency.

Meanwhile, the role of CEX is also evolving. No longer just the sole trading hub, it is increasingly positioned as the gateway between traditional finance and the on-chain economy—responsible for fiat on/off ramps, user onboarding, and institutional compliance.

In this sense, the crypto market is forming a “dual-track infrastructure”:

- CEX as the entry point and liquidity hub for global capital.

- DEX as the core venue for on-chain finance and innovation.

Rather than substitutes, the two are complementary pillars forming the foundation of the future crypto financial system.

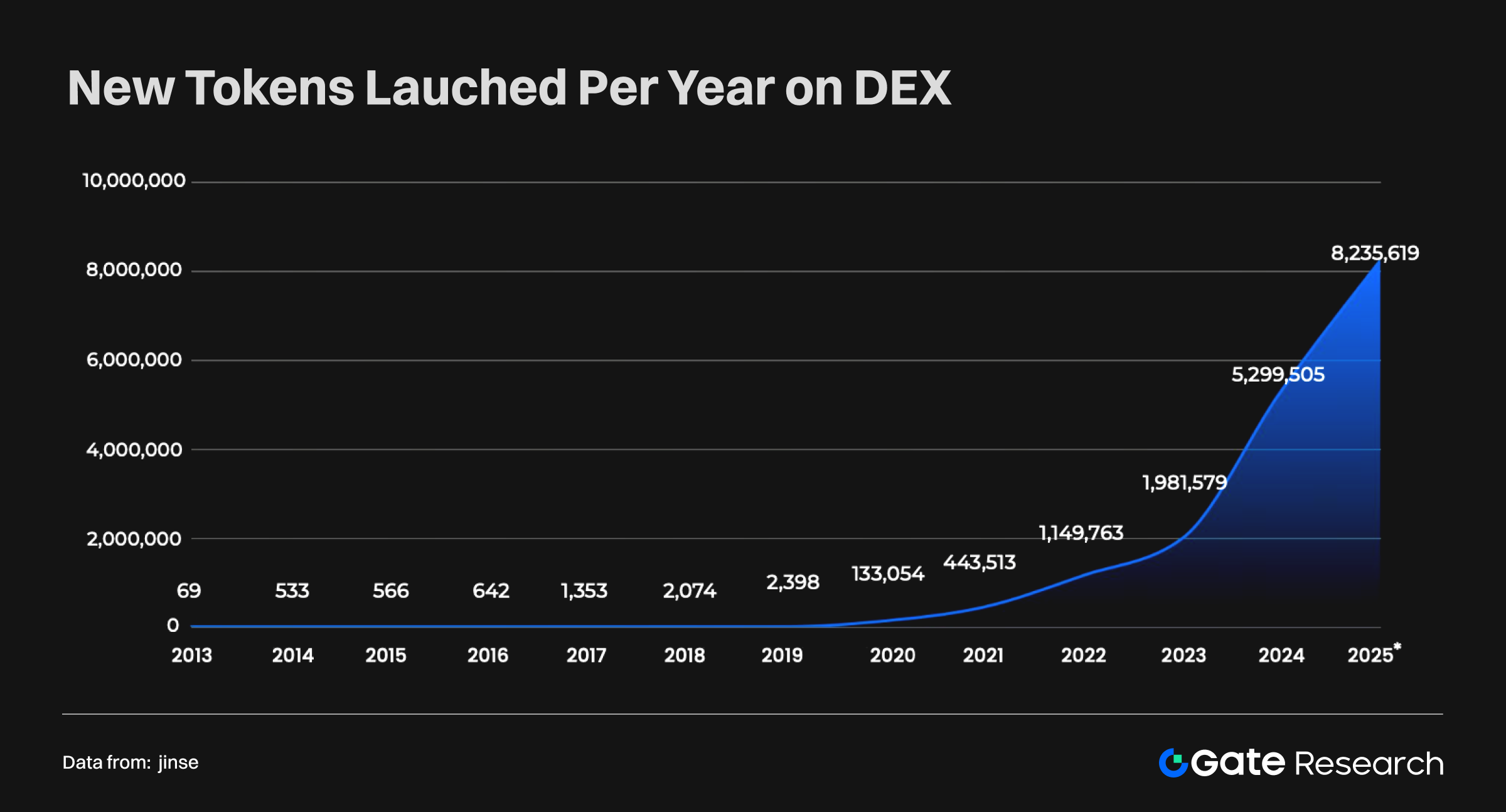

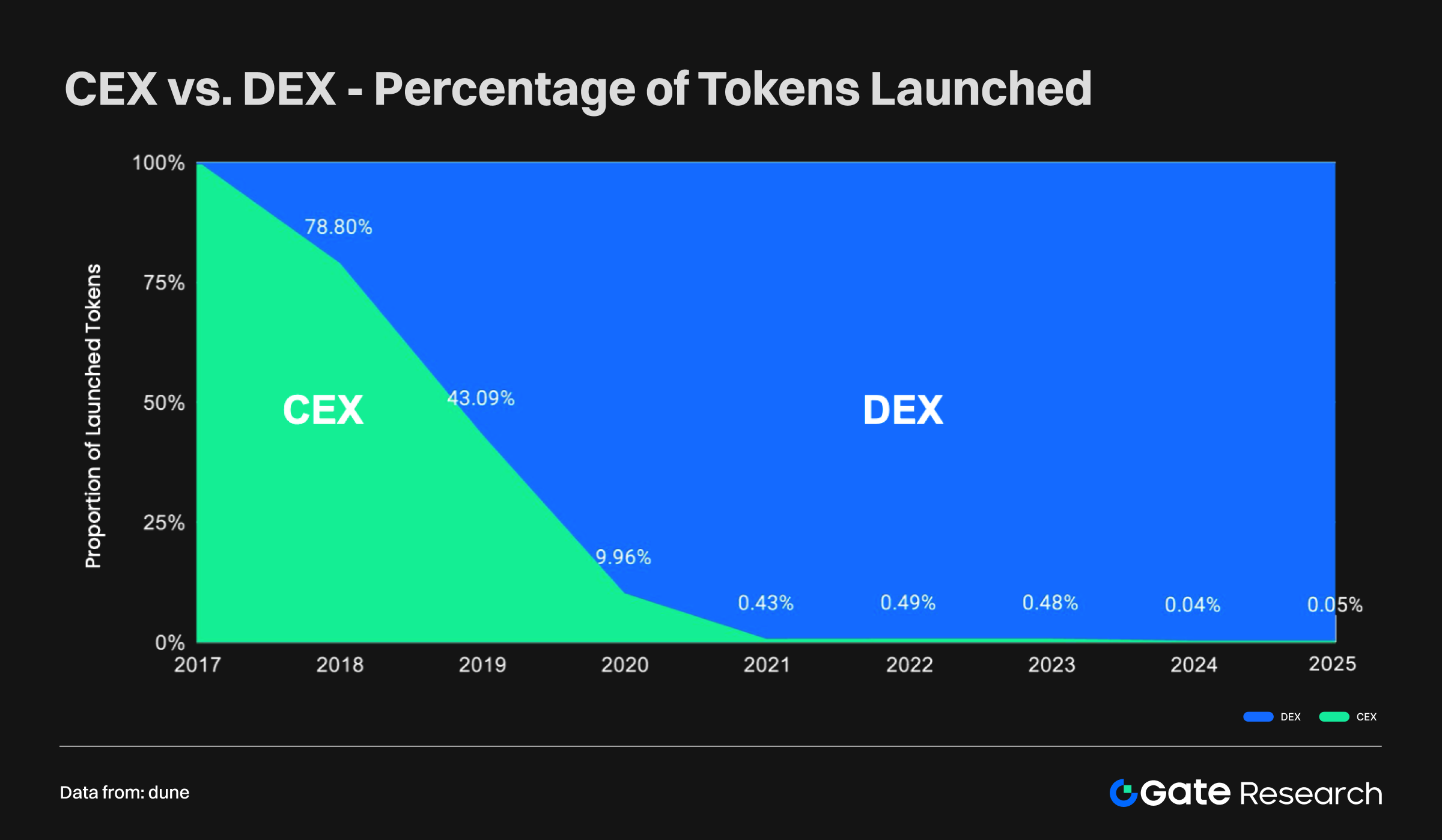

Token Issuance and Ecosystem Vitality

Token issuance has grown at an extraordinary pace in recent years. Particularly since the “DeFi Summer” of 2020, decentralized exchanges (DEX) have become the primary channels for new token launches. Today, the number of tokens issued on DEX has reached staggering levels—with over 50,000 new tokens launched daily. By 2025, more than 8 million new tokens are expected to be added, with cumulative issuance surpassing tens of millions.

By contrast, centralized exchanges (CEX) continue to list many tokens, but their pace of new listings now lags significantly behind DEX.

This shift brings two key impacts:

- Ecosystem vitality – The openness of DEX offers developers and startups broader access. New projects can quickly launch and circulate, accelerating diversification across GameFi, DeFi, SocialFi, and beyond.

- Risk and quality divergence – With minimal barriers, most tokens issued on DEX are small-scale, short-lived, and high-risk. Meanwhile, CEX maintains strict listing standards, issuing fewer tokens but ensuring higher quality and credibility.

At present, the vast majority of new tokens are issued on DEX, with CEX accounting for less than 1% of total issuance. This shows that in terms of ecosystem vitality, DEX has taken the lead. However, CEX remains irreplaceable in curated listings, brand trust, and compliance guarantees.

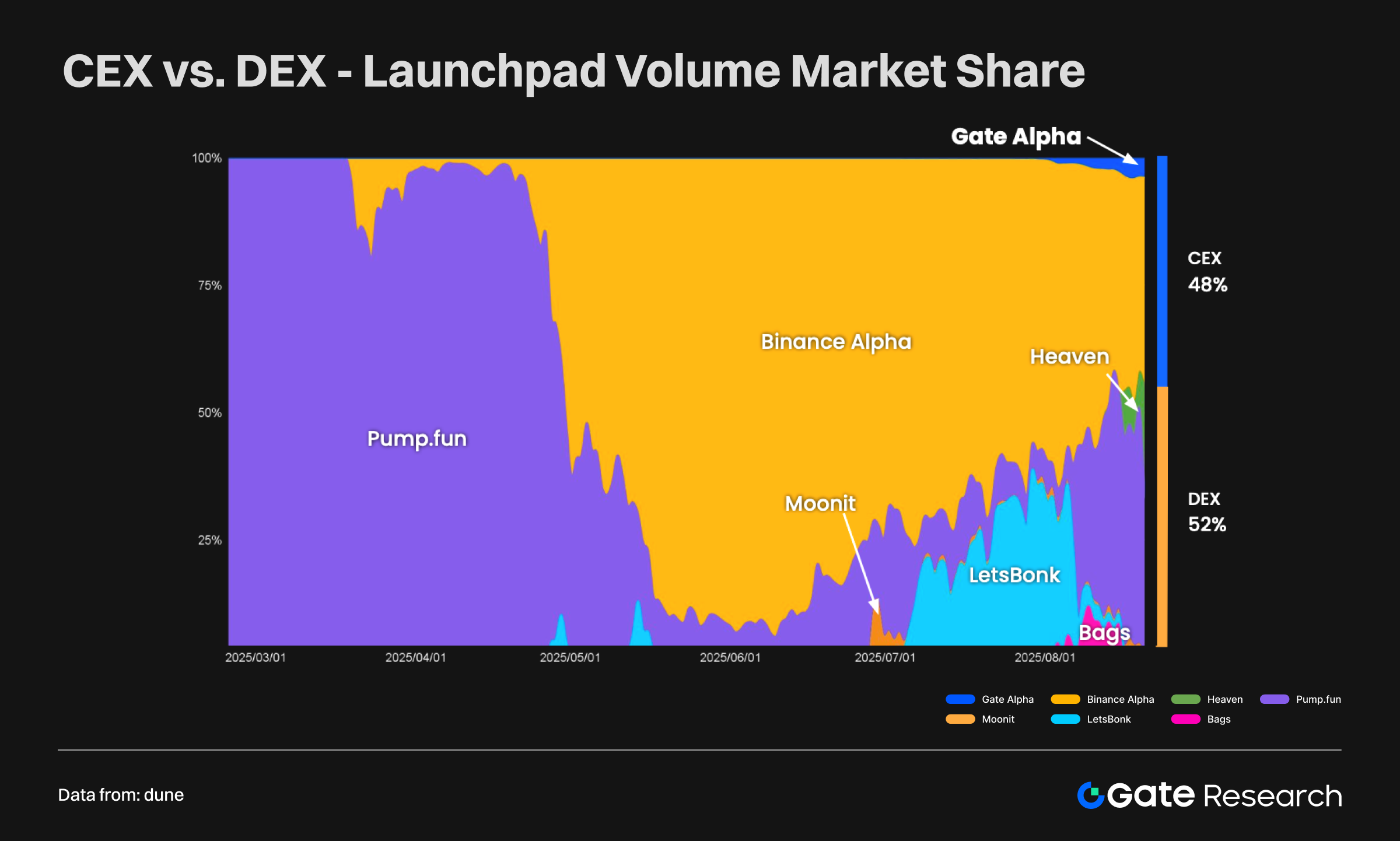

In fact, more than half of all Launchpad token issuances have come from DEX. This highlights the ecosystem’s transition from a single model toward a dual-track structure, where CEX and DEX coexist as key drivers of innovation.

Evolution of Market Dominance

In terms of trading volume and market dominance, the competitive relationship between CEX and DEX is steadily evolving. Overall, centralized exchanges (CEX) remain the core force in the market, but decentralized exchanges (DEX) are continuously expanding their share, gradually narrowing the gap.

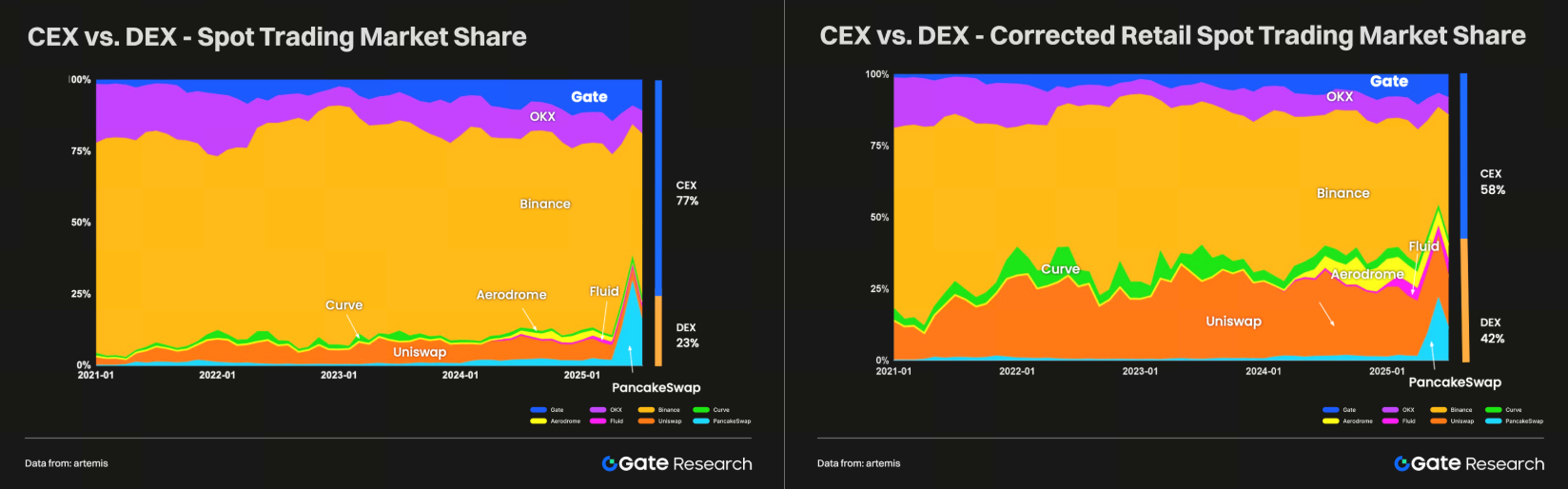

Spot Trading

Currently, CEX account for around 77% of global spot trading volume, while DEX represent 23%. However, if we exclude wash trading—which provides a more accurate reflection of retail activity—the numbers shift: CEX drop to 58%, while DEX rise to 42%. This indicates that in user-driven trading, DEX are catching up rapidly with CEX.

Annual Trading Volume

Over the past decade, the gap between CEX and DEX annual trading volumes has steadily narrowed. While CEX still dominate in absolute scale, DEX are growing faster, and in certain periods and new asset classes, they have even approached or surpassed CEX levels. Meanwhile, when comparing total value locked (TVL), CEX once held an overwhelming advantage, but DEX TVL is now nearly on par—forming a dual-pillar market structure.

Future Market Dominance

Short term: CEX will maintain dominance thanks to deep liquidity, regulatory licenses, and superior user experience, especially in tightly regulated regions.

Medium to long term: As blockchain infrastructure improves, users gain stronger awareness of self-custody, and DEX usability and security increase, DEX market share is expected to expand further. Over the next 5–10 years, DEX may approach or even challenge CEX dominance.

In summary, the market is transitioning from “CEX absolute dominance” toward a “CEX leading + DEX catching up” dual-polar structure. CEX maintain scale and compliance advantages, while DEX represent the forefront of decentralization and ecosystem innovation.

Security Risks and Compliance Trends in the Crypto Ecosystem

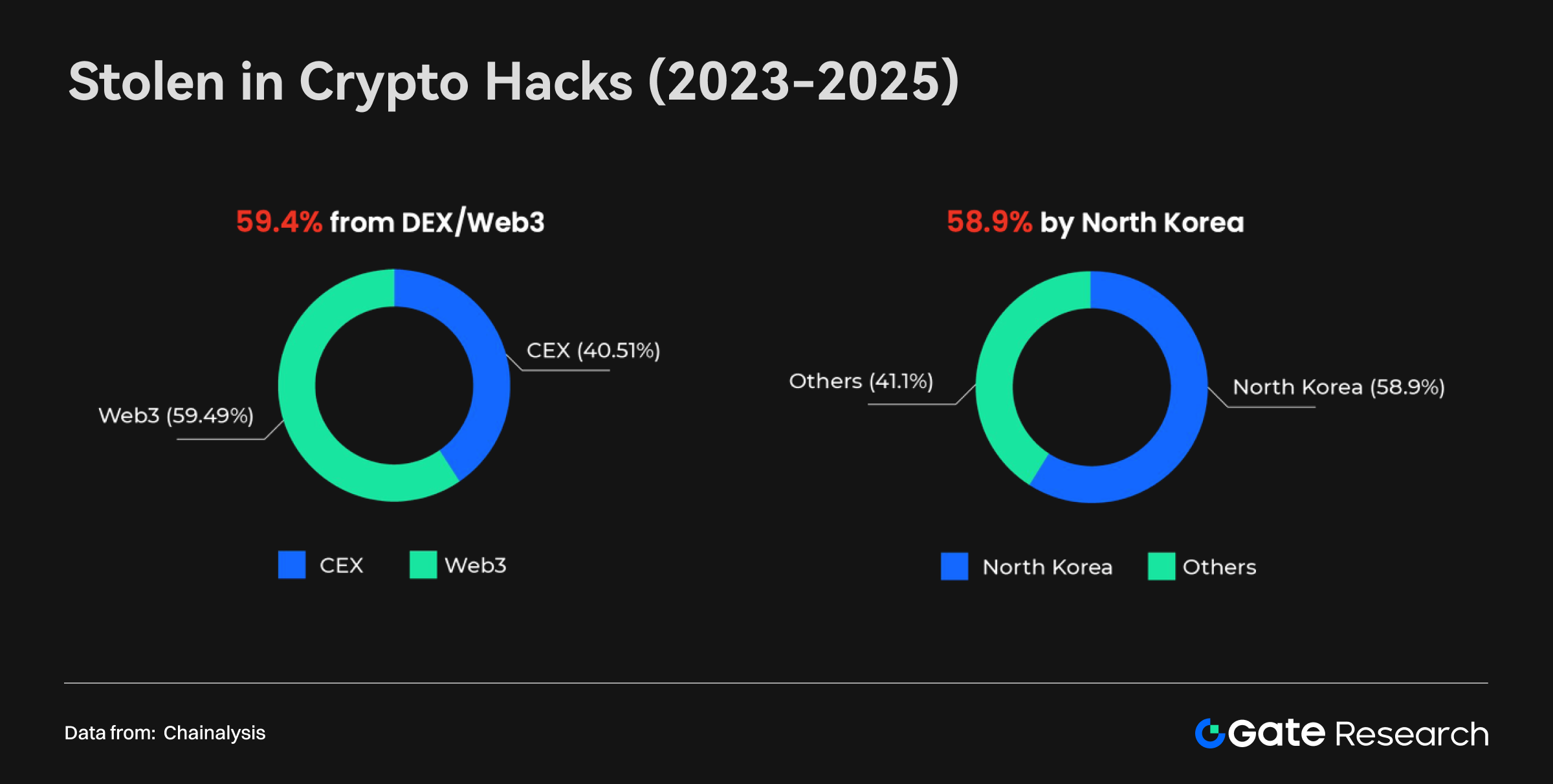

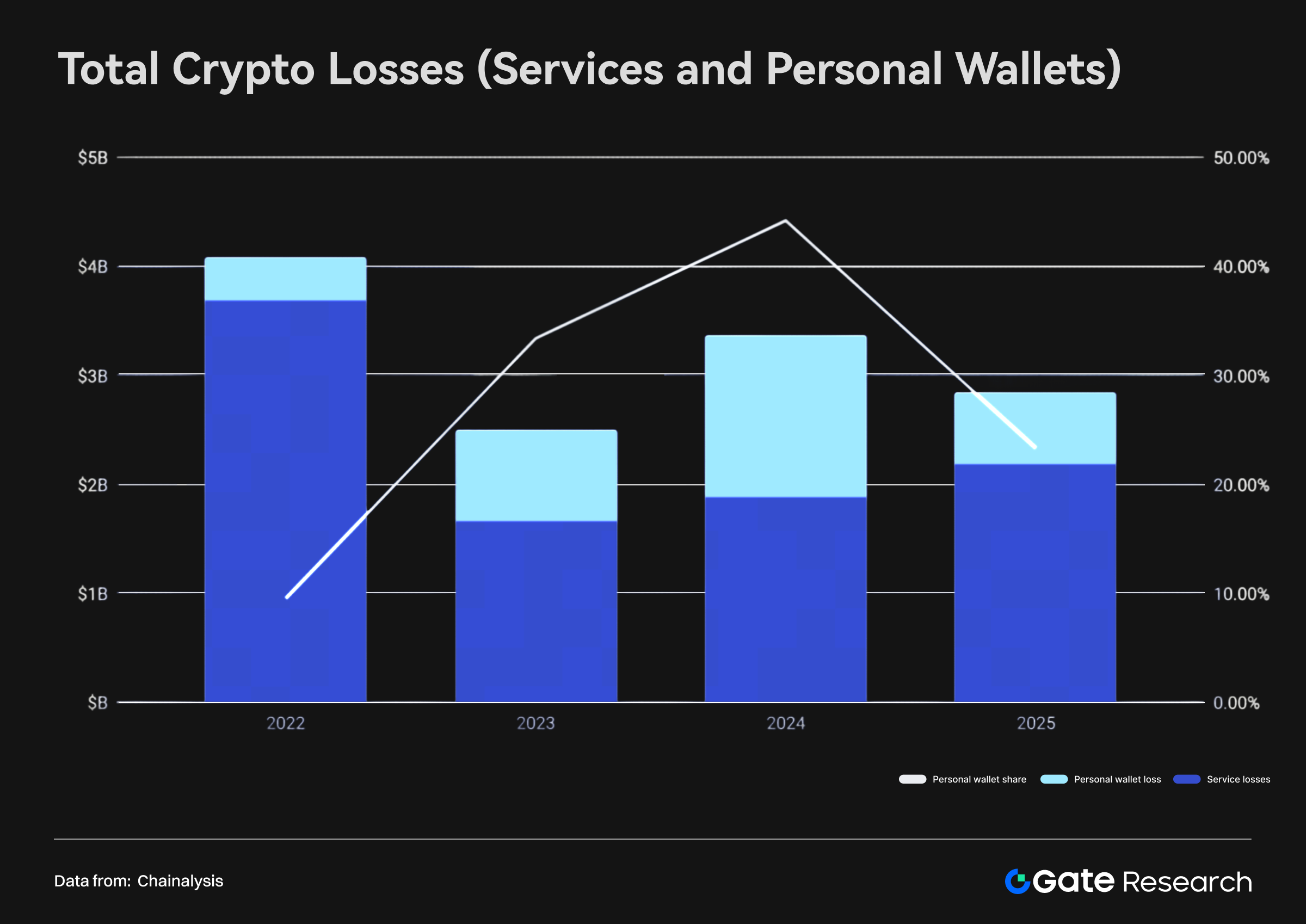

Hacks and Loss of Funds

Between 2023 and 2025, the crypto sector continued to suffer major theft incidents. According to Chainalysis, around 59% of stolen funds—amounting to as much as $5.9 billion—came from DEX/Web3 protocols—underscoring security weaknesses in decentralized systems. Key attack types included smart contract vulnerabilities, cross-chain bridge failures, and governance flaws. While CEX also carry centralized risks, their relatively mature security frameworks have kept their share of total losses lower.

At the same time, personal wallet theft has become the new frontier of crypto crime. By June 2025, attacks targeting retail wallets accounted for over 20% of all stolen funds. These incidents are often underreported due to their stealthy nature, but the risks are escalating. Drivers include: stronger security at large platforms forcing attackers to shift focus, the growing number of crypto holders, rising asset values in wallets, and hackers leveraging advanced tools like LLMs to execute more complex attacks.

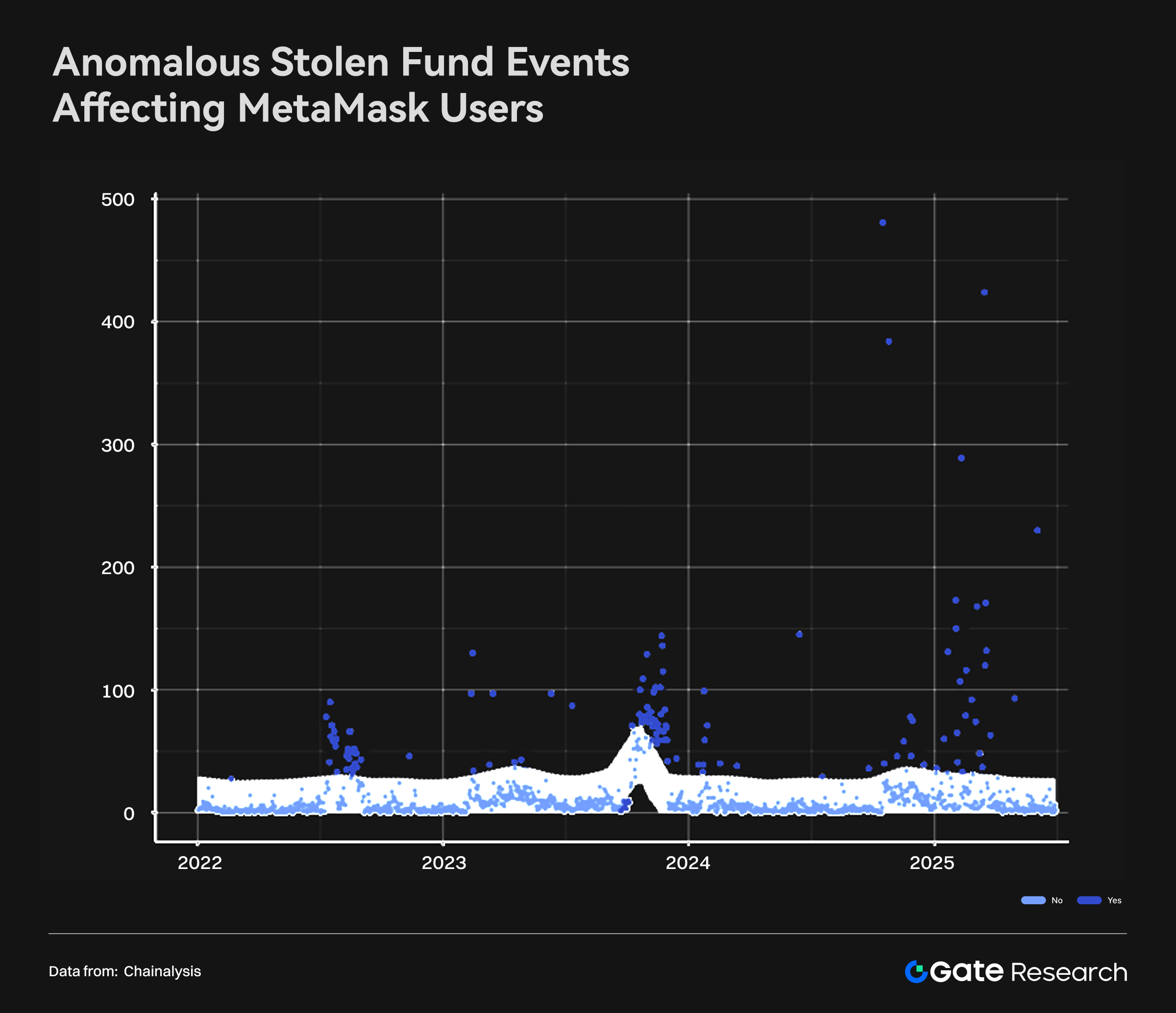

Among cases, MetaMask stands out. Since late 2024, reports of abnormal fund theft from MetaMask wallets have risen sharply, continuing into 2025. Some incidents saw nearly 500 wallets compromised in a single day, showing that attackers now deploy systemic methods to target large user bases. While similar spikes occurred in mid-2022 and late 2023, today’s frequency and severity are far greater—evidence of evolving threat models.

Potential causes include systemic wallet software vulnerabilities, security gaps in third-party infrastructure (e.g., browser plugins, malicious dApps), and the expanding attack surface as user numbers grow. MetaMask cases illustrate that widely used wallet apps are prime hacker targets—and such attacks are likely to spread further as adoption increases.

In sum, crypto security risks are becoming broader and more diversified, with a growing focus on individual users. The industry must strengthen defenses on two fronts:

- Platforms: Reinforce infrastructure security through smart contract audits, bridge risk assessments, and multi-signature hot wallet solutions.

- Users: Expand education on operational security (OpSec), cold wallet usage, and protection against social engineering.

On the regulatory side, authorities may need to impose compliance requirements on DeFi protocols and wallet apps—balancing transparency with decentralization—to reduce illicit fund flows. These risks also provide crucial context for understanding capital movement and anti-money laundering (AML) trends.

Money Laundering and Fund Flows in Crypto

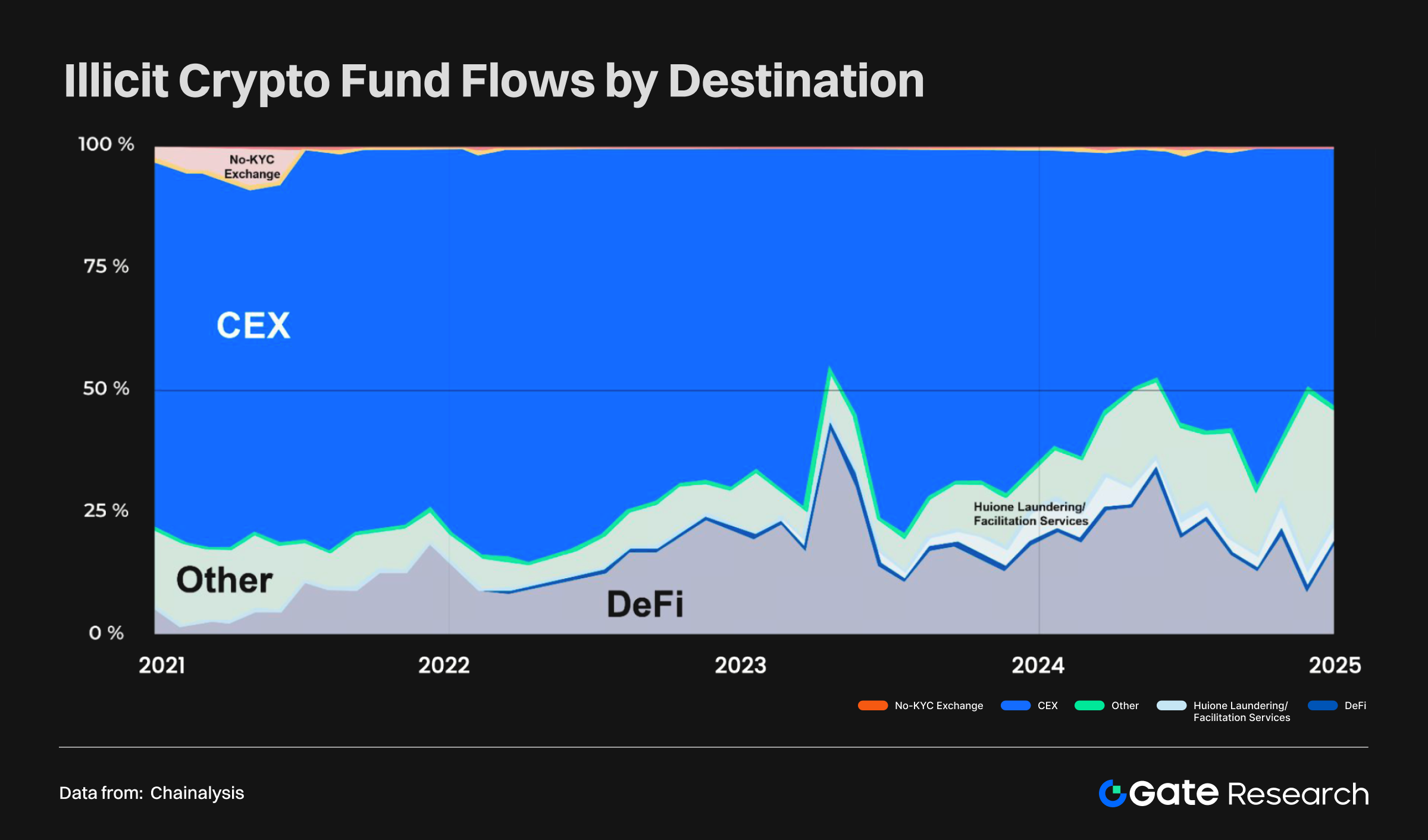

From 2021–2024, around $50 billion annually in illicit funds flowed through crypto channels, primarily into CEX. However, as DeFi and non-KYC platforms have developed, on-chain protocols have become major exit routes for illicit capital—especially during high-activity market phases. The lack of identity verification and the anonymity of cross-chain transfers make DEX particularly vulnerable to AML risks.

Between 2024–2025, different attack types revealed distinct laundering patterns:

- Service platform attacks: Stolen funds often moved through bridges and mixers.

- Personal wallet theft: Proceeds typically flowed into token smart contracts and CEX.

Interestingly, laundering costs have risen despite blockchain transaction costs falling. Between 2022 and mid-2025, average blockchain fees fell by over 80% thanks to Solana and L2 scaling, but criminals paid 100%+ higher fees to ensure speed and irreversibility. Not all funds circulate quickly, either—by June 2025, 37%+ of stolen wallet funds still sat idle in attacker addresses, reflecting hoarding behavior.

Overall, crypto money laundering is becoming more complex, high-cost, and stablecoin-based. While technology reduces costs for legitimate users, illicit actors face higher premiums for anonymity and efficiency. This raises demands on regulators for cross-chain tracing, mixer monitoring, and sanctions enforcement—intensifying compliance pressures on DeFi and stablecoins.

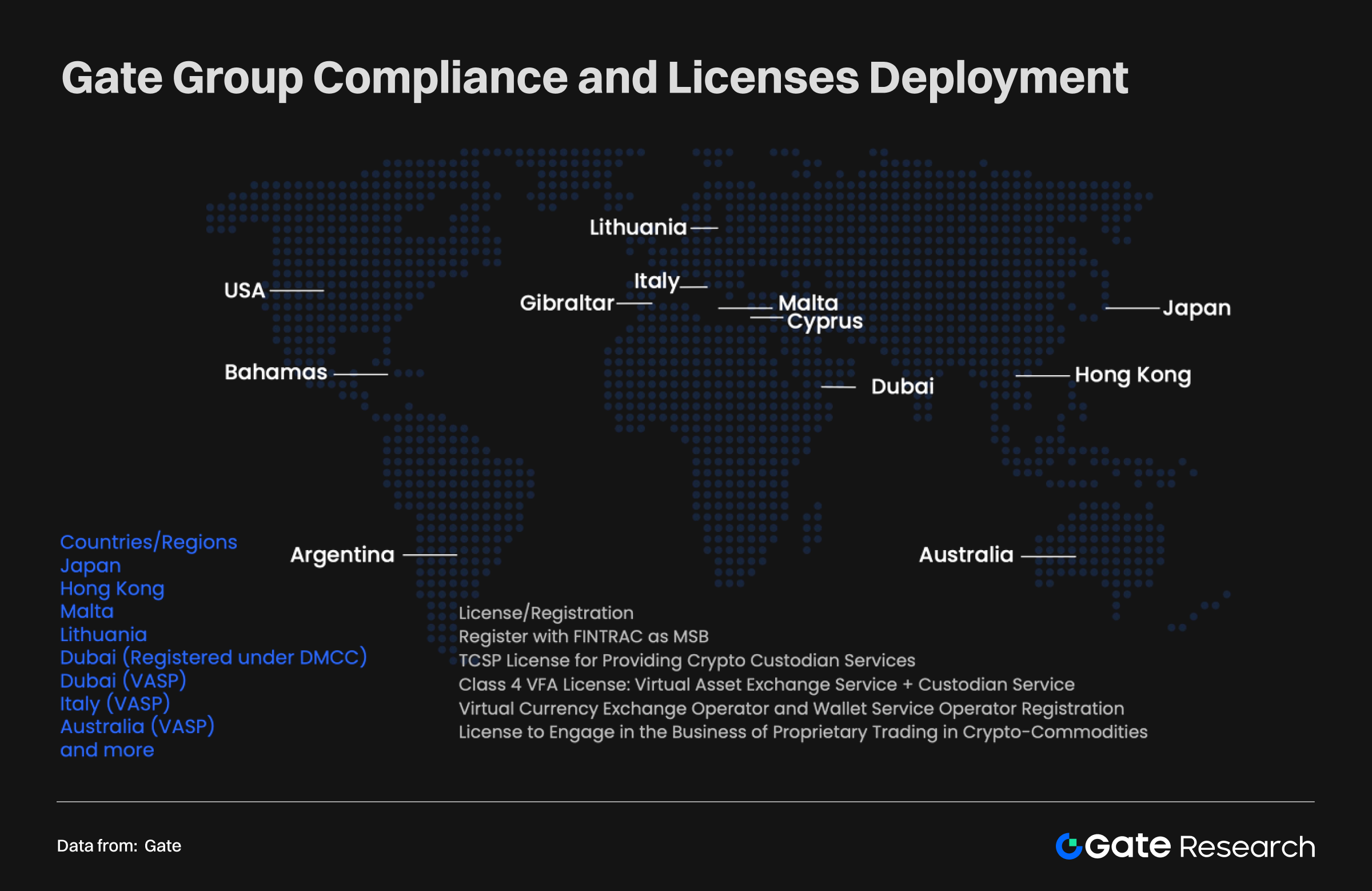

Compliance Responses and Global Strategy

Amid evolving security risks and increasingly complex money laundering pathways, compliance has emerged as the key differentiator between CEX and DEX. Centralized exchanges (CEX), such as Gate, are progressively building global compliance frameworks and licensing structures to meet AML/KYC requirements across multiple jurisdictions. These frameworks cover a wide range of business activities—including trading, custody, and derivatives—which in turn require CEX to fulfill obligations such as disclosure, customer identity verification (KYC), transaction monitoring, and anti–money laundering (AML) reporting. By establishing a global compliance architecture, CEX not only enhance user trust at the institutional level but also lay a solid foundation for cross-border expansion and long-term growth.

By contrast, decentralized exchanges (DEX) operate under fundamentally different models. Lacking centralized legal entities and a unified cross-border regulatory framework, most DEX do not implement mandatory compliance mechanisms and generally do not require KYC or identity verification. While this openness and anonymity provide greater freedom for users, they also create clear gaps in AML risk management. Data shows that the proportion of illicit funds circulating through DEX has been rising year by year. During periods of market volatility, DEX are particularly prone to becoming key conduits for scam and hacker funds. As a result, compliance is not only the institutional baseline that separates CEX and DEX but also a decisive factor in shaping the future evolution of market structure.

Conclusion

The comparison of CEX and DEX is not merely about trading models, but reflects the multi-dimensional evolution of the crypto industry—spanning user growth, market structure, security risks, and compliance frameworks.

Over the past decade, exponential user adoption has driven crypto from a niche experiment to a mainstream global market. The rapid rise of DEX and the steady growth of CEX have together created today’s diverse ecosystem.

Yet, security and compliance remain the critical variables. Hacks, wallet thefts, and increasingly complex laundering paths reveal the vulnerabilities of DeFi and DEX, while CEX provide relative stability through compliance structures and mature security. This divergence suggests both models will play distinct roles in the years ahead.

Looking forward, CEX and DEX are not outright substitutes but rather complementary pillars.

- CEX: Will remain the mainstream gateway thanks to liquidity, compliance, and user trust.

- DEX: Will lead in openness, token issuance, and ecosystem innovation.

As adoption expands and regulation matures, the industry’s ability to strike a balance between transparency, efficiency, and risk management will determine whether crypto advances into a more mature and sustainable era.

References:

- ExplodingTopics, https://explodingtopics.com/blog/cryptocurrency-stats

- economictimes, https://economictimes.indiatimes.com/markets/stocks/news/from-uae-to-south-korea-the-worlds-most-crypto-obsessed-countries-in-2025/crypto-watch/slideshow/119897178.cms?utm_source=chatgpt.com&from=mdr

- Dune, https://dune.com/queries/3365957/5669035

- 8MarketCap, https://8marketcap.com/#google_vignette

- CoinGecko, https://www.coingecko.com/

- Statmuse, https://www.statmuse.com/money/ask/tesla-market-cap-in-august-2022

- CompaniesMarketCap, https://companiesmarketcap.com/time-machine/2025-08-01/#google_vignette

- ARK, https://www.ark-invest.com/articles/valuation-models/arks-bitcoin-price-target-2030

- DefiLlama, https://defillama.com/chains

- CoinMarketCap, https://www.jinse.cn/blockchain/3681462.html

- Dune, https://dune.com/queries/3830496/6442441?start+date_d83555=2016-12-01+00%3A00%3A00

- Dune, https://dune.com/adam_tehc/memecoin-wars

- Artemis, https://app.artemisanalytics.com/sectors?tab=spotdexs

- The Block, https://www.theblock.co/data/crypto-markets/spot/cryptocurrency-exchange-volume-monthlys

- CoinMarketCap, https://coinmarketcap.com/;DEX:https://defillama.com/dexs

- Slowmist, https://hacked.slowmist.io/

- Chainalysis, https://hacked.slowmist.io/

- Chainalysis, https://www.chainalysis.com/wp-content/uploads/2025/03/the-2025-crypto-crime-report-release.pdf

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?